First, a little background. Became interested in Forex back in the early 2000’s but quickly realized that most systems and products were meant to separate a fool from his money. I was very interested, but being young, dumb, and broke didn’t leave me with much in the way of options. I toyed with demo’s, systems, and strategies over the next few years never quite finding anything that I trusted, or that I could remain profitable demo trading over time. A couple of years ago I stumbled upon Apex and I was very interested in what DM was preaching. It sounded good, it looked great, it looked easy, but I still could not make my mind work with the system. I could only trade nights, and working what seemed like non-stop in IT, I just didn’t have the focus at night to really do what was needed.

So a week or so ago I saw a sniper system email and a blurb about the automation, and being someone who builds, drives, and dreams up automation in my day job, it had my interest. Different job where I am crazy busy but primarily work from home so my options are more open. So, 6/4/2020 I consumed ALL of the videos (yes, all of them), and started the process of restarting a dormant Dorman account and getting sniper setup. I purchased the automation piece and below will be a trade log of sorts, bone headed moves and all.

Defined Goals and Self-Imposed Rules

- 4 Full weeks of sim trading with nothing but the free bootcamp indicators and TA is allowed

- Each day must have a corresponding forum post and 90 day challenge sheet filled out completely

- Only micro lots as that is where I will start when live, no more than $3 per tick of risk

- Only NQ and MES, and ONLY Sniper TX Filtered ES, and Sniper TX ODD DRD ETX ES trades are allowed

- No scalping, Testing, ATM testing, ATM changes, pick ONE and stick with it for 4 full weeks

- No chart changes, default template only

- Only US session and 7PM -10PM CDT trades allowed. I am allowed ONLY a single trade per night regardless of the outcome.

- No trailing stops, TP and SL are fixed values and cannot be moved unless my fill was at a level that was unexpected.

Prep work 6/7/2020:

-

Knocked the rust off my Ninja 7 license

-

Watched the setup videos several times again

-

Did some replay on it (which was a giant pain and less than helpful if I am being honest)

-

Started the process for funding a live account

Day 1: 6/8/2020

- Fire up the charts and the automation (MNQ and MES)

- Joined the trade room so I could listen in between calls

- Turned on all long and shorts for all systems (not realizing that with bootcamp I really only have two available.

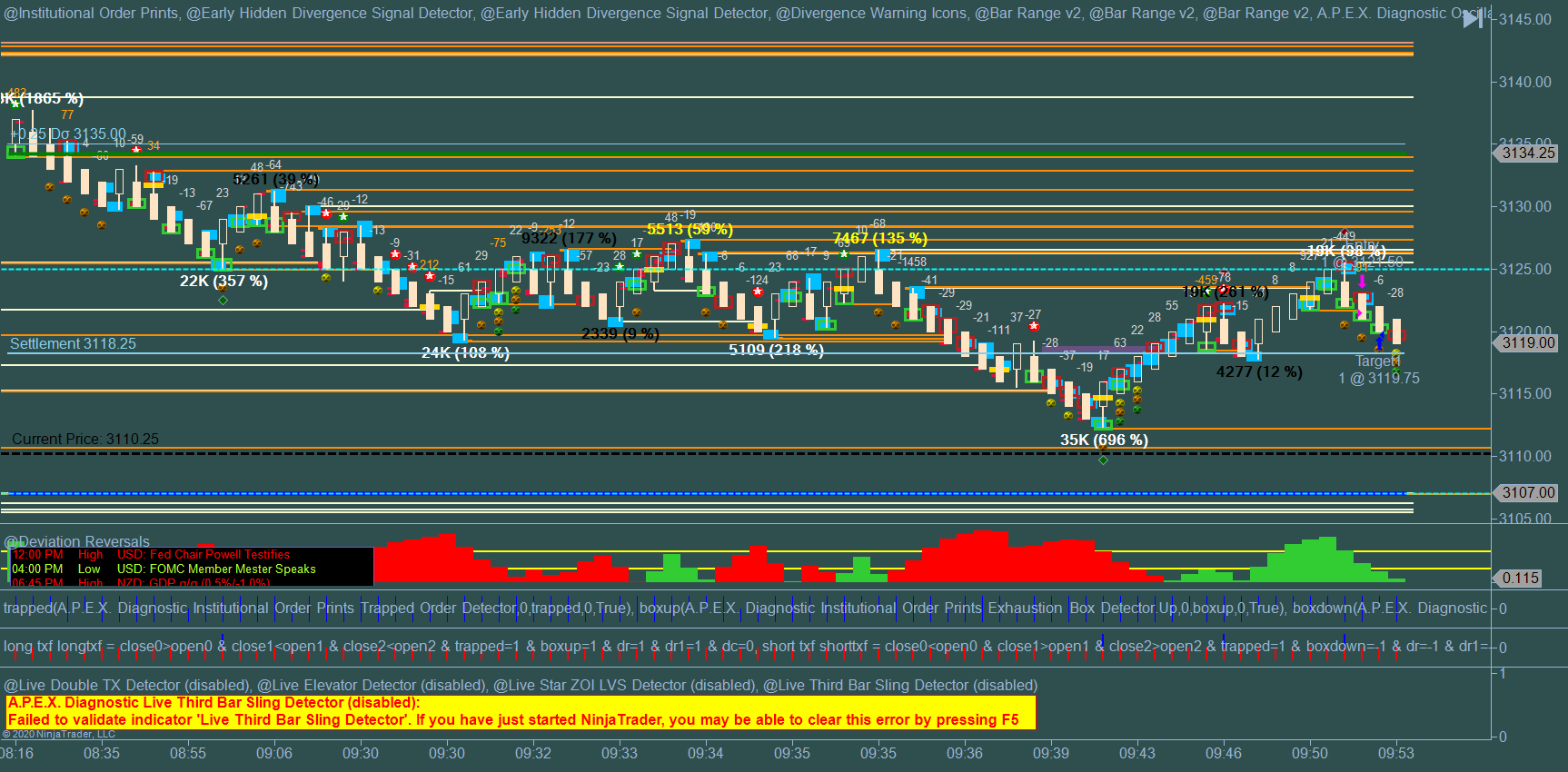

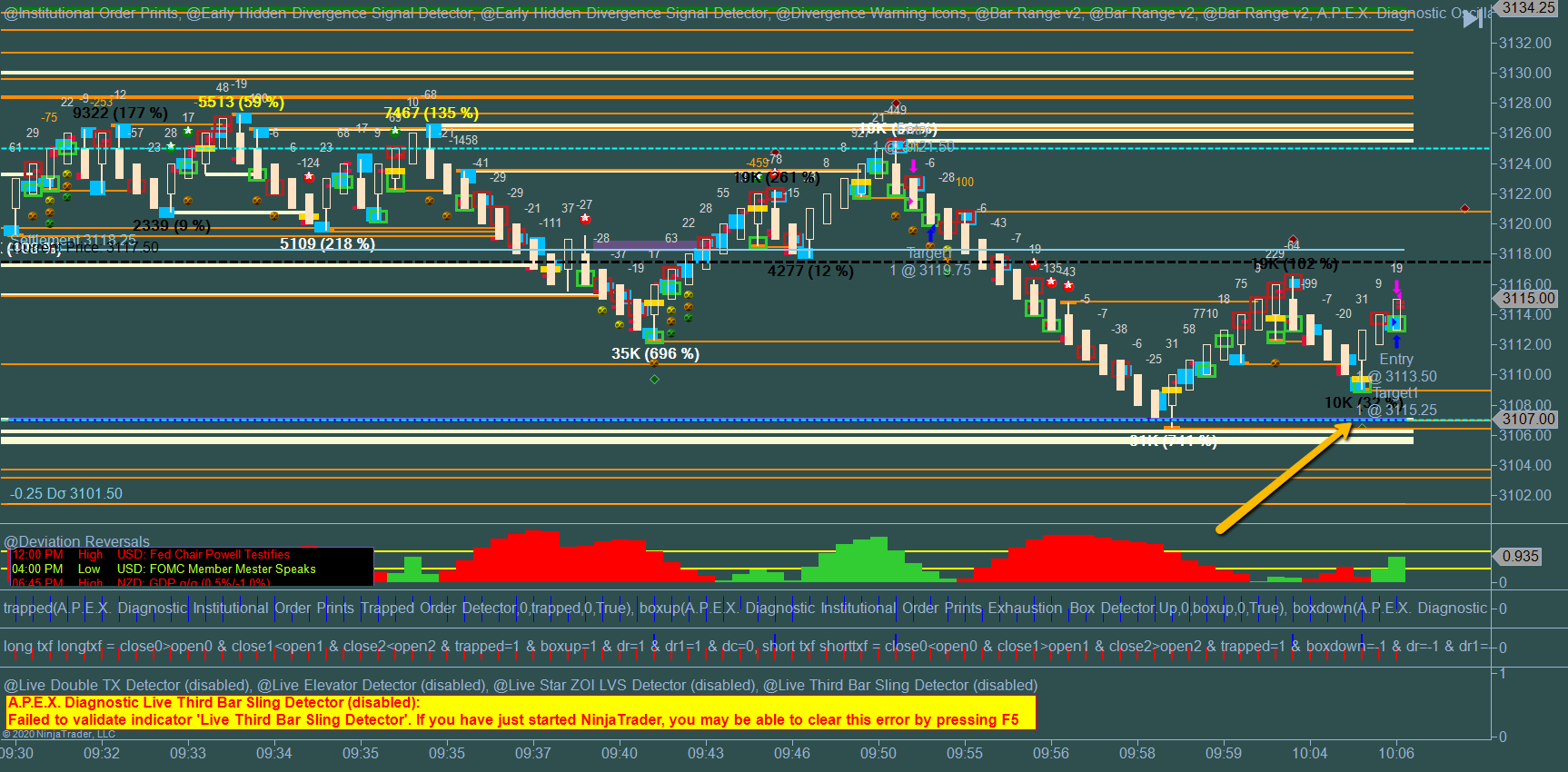

- Watched it trade like mad with seemingly no real pattern that my tiny brain could discern.

Being a hands on visual learner, I expected this to be honest. I needed to see it take the trades, see what won, what lost, why it lost, how it compared to the rules before I could begin to wrap my mind around it. Needless to say it was a disaster.

Total Trades: 28 (yes, I know this is WAY to many but the goal was to expand the number of examples I could see in demo)

- Winning Trades : 17

- Losing Trades: 11

- P/L: -$36.25

Lessons learned:

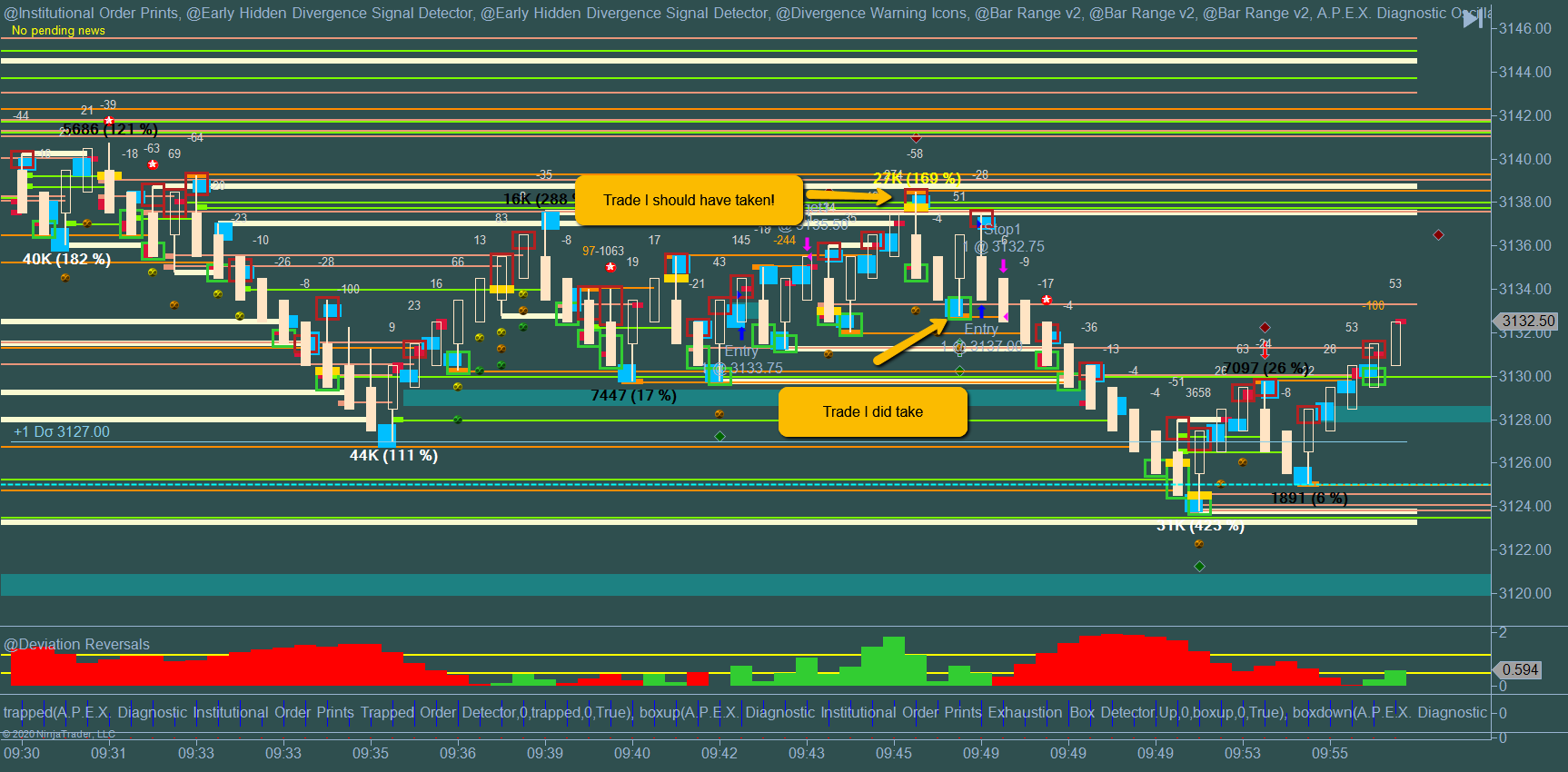

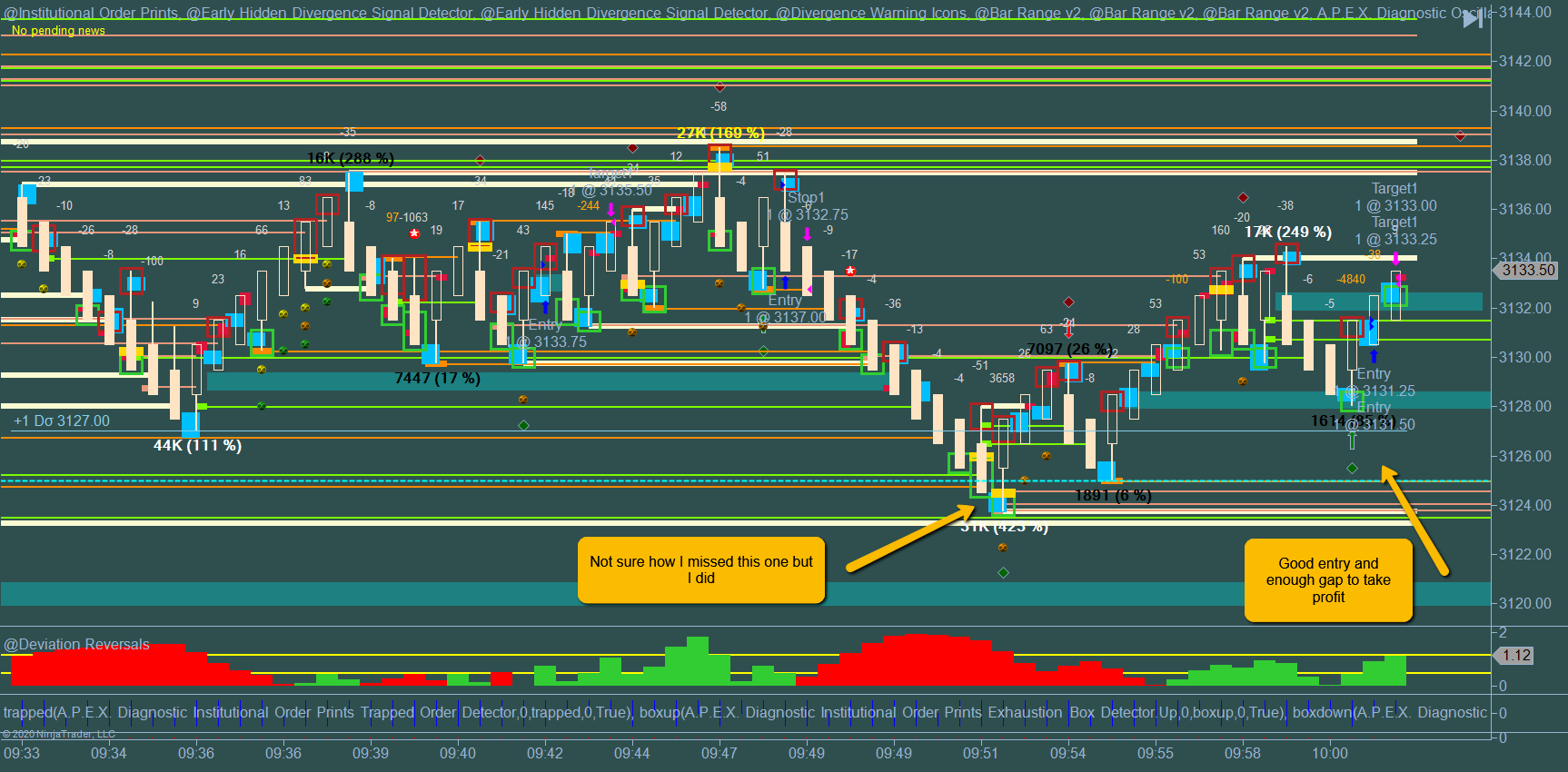

- Focus on the rules for one single setup, even if it does not occur very often (rookie mistaking wanting more trades when I lose most of them)

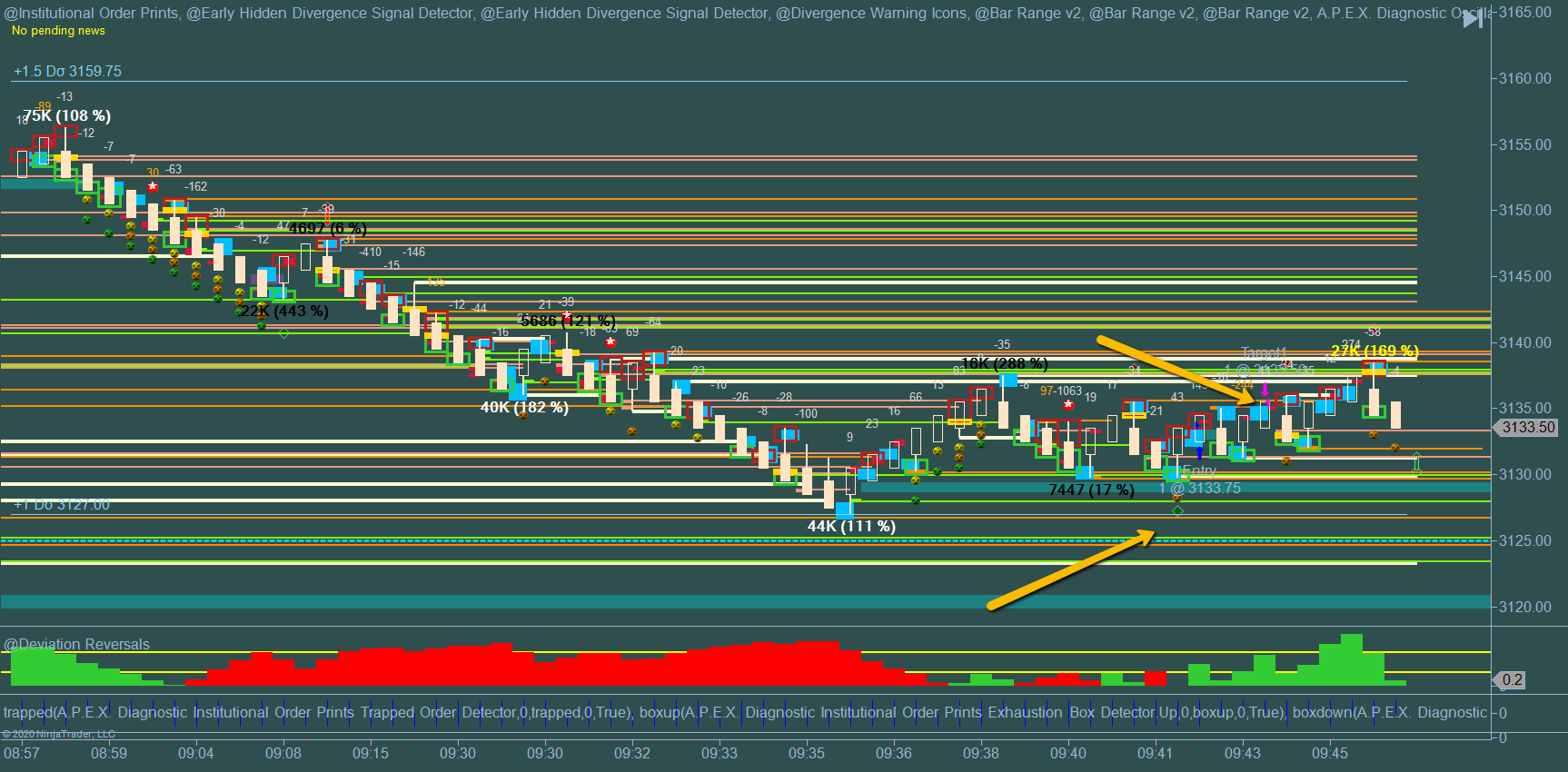

- I have more mental confidence in trades coming off of levels (Paw, MM, Deviation, ZOI, walls, etc) so focus setting the TA to hone in on those.

- Looked over every single trade for the day, looking left, beginning to recognize chop, and other flags.

End of day feeling: I ended the day thinking yep, another swing, another miss but given the myriad of previous failures, I should not expect immediate success. Overall mood = “meh”

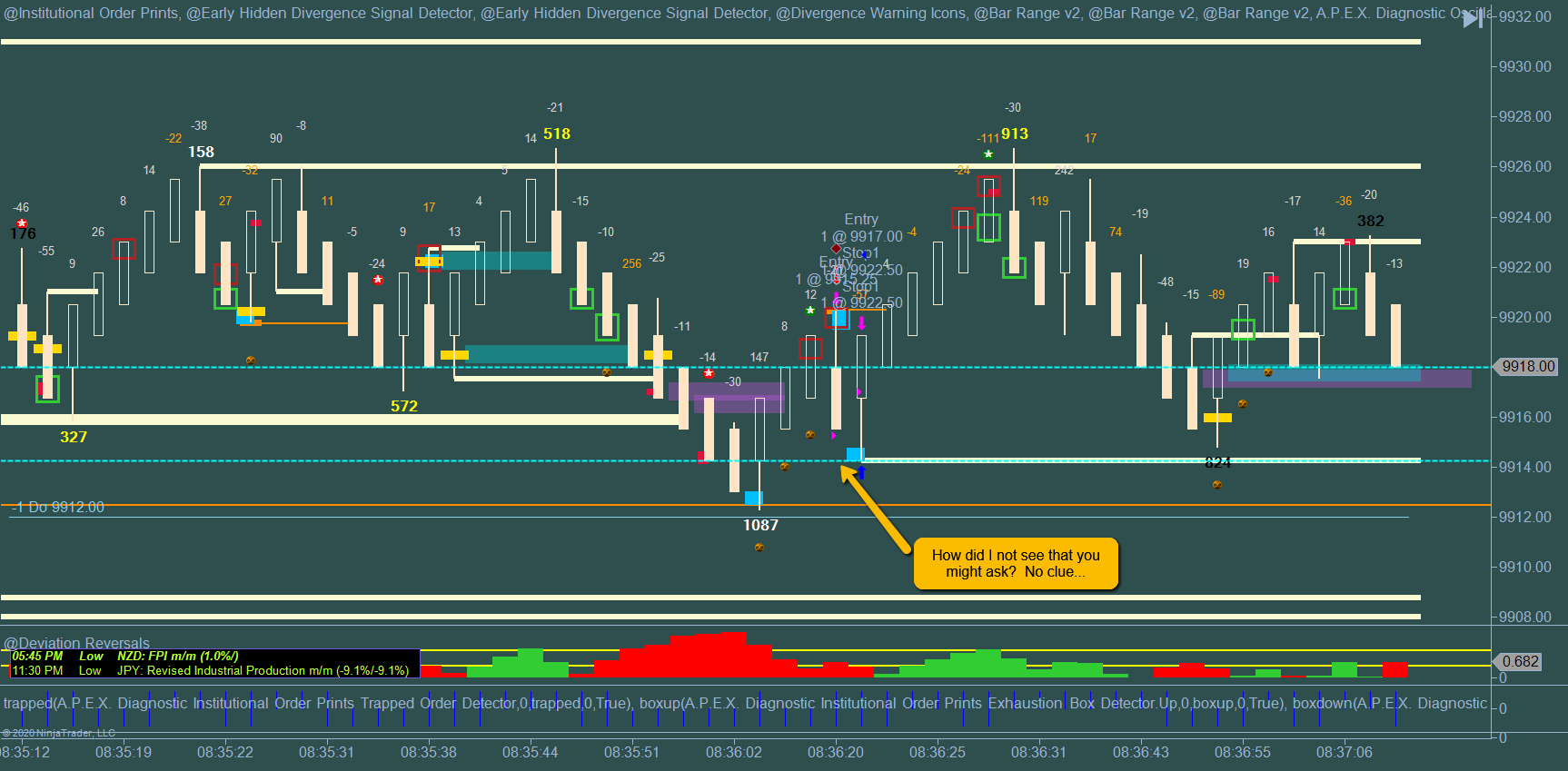

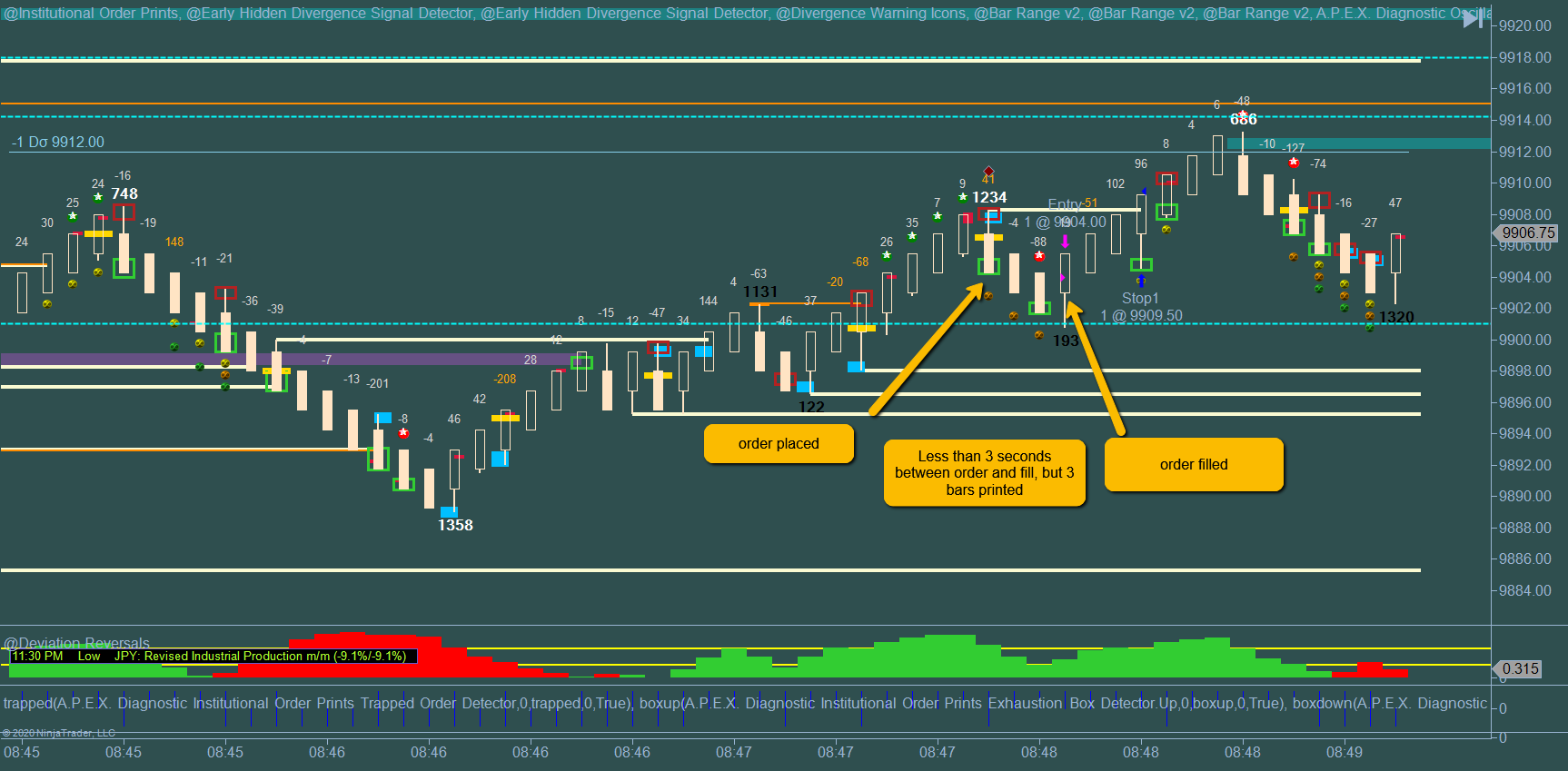

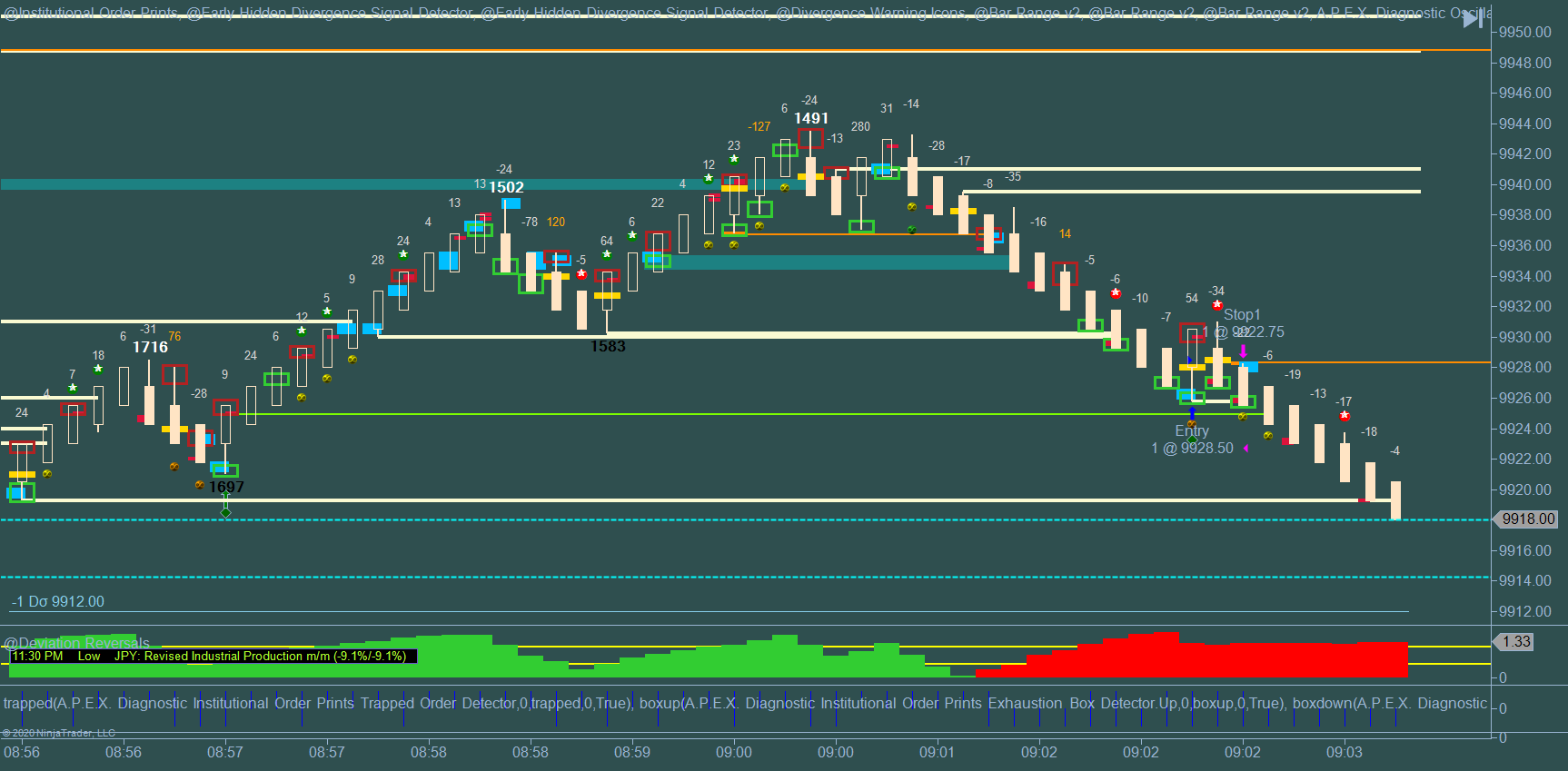

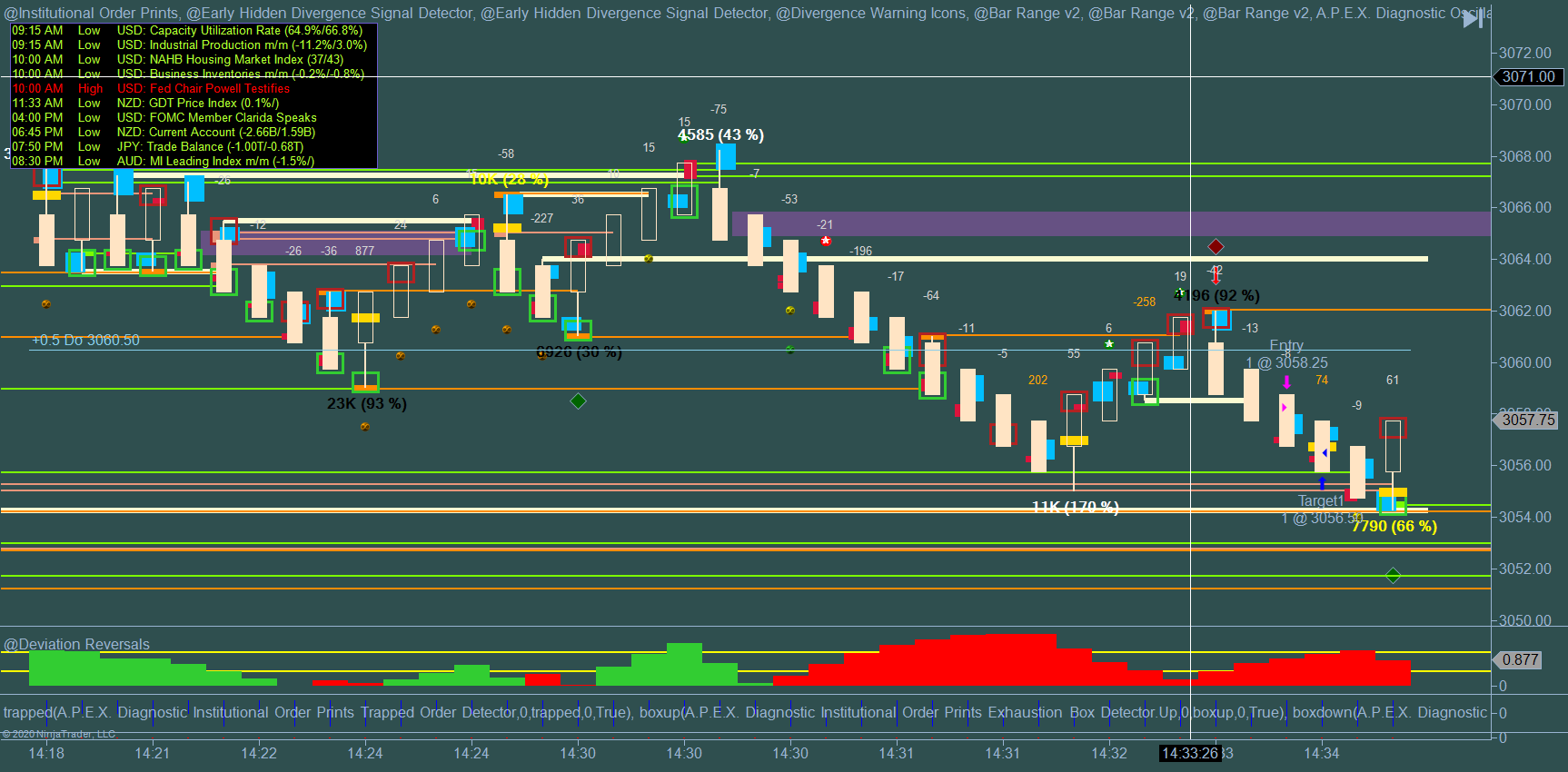

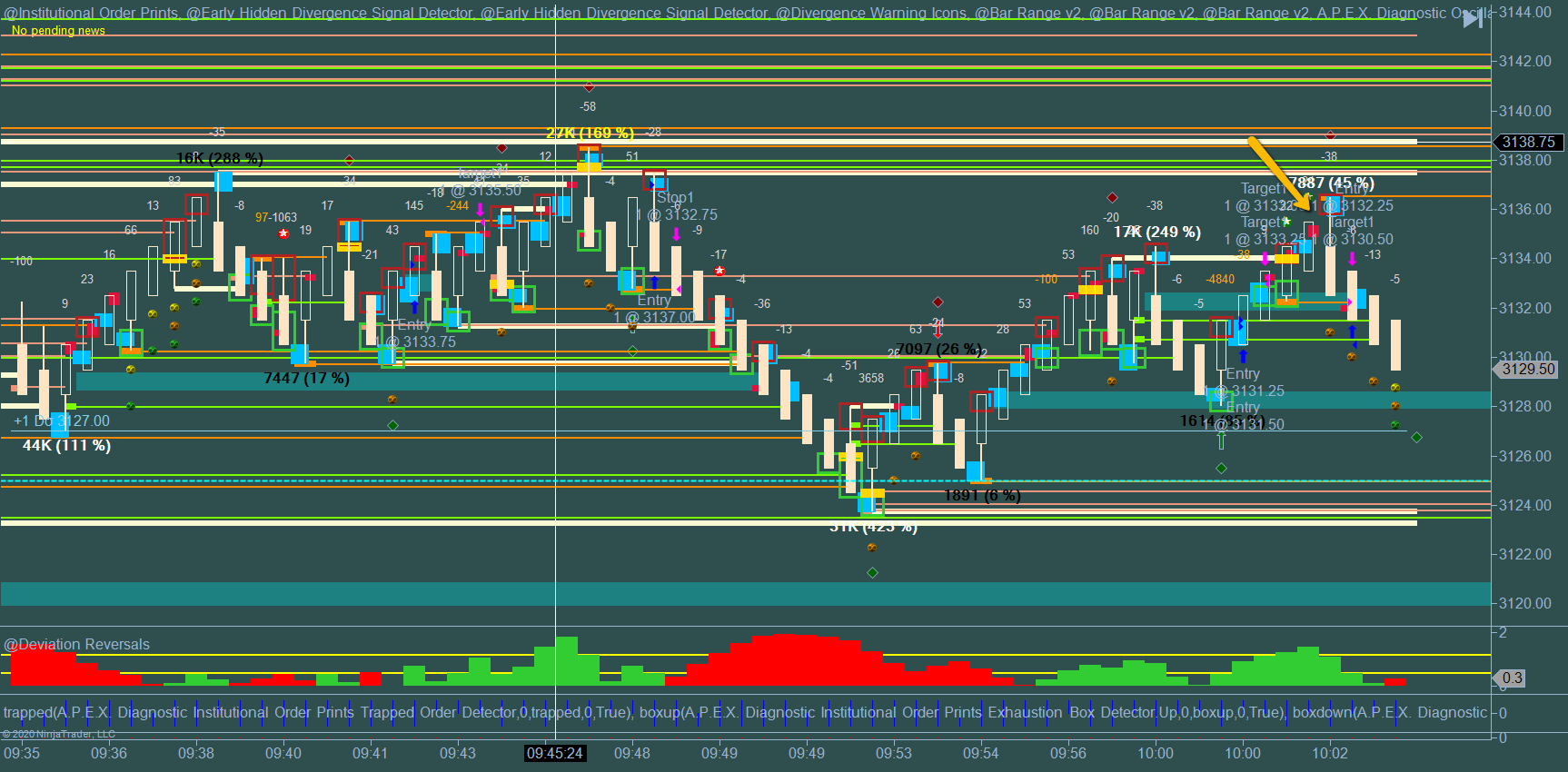

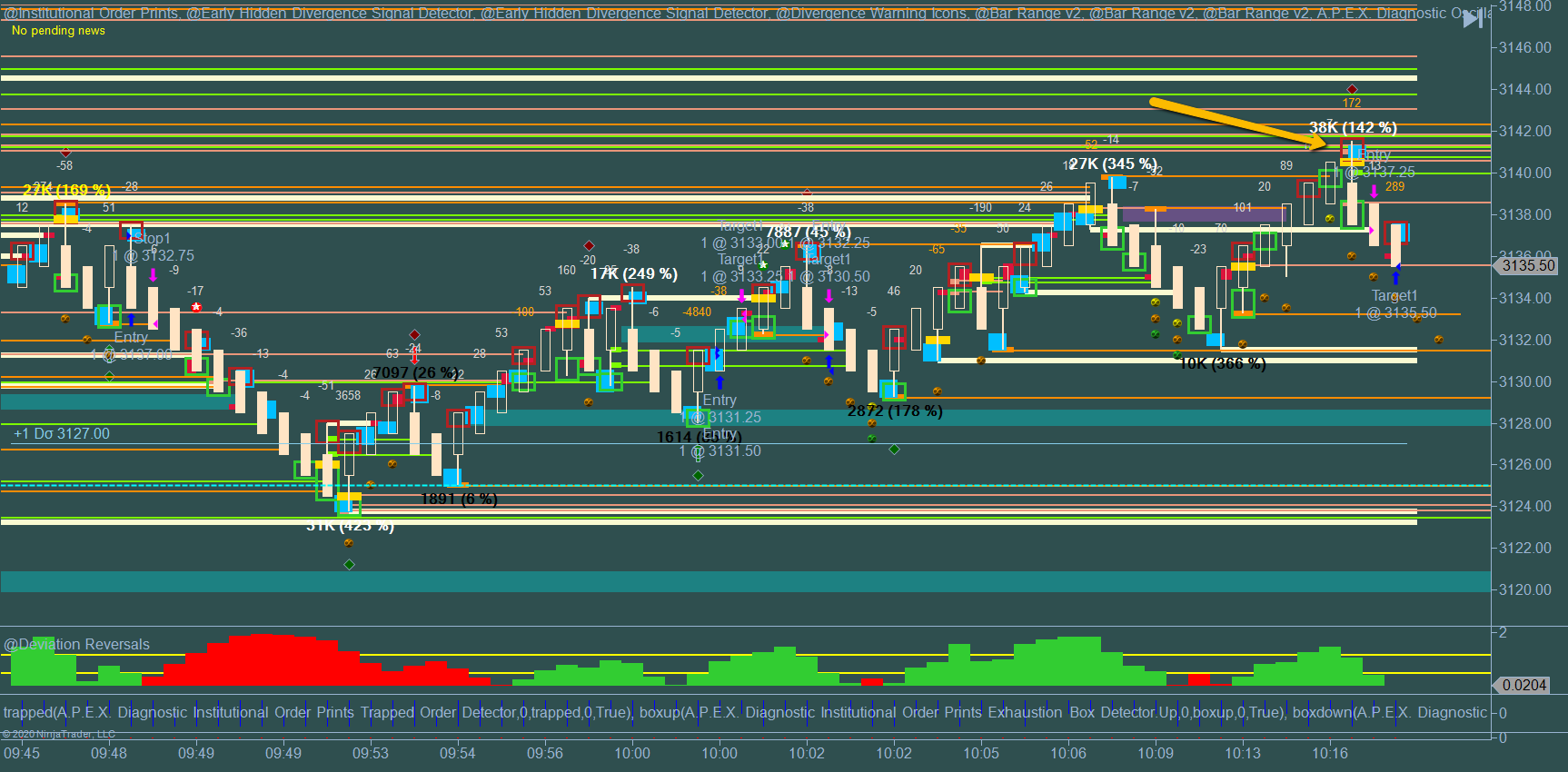

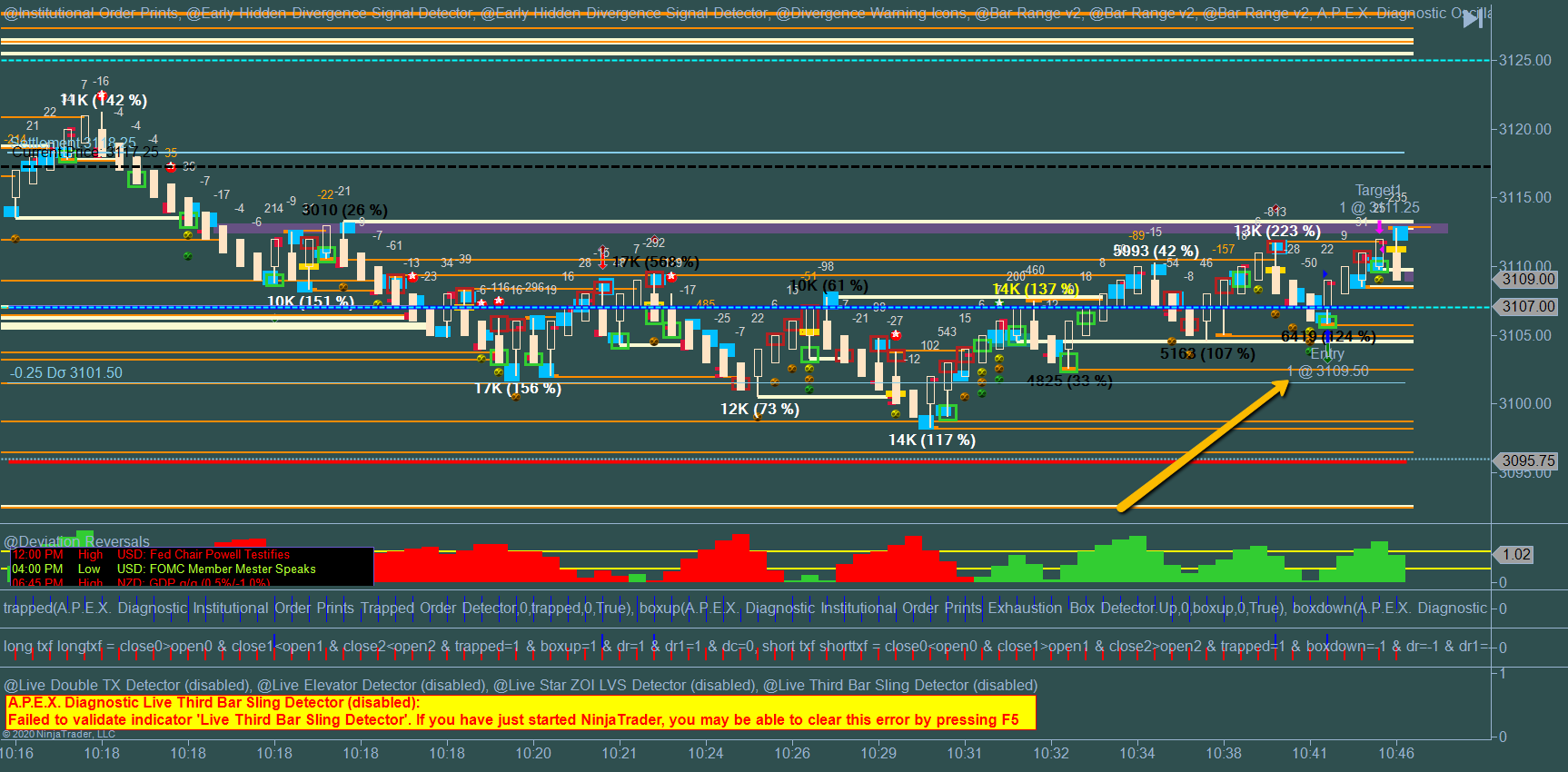

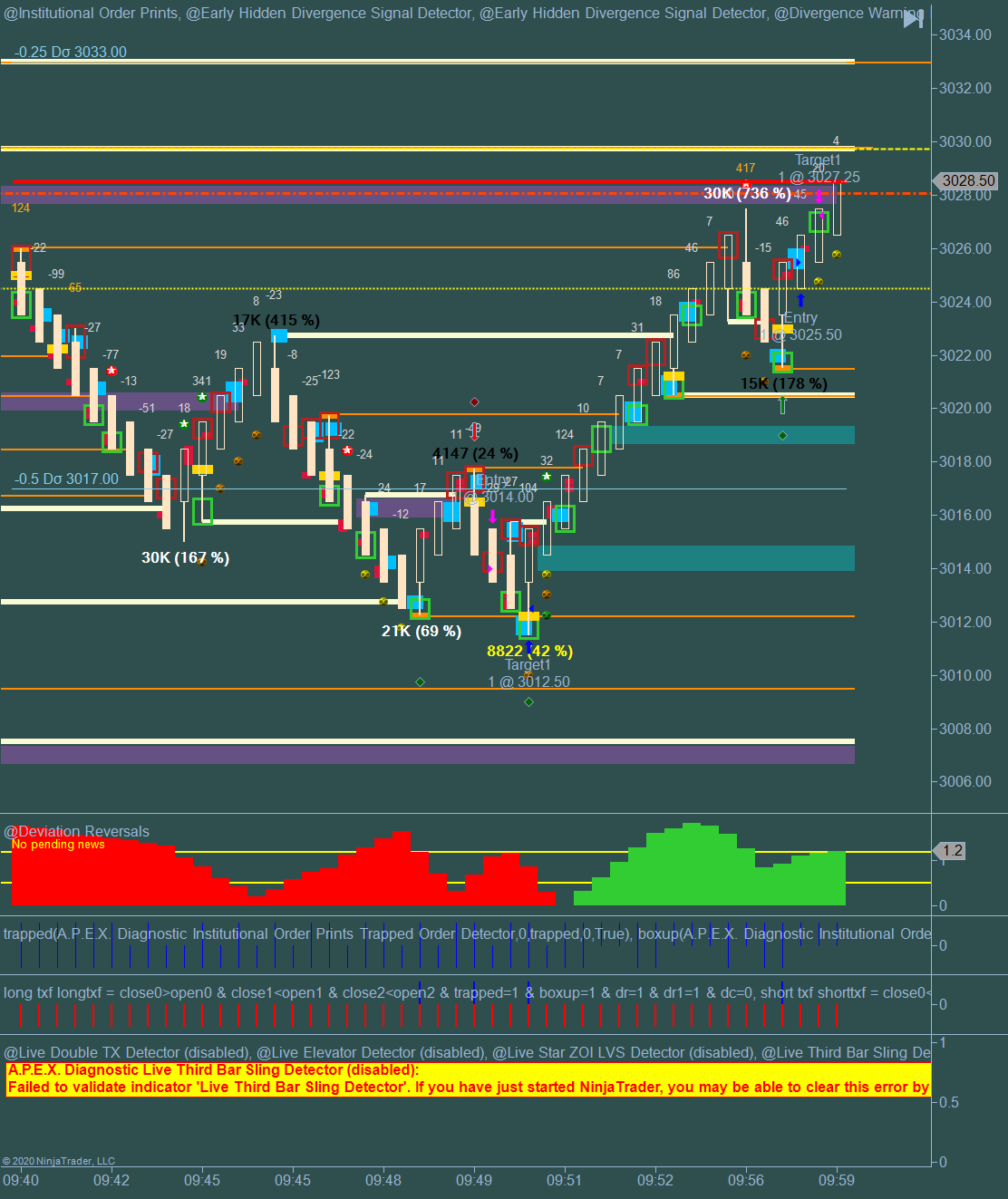

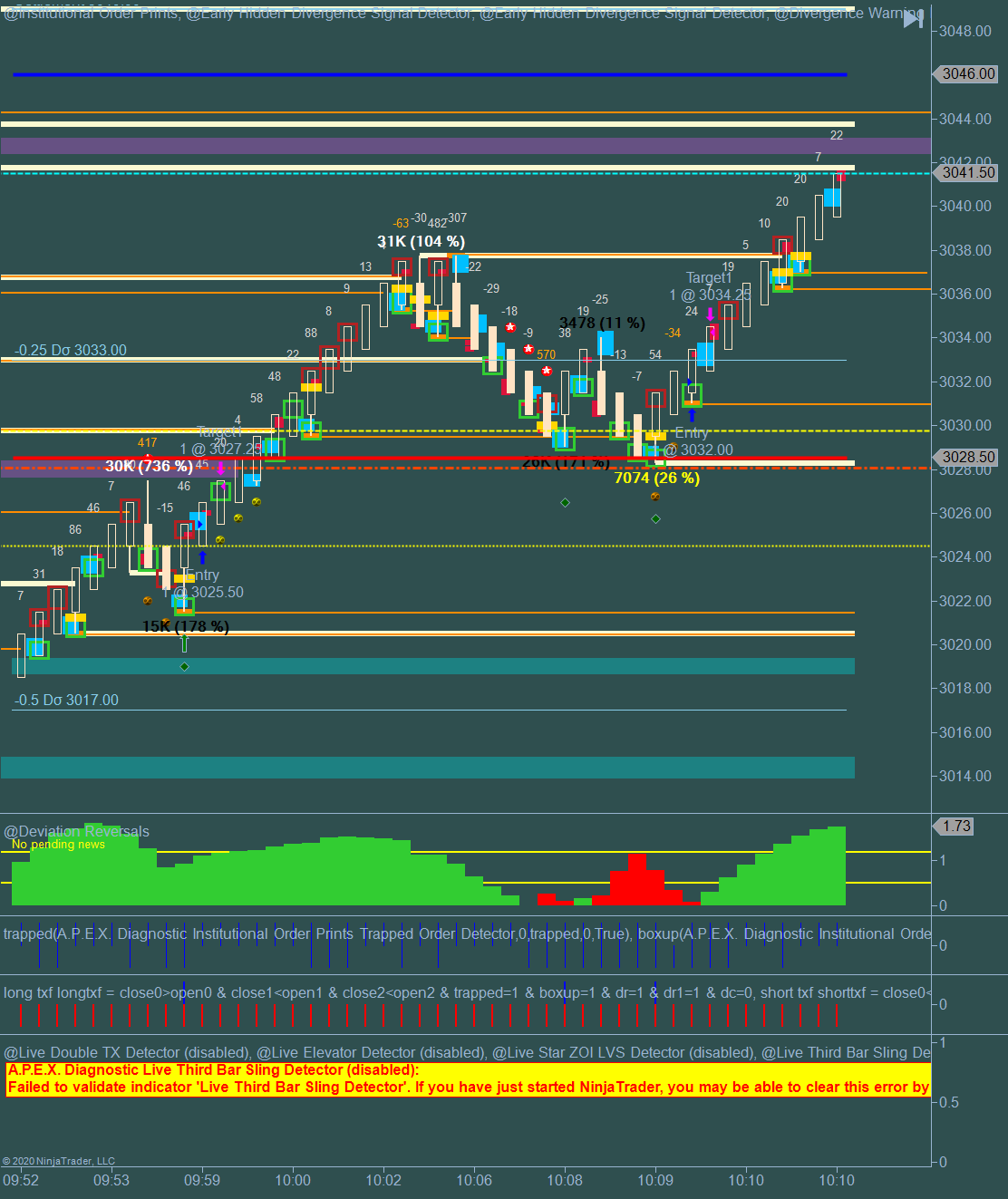

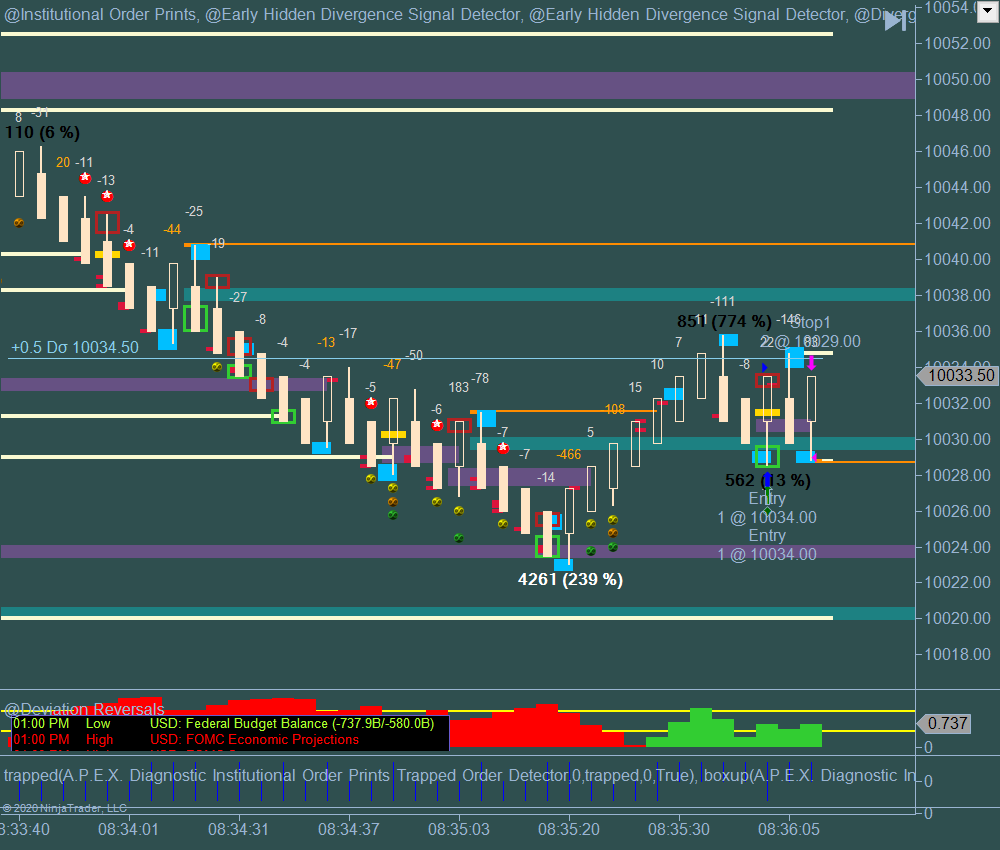

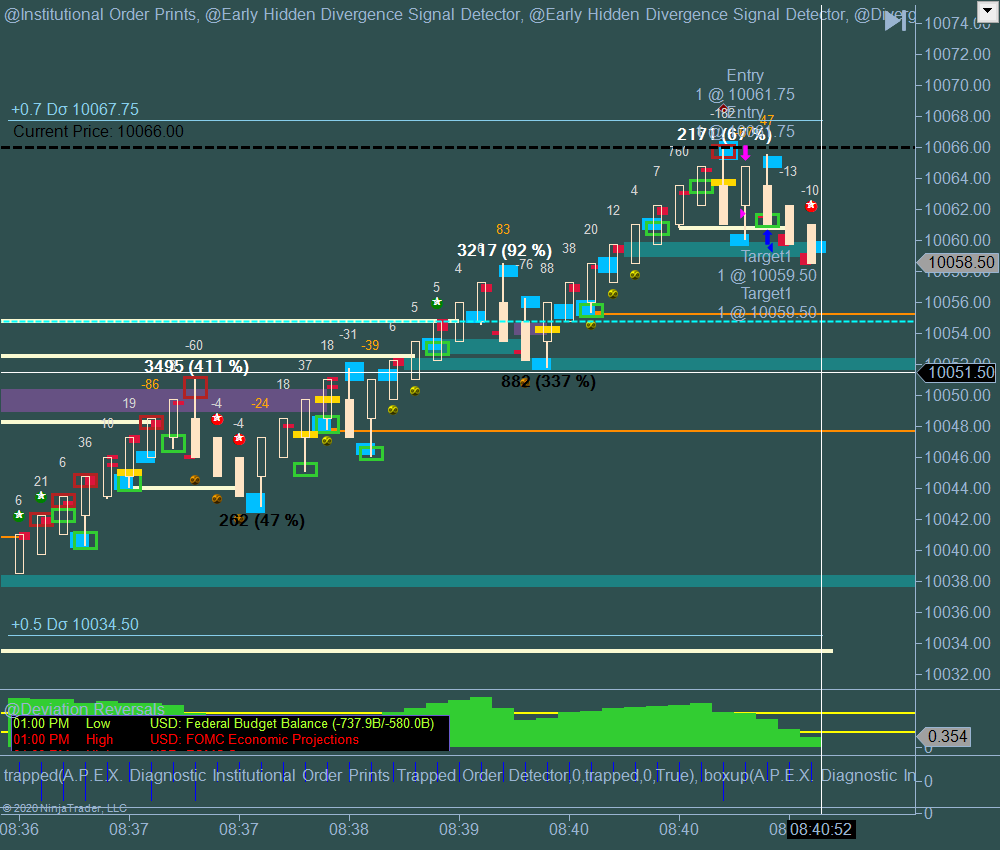

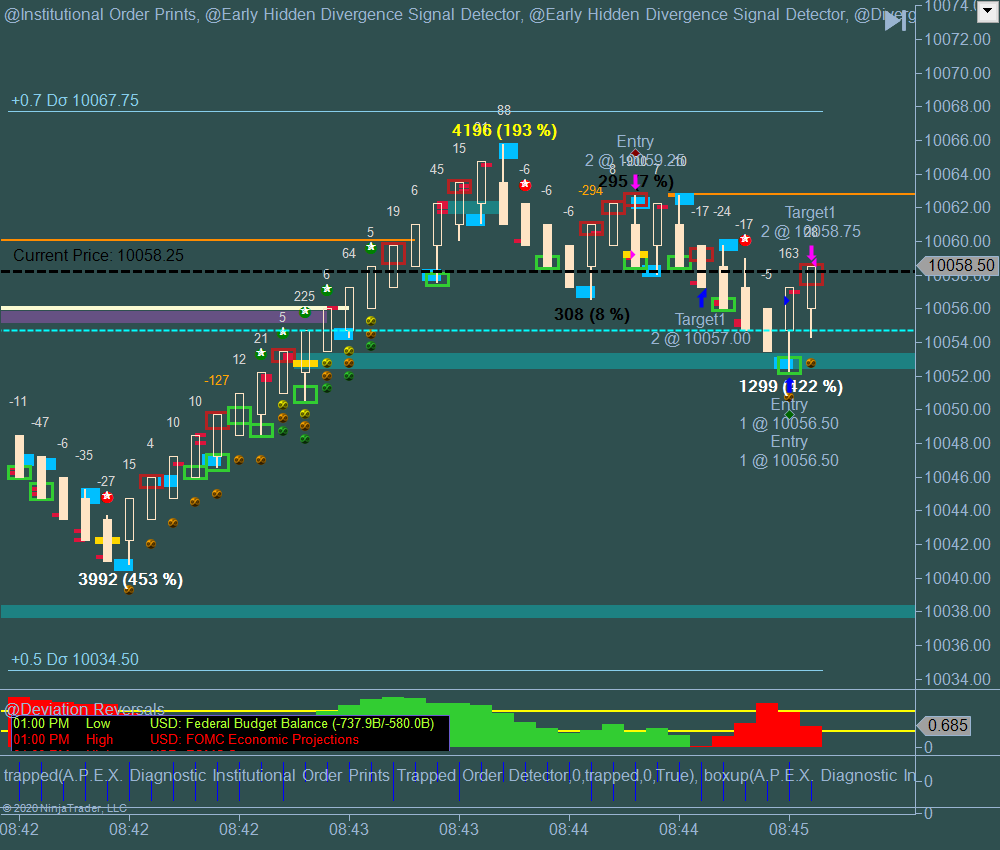

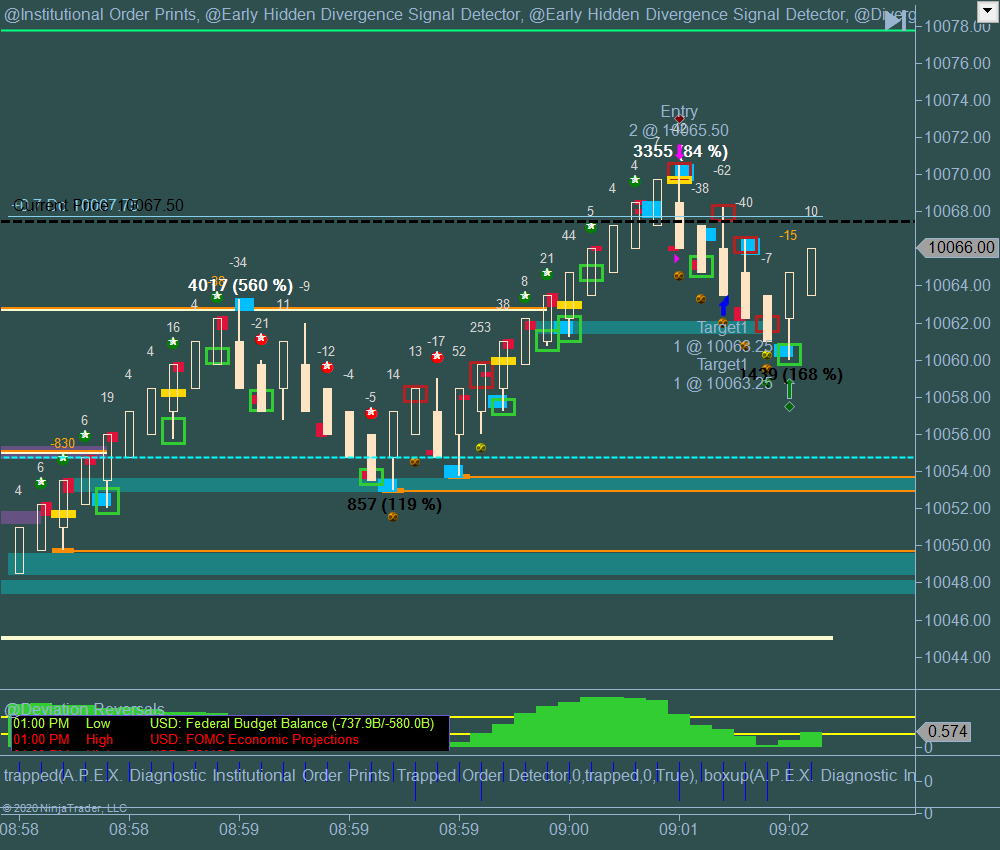

Both signals fired on the same bar, so I turned on the TA. Fill got jumped, price immediately came back to the fill before I could even cancel them and then closed in the same bar. Total time in trade was something like 4 seconds from entry to exit, pretty amazing.

Both signals fired on the same bar, so I turned on the TA. Fill got jumped, price immediately came back to the fill before I could even cancel them and then closed in the same bar. Total time in trade was something like 4 seconds from entry to exit, pretty amazing.