I seem to be having some problems which are mostly psychological/emotionally based. I have tendency to get my first trade to be a winner, then a loss or 2, then the rest of the day I fight to break even, or get my net 3. I don’t know what “normal” means, so any perspective is appreciated. I’ve yet to have a net 6 loss day. I either quit early due to lack of time, or the intensity of my emotional state. Overall things are going well. I want to re watch the mind mastery course to actually write down my “gremlins,” and further examine the material focused on my weaknesses. Other areas I am having some issues with are the OD divergence. Some of my trades start with the OD divergence numbers being correct, but end with the current number moving to the next bar and growing high enough to no longer qualify as an OD divergence. Is there something I’m missing? Also with issues about when to close trade at break even, and moving my stop or taking profit early. Could use some clarification in that area too. I posted in psychology because I believe most of my issues are emotionally based. For example, today I missed out on 2 perfect short set ups, and then jumped into the next short without seeing the stack of obstructions which invalidated the entry. Attached is a spreadsheet I made for today only. Screenshots are include, but probably too zoomed in. Could also use some advice on how to focus on the market and take screen shots at the same time. Is it best to go back at the end of the day to document things? I’ve missed out on trades doing that too. I guess I can’t upload an excel file in here? Please look on the FB page. I’ll try there Thank you for any input. George

An example of my daily pattern of behavior

For comments on trade would need you to pleae number the trades on each screenshot. You are on the right track. Learning to see OD - it should not change once that bar closes once entered so not sure what you mean unless it reverses. I would be happy to review each chart but please number the trades.

Thank you. I will re-post when i get home in the am, or b4 i leave for work tomorrow afternoon. Didnt sleep much today. Was trying to get this posted before i left for work.

Thanks Darrel. I will re-post them as you ask.

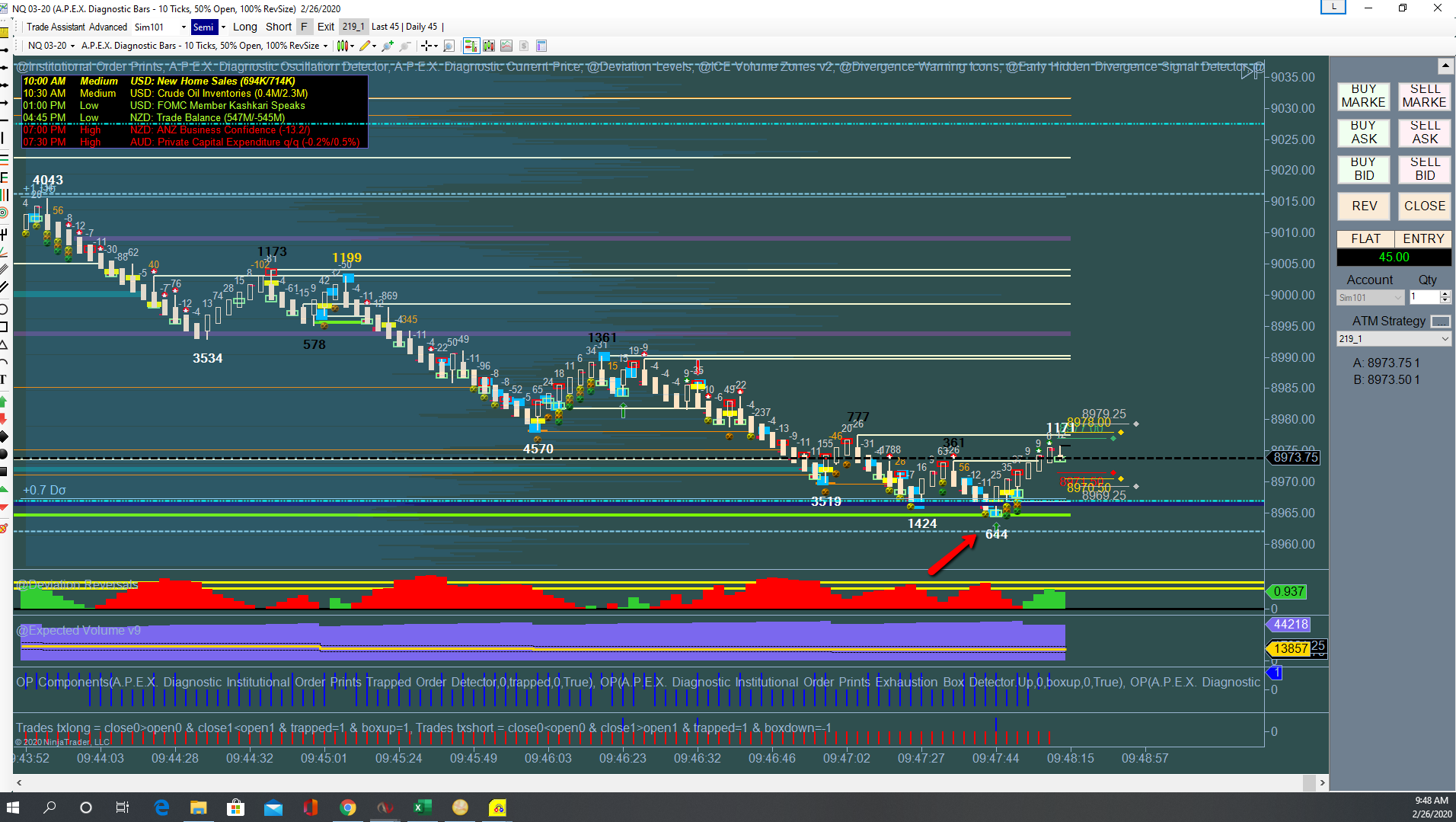

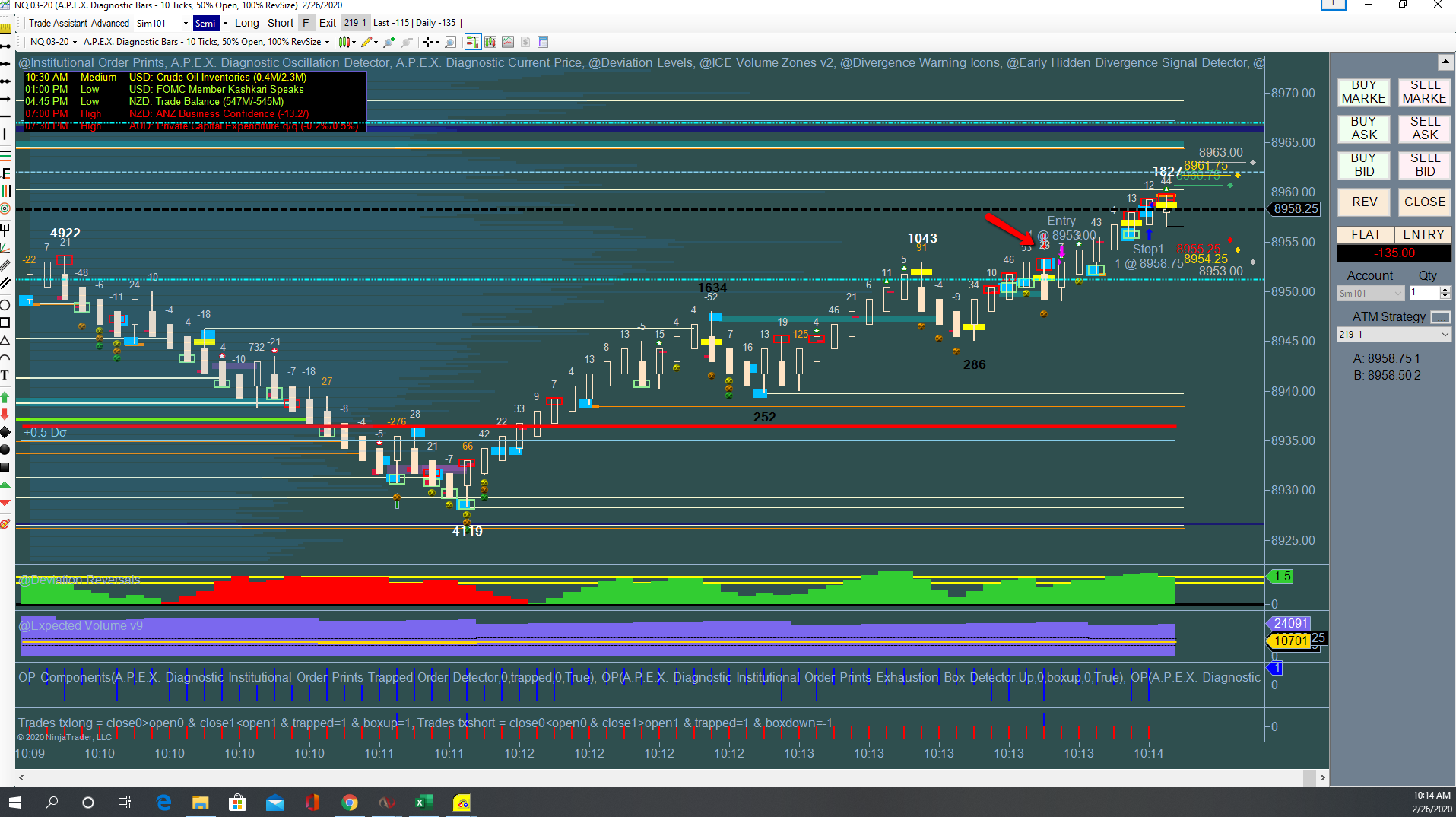

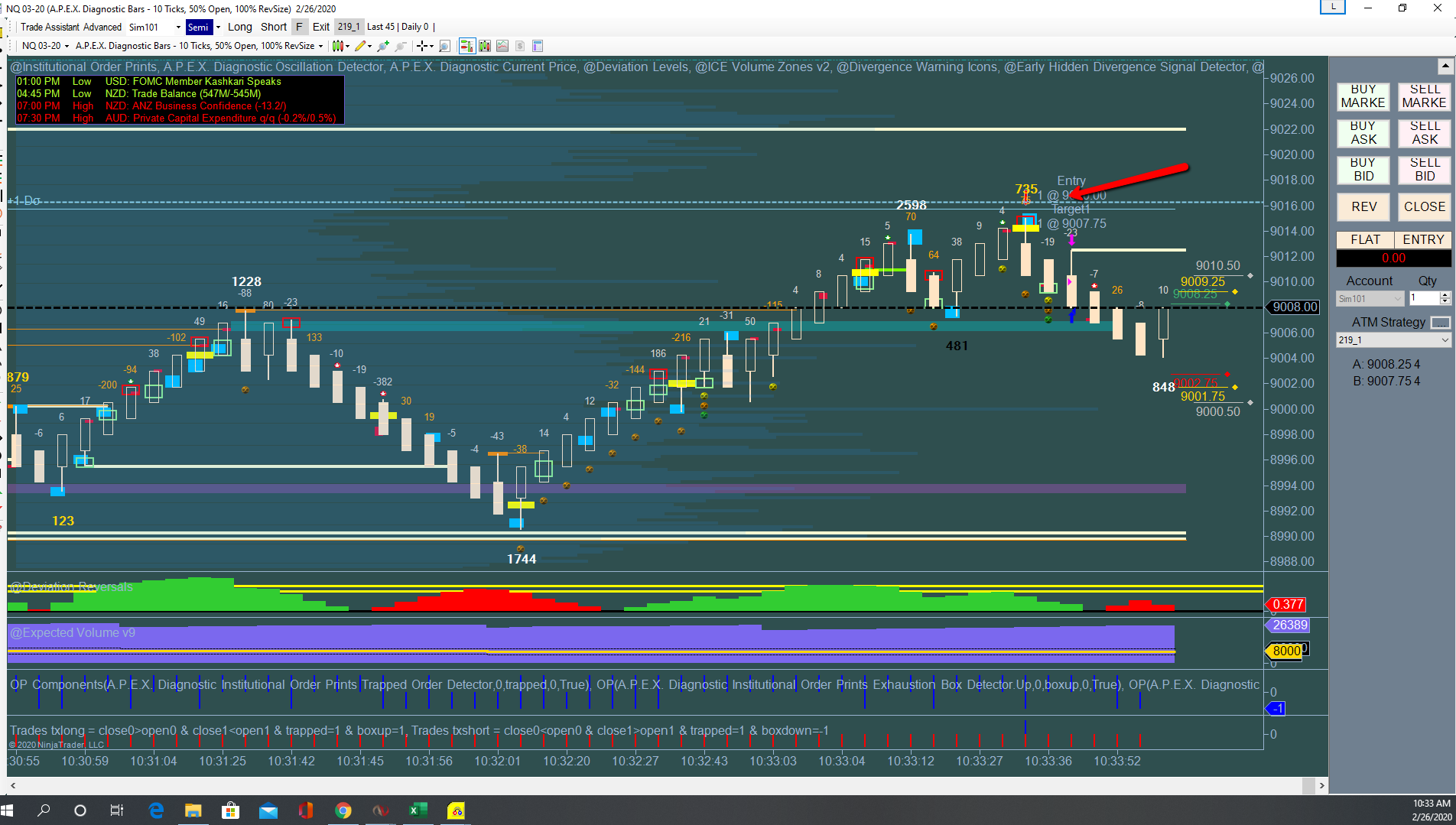

Trade 1 OD divergence trade. My first one of the day with my first cup of coffee.

Trade 2. This is an example of when I set the trade to enter because, at the time I make the decision there was OD divergence. As you can see, when the trade closes the OD is higher, and on another bar. I think I’m missing something about when the OD is finished on a given bar?

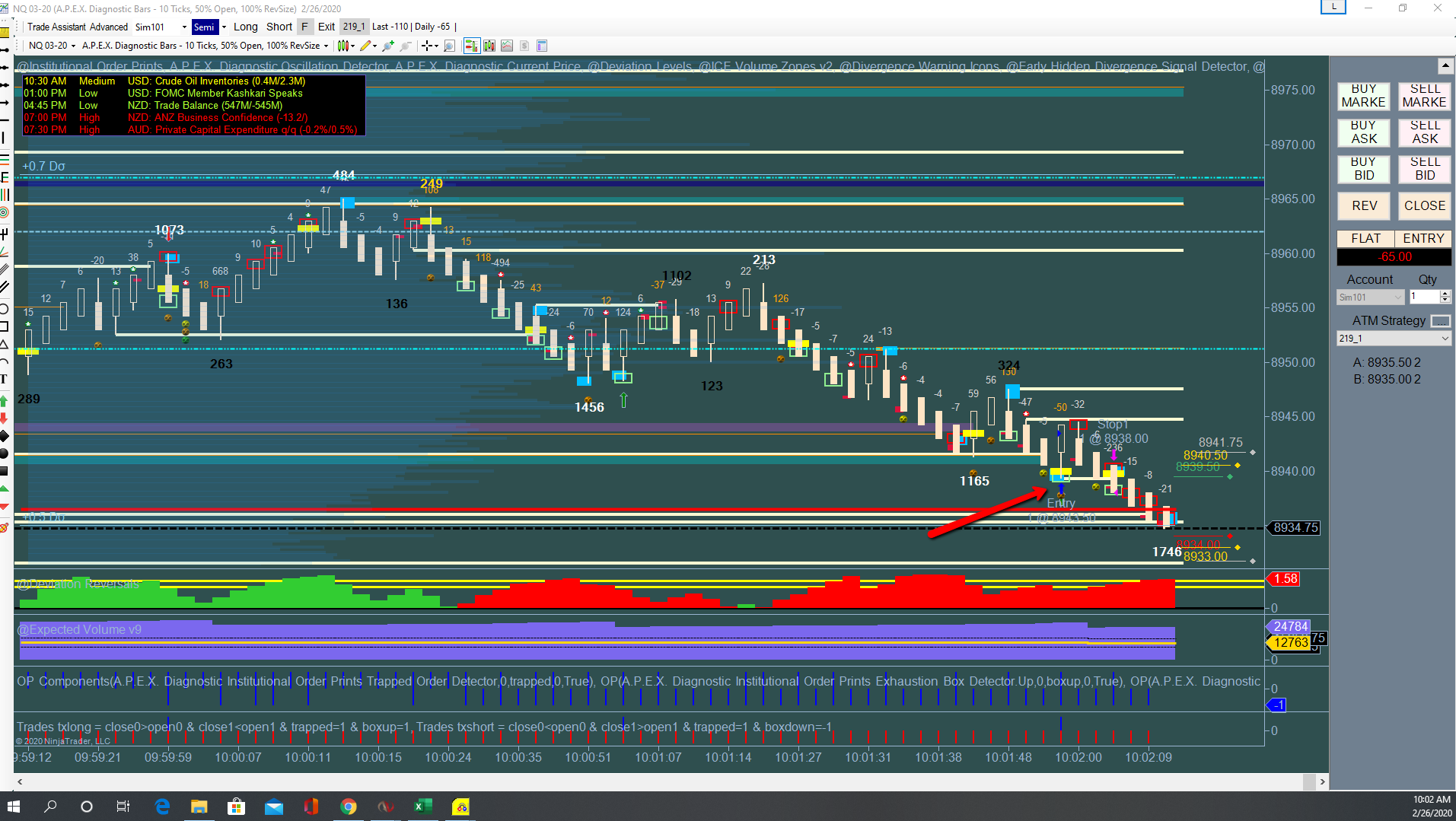

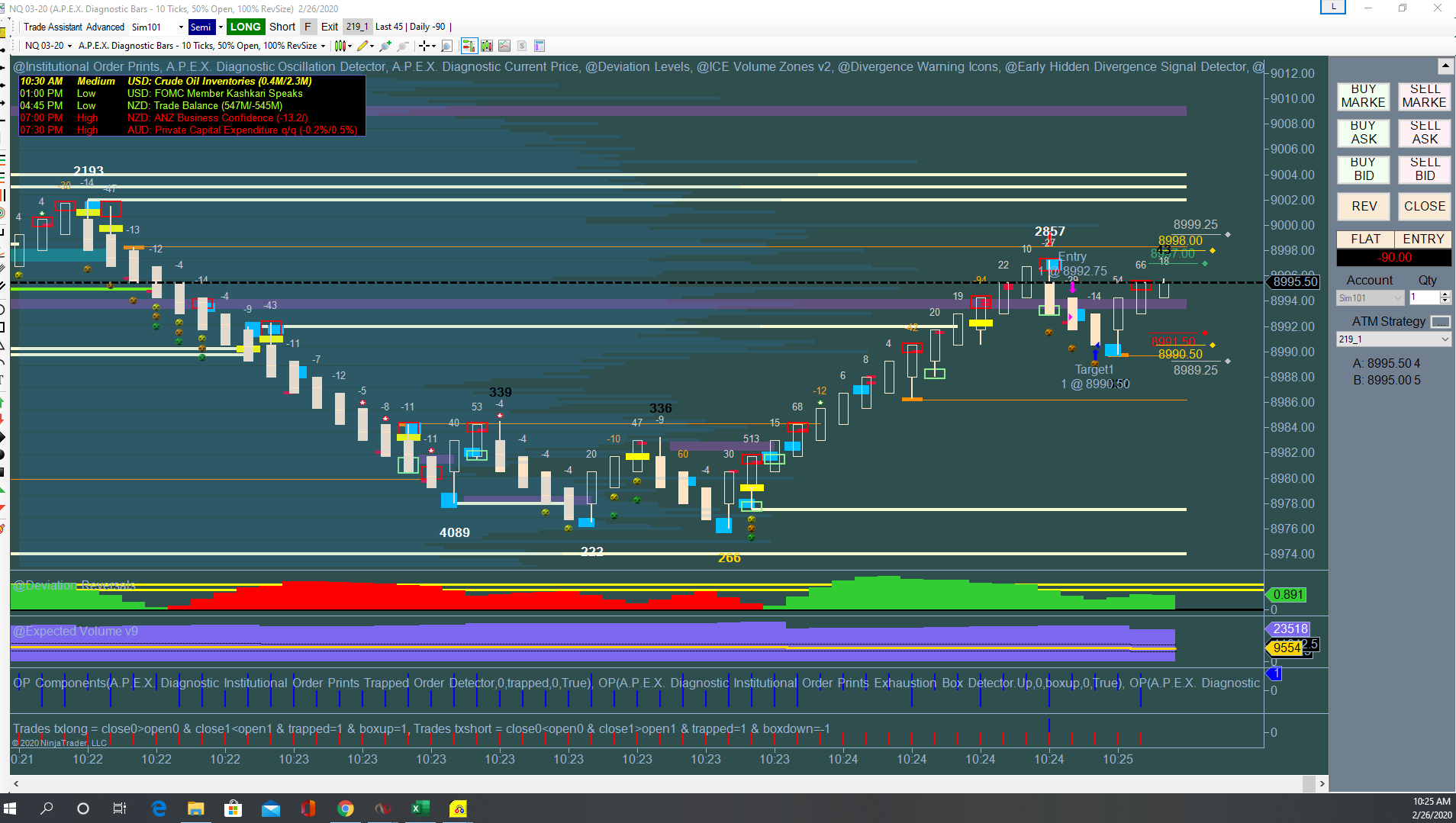

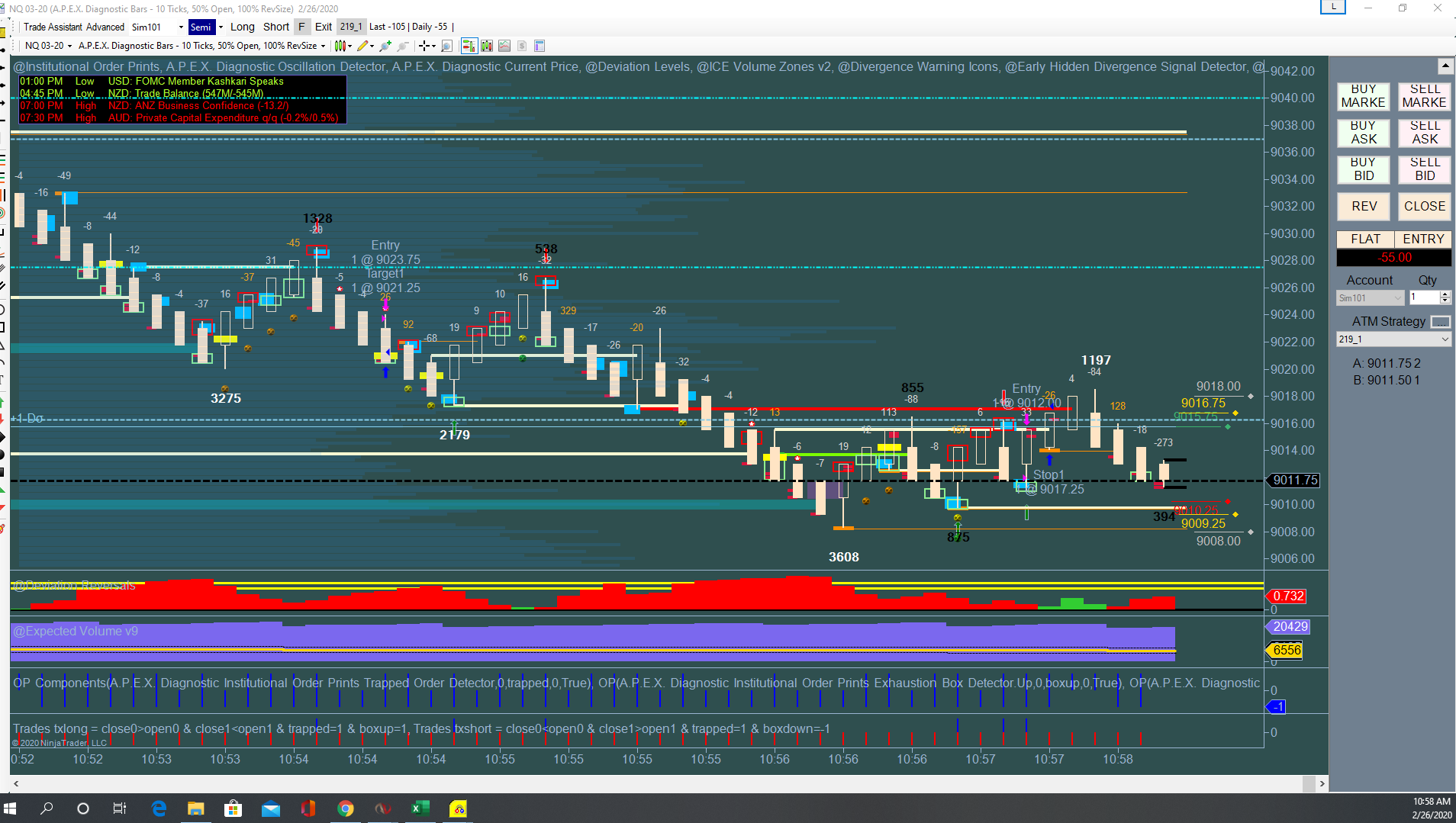

Trade 4 was meant to be a short off the NQ wall.

Trade 5 was where the emotion sets in. No justification to enter.

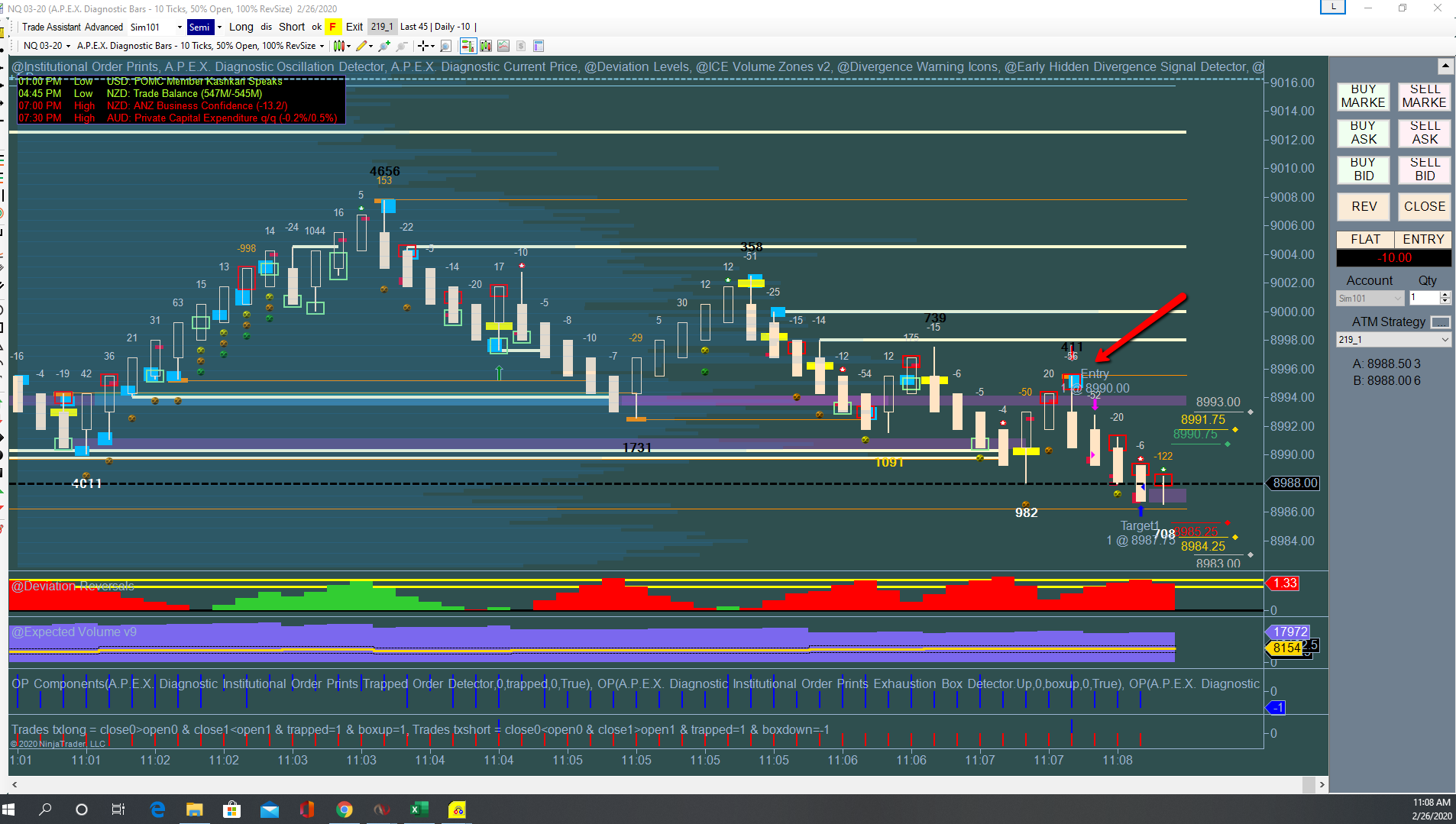

Trade 7 was another OD divergence.

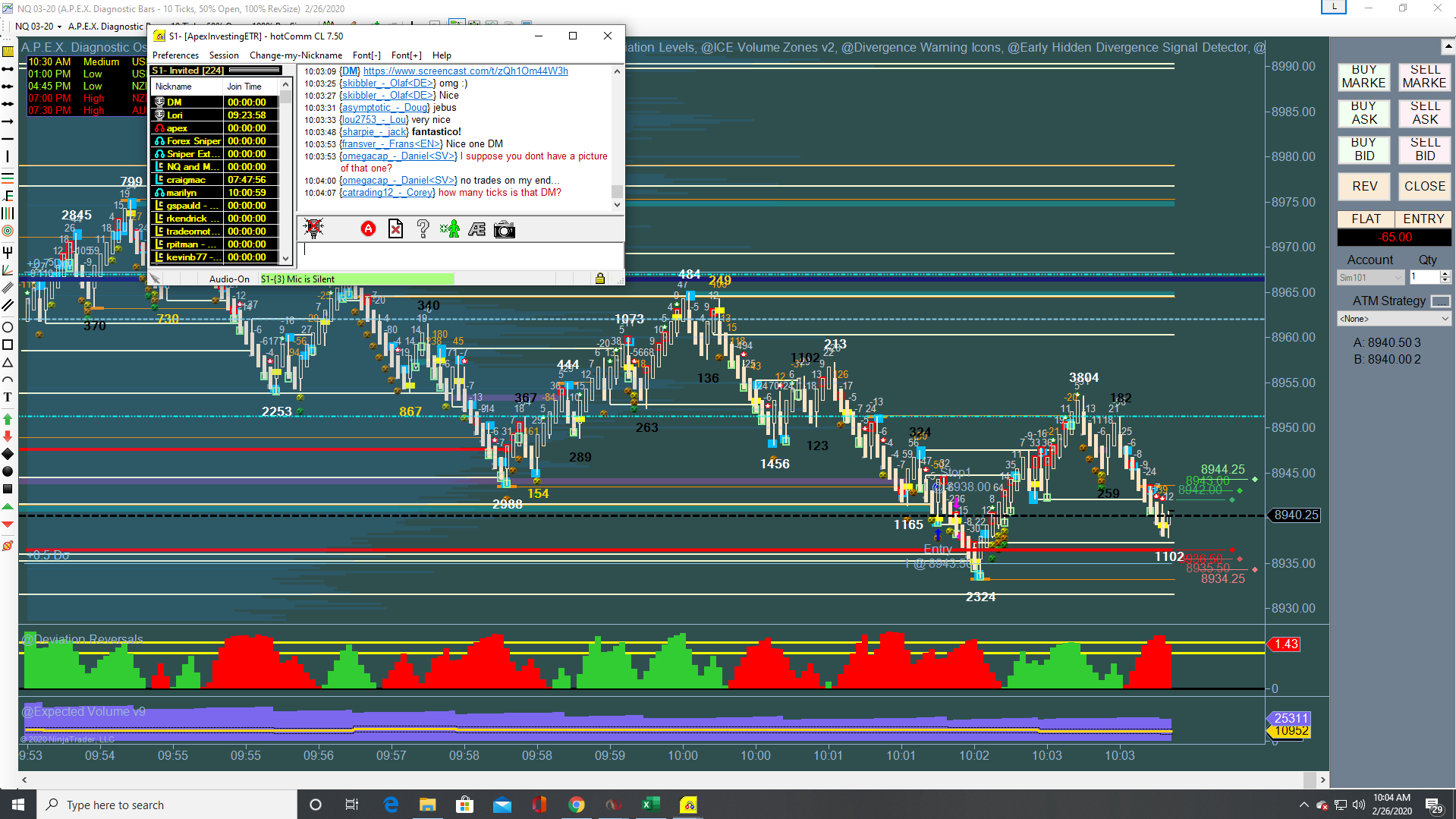

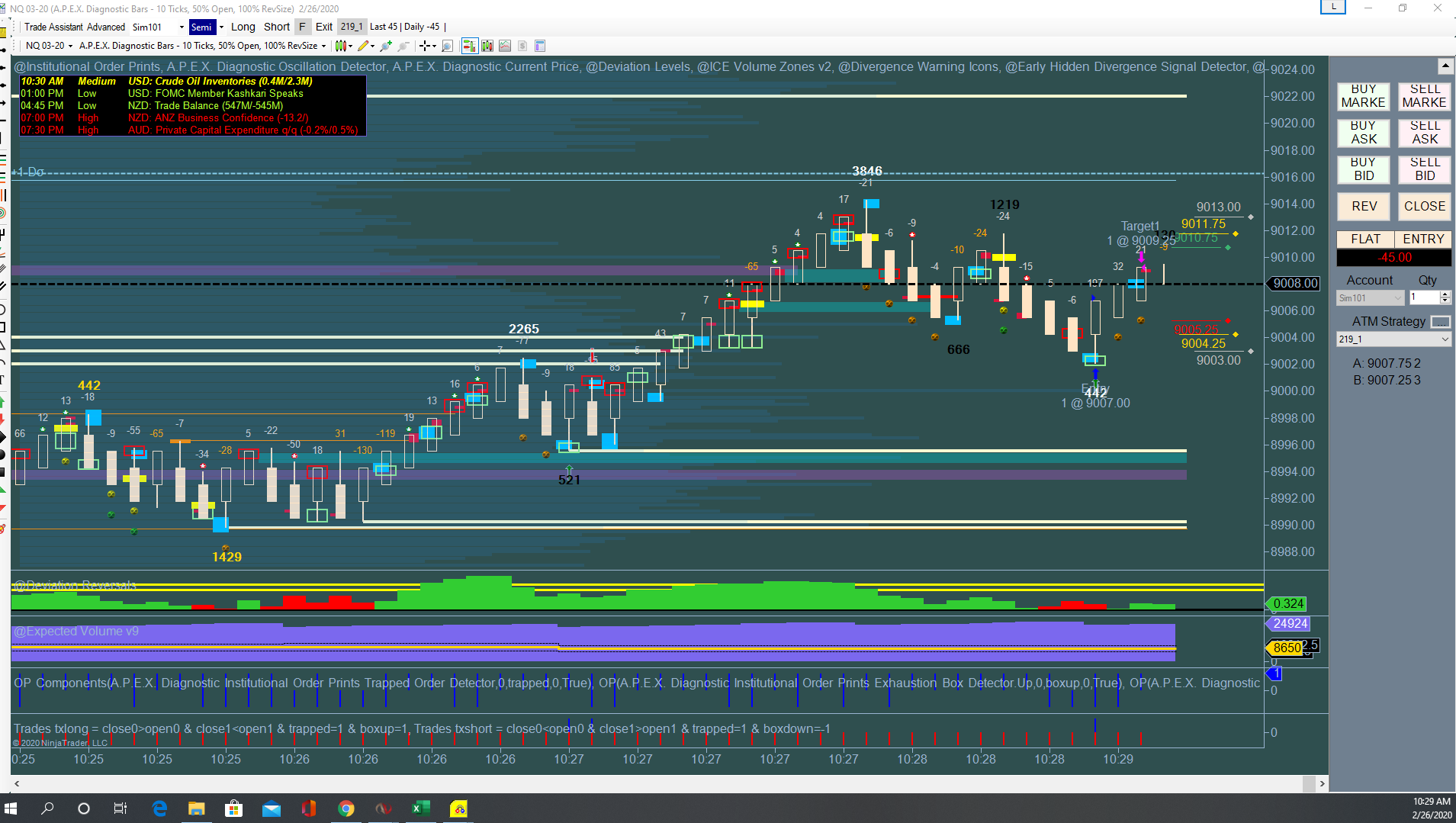

Trade 8 was a trend continuation off an NQ wall

Trade 9. This was an impulse trade. Looking left I thought I had missed 2 great short set ups. I juped into this one without noticing the obstructions.

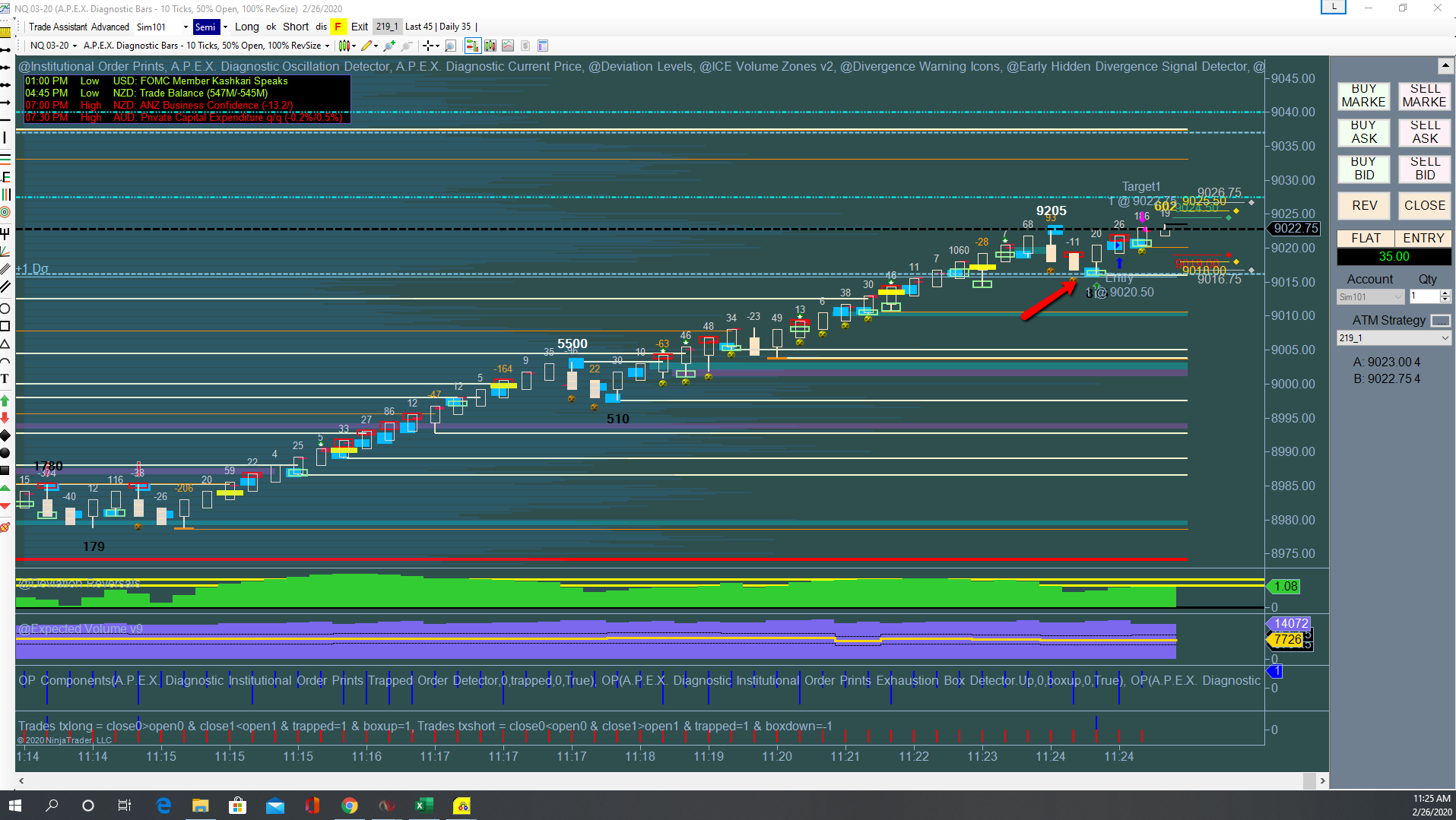

Trade 10 is a trend continuation.

Trade 11 was a trend continuation.

Trade 12 was a Short off a major level. NQ wall.

Trade 13 was a downtrend continuation.

Trade 14 was another trend continuation trade. This one I almost closed out early, but reminded myself to stick with the strategy.

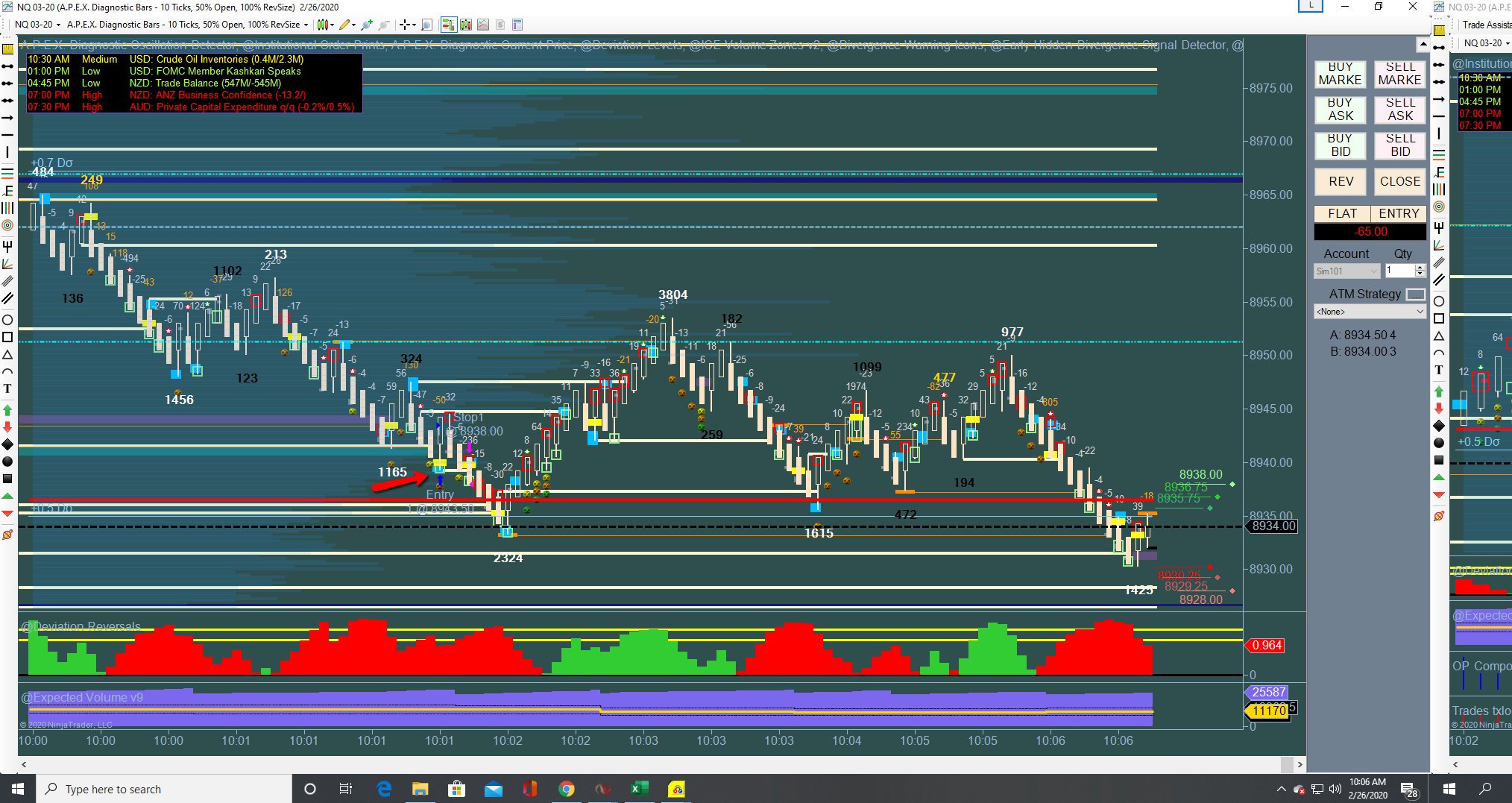

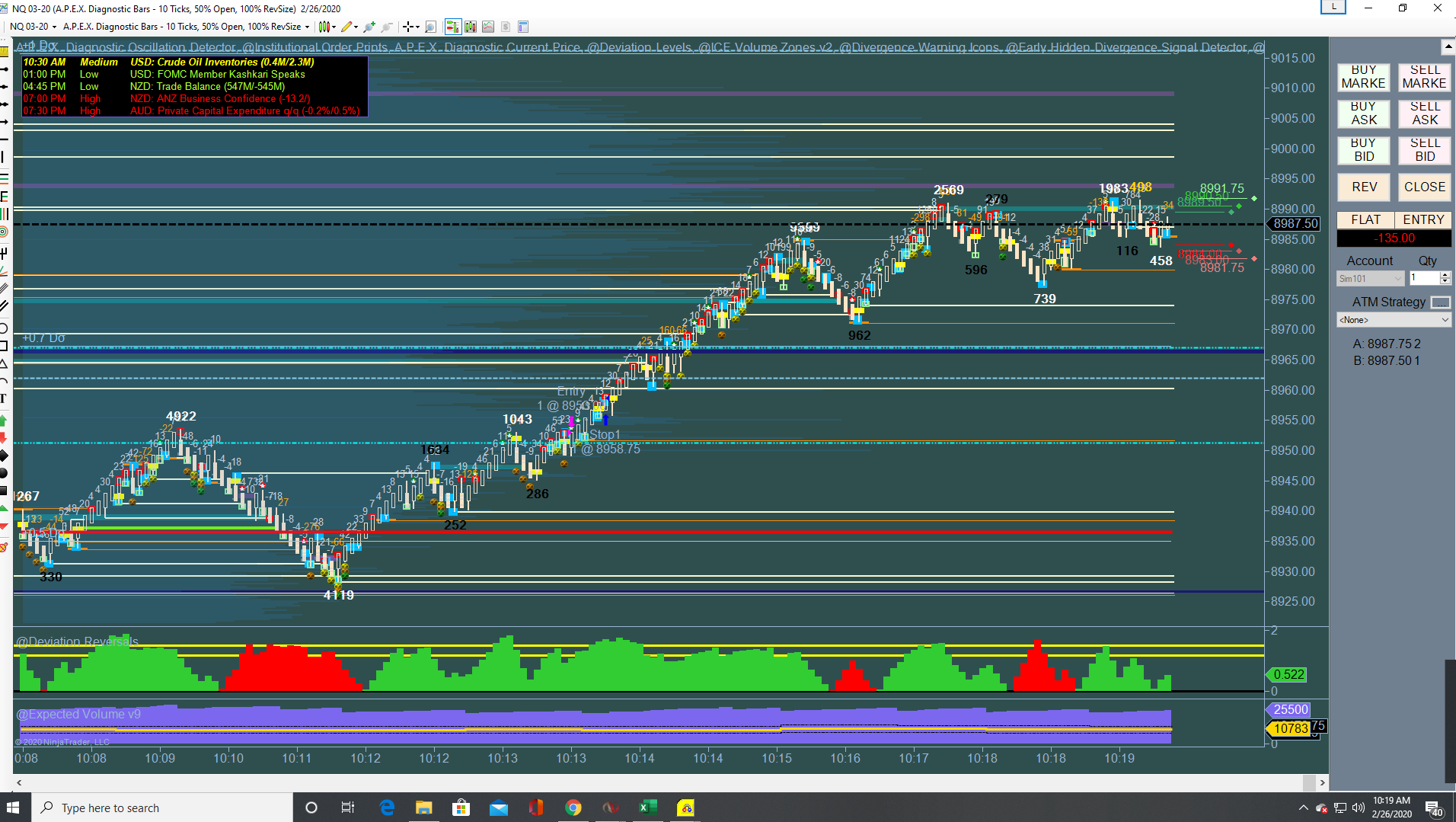

Those 14 trades were from yesterday 2/26/2020. Today the 27th I was very focused on my emotions and considering the levels. The SS here have both a zoomed in and zoomed out image.

Trade 1 I moved my TP according to rules and got 8 ticks.

Trade 2 was a trend continuation trade.

Trade 3 had DR and OD divergence at the bottom of a range about to hit a level.

Trade 4 was a $5.00 loss. I din’t adjust my TP. It did hit 9 ticks profit. Jumped out as soon as I could.

Trade 5 was a trend continuation trade.

Trade 6 was not an intentional trade. I had called it a day, and sat down when I heard the trade entry. I think I left the TA long button on. Does the yellow square on the left suggest why this trade may have happened?

Overall I think I am paying better attention to my emotions. Today was day 4 of 4 with a net 3 profit. Is net 3 actually 30 ticks after considering fees? so if I take more trades I need to compensate for the cost? Thanks again for looking at my charts. I must run out to work now. Literally this minute.

Please include charts in screenshot by clicking on the link and posting the link with .png at the end in the future.

Trade 1 DR - good trade and off a wall. Should have got at least 9 ticks on it.

Trade 2 - don’t have picture of what OD was at that bar…but it just kept reversing one that was not necessarily avoidable

Trade 3 good but choppy so risky

Trade 4 did you have OD divergence? looks like a bad entry but should have won

Trade 5 it won but no reason to enter (causes false over confidence which leads to a downward spiral) looks like manual entry per your statement above

Trade 6 good trade (at net 3 now should have stopped) it was a continuation x box

Trade 7 - good trade (at this piont your up your net 3 plus some now should have stopped)

Why are you stil trading

Trade 8 good trade

Trade 9 good trade with tren looks like entered late

trade 10 good trade good trade

trade 11 good trade

trade 12 good trade

trade 13 good trade

Trade 14 good trade

Dont factor in fees for net 3 -ever - approx 30 ticks - you where net 3 well before taking 14 trades