22:58:23 {Darrell_(Admin)} Webinar has been uploaded

22:58:29 {Darrell_(Admin)} I heard a few comments note i said due to the magnet level i would not put on the trade thats why i transferred it off screen and cancelled order

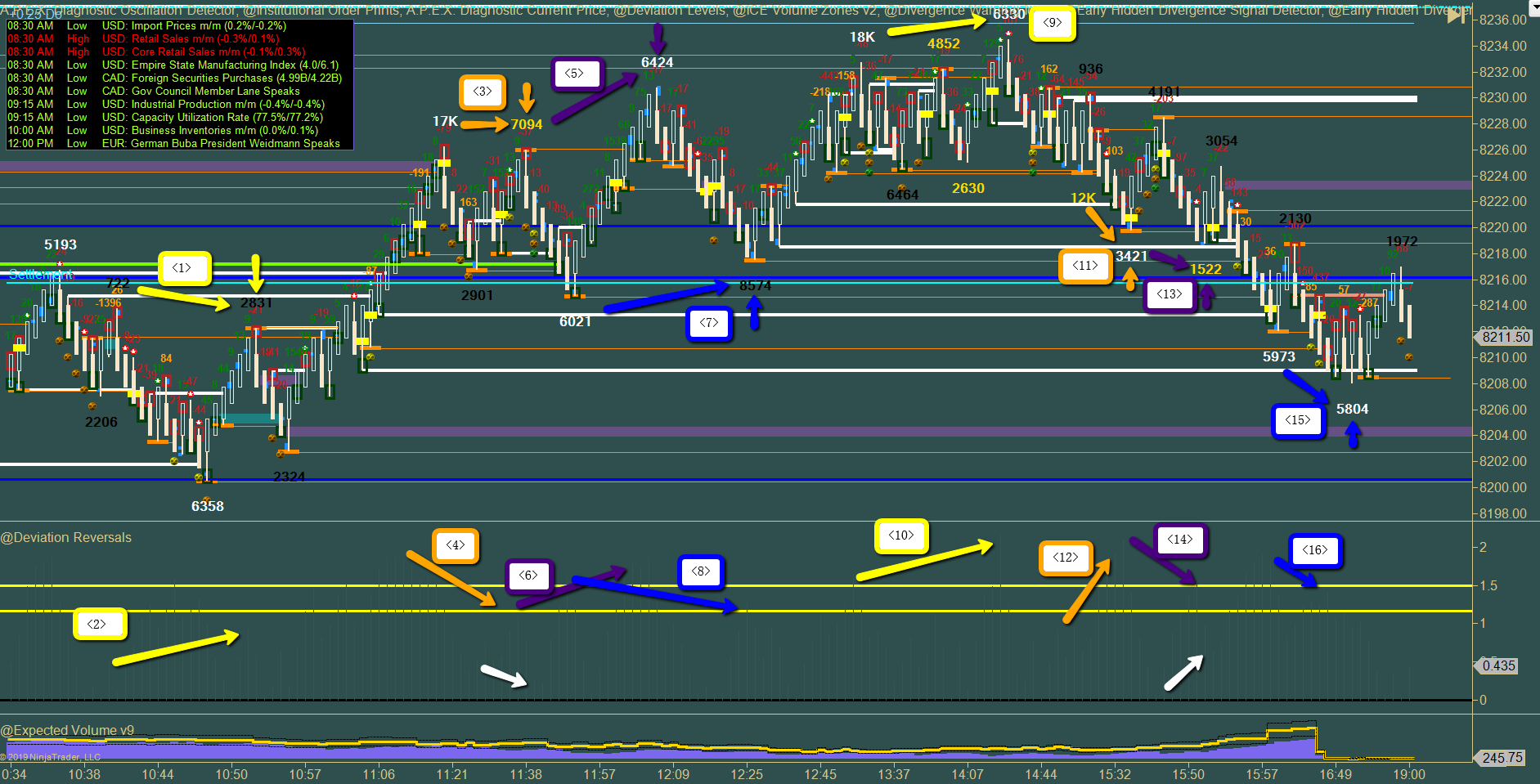

22:59:21 {Darrell_(Admin)} Raymond yes the 1st and 2nd x box are valid

22:59:44 {Darrell_(Admin)} The thir would be counter trend and no divergence indicating to take it

23:00:19 {Darrell_(Admin)} Sorry was with trend though i prefer the 1 bar reversals on additional entries

23:01:26 {Darrell_(Admin)} 14:47:31 {kidojun_-_Raymond<EN>} https://www.screencast.com/t/wUFJTU9JLurw

23:01:28 {Darrell_(Admin)} 14:47:37 {kidojun_-_Raymond<EN>} Is there something i’m missing with that one?

23:01:28 {Darrell_(Admin)} opposing X box said get out

23:01:35 {Darrell_(Admin)} was at a magnet level i gave in room which means unlikely

23:01:45 {Darrell_(Admin)} also no divergence

23:01:53 {Darrell_(Admin)} on large level

23:01:57 {Darrell_(Admin)} and notice how the volume kept increasing on the way up 900 2000 17k nothing indicated it should reverse

23:02:24 {Darrell_(Admin)} i also commented on this in the webinar with those 2 previous OD so close look at the 2nd one

23:02:43 {Darrell_(Admin)} in either case did not diverge

23:03:05 {Darrell_(Admin)} Jim Download 7 please watch setup video under setup section as i do say ninjatrader 7 and there is other important information in it

23:04:10 {Darrell_(Admin)} 20:41:01 {rpitman_-_RONALD} https://www.screencast.com/t/9BIbNFt1v lvs star zobb didnt take went wrong way

23:04:11 {Darrell_(Admin)} There was no zone on bar before there was a zone way back - thats only useful for setup 3 MM and Paw off a previous zoi so thats not a zobb

23:04:55 {kidojun_-Raymond<EN>} 22:59:21 {Darrell(Admin)<EN>} Raymond yes the 1st and 2nd x box are valid

23:05:01 {kidojun_-_Raymond<EN>} Is that (1) and (2)?

23:05:25 {Darrell_(Admin)} 20:23:03 {jimfurr2_-_Jim} And - Is there a link to where I download it? (I have NinjaTrader7 - but I’m sure it is old by now

23:05:27 {Darrell_(Admin)} yes download latest ninja trader

23:05:27 {tradefinder90_-_Joshua} Hey Darrell can we go over on the next webinar how to spot divergence on the divation reversal indicator I know you talked about it a few times i just cant get it to click lol

23:05:53 {Darrell_(Admin)} 16:33:55 {themann_-_Danny} Nice. Is webinar 2 uploaded yet? I missed the last half of it.

23:05:54 {Darrell_(Admin)} yes its uploaded

23:06:16 {Darrell_(Admin)} 15:52:25 {crossedout_-_Brad} I may have confused myself. Can anyone confirm. Setup 2 reversal trades ONLY happen with Divergence? Or what if bouncing off a major level (without notable divergence?

23:06:19 {Darrell_(Admin)} No they can happen without divergence divergence is when your going against the trend that its needed

23:08:23 {Darrell_(Admin)} 15:30:15 {kidojun_-_Raymond<EN>} https://www.screencast.com/t/ocnY3u28bdn

23:08:29 {Darrell_(Admin)} dont take counter trend take trend

23:08:38 {Darrell_(Admin)} if taking that trade i would put the entry above the two mini magnets to make it break it thats more advanced but just thinking practically

23:09:26 {Darrell_(Admin)} Joshua did you see the webinar tonight. Its been uploaded and edited a bit to eliminate some confusing pieces and clarify things.

23:10:53 {Darrell_(Admin)} 23:04:55 {kidojun_-Raymond<EN>} 22:59:21 {Darrell(Admin)<EN>} Raymond yes the 1st and 2nd x box are valid

23:10:54 {Darrell_(Admin)} 23:05:01 {kidojun_-_Raymond<EN>} Is that (1) and (2)?

23:10:57 {Darrell_(Admin)} what do you mean?

23:11:00 {tradefinder90_-_Joshua} https://www.screencast.com/t/q3Dlo6NC0

23:11:14 {kidojun_-_Raymond<EN>} Each box setup has a (1) or (2) or (3) in it for clarity

23:11:24 {Darrell_(Admin)} Joshua 3 is not a valid entry no x box

23:11:30 {kidojun_-_Raymond<EN>} Did you mean (1) and (2) were valid and (3) was invalid because it was counter?

23:11:46 {Darrell_(Admin)} 4 correct not a reversal bar

23:11:59 {Darrell_(Admin)} 5 correect

23:12:09 {Darrell_(Admin)} 2 worked but was counter trend so was risky

23:12:10 {tradefinder90_-_Joshua} my setups from replay tonight… setup 3 was mm/paw off zoi not xbox

23:12:59 {Darrell_(Admin)} there was no zoi it was bouncing off of it literally has to be bouncing right off it

23:13:05 {Darrell_(Admin)} on 3

23:13:29 {Darrell_(Admin)} Raymond can you post your screenshot or are you talking same thing Joshua is?

23:13:25 {awapex_-_Anthony} (Ver:7.50.070) Connected 11/14/2019 [Encryption Active!].

23:13:44 {kidojun_-_Raymond<EN>} https://www.screencast.com/t/GQiABTe0JUE

23:13:47 {Darrell_(Admin)} Also you need to add the NQ Walls indicator to your charts

23:13:55 {julian123_-_julian} Disconnected 11/14/2019.

23:14:02 {tradefinder90_-_Joshua} ok I gotcha in one of the training it looks like its breaking through an zoi

23:14:17 {tradefinder90_-_Joshua} ill go re watch and review again

23:14:22 {Darrell_(Admin)} 1 i can’t tell if you have any divergence

23:14:32 {Darrell_(Admin)} 2 yes

23:14:47 {Darrell_(Admin)} 3 would help to see od further back on short side to see if you where divergent or not

23:15:06 {Darrell_(Admin)} without that i would say no way to see it

23:15:12 {Darrell_(Admin)} also your missing NQ Walls add them to your chart as that could help

23:15:46 {kidojun_-_Raymond<EN>} But isn’t (3) continuing on a short trend and thus not require divergence. Also my indicator list has NQ walls listed in there…

23:16:01 {tradefinder90_-_Joshua} can you explain divergence more on next webinar as well as explain what your seeing on counter trend I do not understand that lol

23:16:08 {tradefinder90_-_Joshua} makes my eyes go cross lol

23:16:42 {Darrell_(Admin)} yes 3 is continuing a short trend

23:16:51 {Darrell_(Admin)} so no it doesnt require divergence

23:16:57 {Darrell_(Admin)} but your question was was there anything indicating to not take it

23:17:38 {Darrell_(Admin)} If you had divergence it stands to reason that you would not want to continue taking trades in that direction as you would be looking for the opposite direction (make sense?)

23:17:42 {kidojun_-_Raymond<EN>} Ah that makes sense. Thank you.

23:18:08 {Darrell_(Admin)} just saying i can’t tell if it was there or not and that would be the only possible reason is if divergence was there

23:18:25 {Darrell_(Admin)} Joshua what more would you want me to explain besides what i covered today?

23:18:27 {Darrell_(Admin)} I mean be happy to review live in room in am with you on charts

23:18:34 {tradefinder90_-_Joshua} darrell are you talking to me?

23:18:45 {tradefinder90_-_Joshua} im getting confused who your talking too lol

23:18:49 {Darrell_(Admin)} now im talking to you joshua lol

23:18:55 {Darrell_(Admin)} what more could i say then what i did - may be helpful to review the uploaded webinar and then lets just review live divergences in am

23:19:19 {Darrell_(Admin)} as not sure what more to say?

23:19:27 {Darrell_(Admin)} thoughts? as again im like what would i say lol

23:19:46 {Darrell_(Admin)} counter trend simply means if im going to trade against the trend i need to see divergence

23:19:59 {Darrell_(Admin)} so do i see it

23:20:12 {Darrell_(Admin)} a) on OD if its has multiple OD’s as it pushes down and gets tired or is it getting stronger (like in last part of webinar it was getting stronger)

23:20:07 {meowsekin_-_Deborah} It’s so good to see you back in the room again…just like the good old days.

23:20:27 {lionking_-_Rajesh} Disconnected 11/14/2019.

23:20:38 {falcon50_-_Walter} (Ver:7.50.070) Connected 11/14/2019 [Encryption Active!].

23:20:47 {Darrell_(Admin)} or b) does it show diveregence on DR

23:20:52 {Darrell_(Admin)} or C) do you see divergence further back on a level (This one is much harder to see and i don’t recommend you focus on it for a bit)

23:21:19 {Darrell_(Admin)} Deborah thank you glad to be back I’m having a blast

23:21:37 {Darrell_(Admin)} Does that help having a list like that Joshua?

23:21:41 {Darrell_(Admin)} or? still confused?

23:21:53 {tradefinder90_-_Joshua} hahaha Darrell that probably best right now you lost my forever ago buddy

23:21:56 {kidojun_-_Raymond<EN>} ah i think a) is what we default to but in the live trades today and yesterday, using a) showed valid divergence but looking at c) it ended up being non-divergent

23:22:02 {tradefinder90_-_Joshua} me*

23:22:07 {kidojun_-_Raymond<EN>} Which confused me personally

23:22:08 {Darrell_(Admin)} right thats why i said 3 is best probably not to focus on i should probably not have dived into that on webinar

23:22:27 {Darrell_(Admin)} i actually cut most that out of the webinar as it just confused everyone (always learning how to be a better teacher)

23:23:00 {Darrell_(Admin)} sorry about that

23:23:17 {Darrell_(Admin)} So if we drop c or 3 whatever does that help clarify divergence better?

23:23:28 {Darrell_(Admin)} Raymond

23:23:38 {tradefinder90_-_Joshua} im a visual person I think once I see what your looking at ill be

good buddy

23:23:38 {Darrell_(Admin)} Joshua rewatch the webinar tonight if you can just skip forward to the divergence section (its on the site youtube facebook etc…) see if its clearer now without that 3rd part in it

23:24:07 {tradefinder90_-_Joshua} ill do that  glad its posted maybe that will help!

glad its posted maybe that will help!

23:24:23 {Darrell_(Admin)} ok let me know will you be on in AM?

23:24:34 {kidojun_-_Raymond<EN>} Knowing that c) can overrule a) helps in the instances where I followed a) and it didn’t end up working out because c) was in play. Just some analysis paralysis in the back of my mind if i see a) when looking for OD divergence thinking if c) would be an obstruction.

23:24:47 {Darrell_(Admin)} Right C can cause that without a LOT MORE experience

23:25:00 {kidojun_-_Raymond<EN>} Still a bit iffy on the divergence with DR but i think i just need to rewatch some videos for that.

23:25:03 {Darrell_(Admin)} so basically if you dont see it on A or B then just stay out and probably be glad you did (would rather wish i have something i don’t as have something i didn’t) its okay to miss a good trade versus take a bad one

23:25:04 {tradefinder90_-_Joshua} I wish lol gotta go to that awful thing called work ugh…its the worst because I hear my sound board is really making people upset …I mean happy hahaha

23:25:05 {lionking_-_Rajesh} (Ver:7.50.070) Connected 11/14/2019 [Encryption Active!].

23:25:48 {Darrell_(Admin)} your sound board is loved by everyone but the two … can’t post it here lol

23:26:17 {Darrell_(Admin)} Raymond divergence on DR is essentially this

23:26:26 {Darrell_(Admin)} Market is rising

23:26:31 {Darrell_(Admin)} DR should be rising

23:26:34 {Darrell_(Admin)} If DR is making a peak valley then a lower peak valley its divergent

23:26:36 {tradefinder90_-_Joshua} lol glad to hear it …alright im signing off for the night

23:26:48 {Darrell_(Admin)} if market is falling

23:26:55 {Darrell_(Admin)} Divergence should be rising

23:27:03 {Darrell_(Admin)} If its making a peak valley with a lower peak valley then its divergent

23:27:19 {Darrell_(Admin)} does that definition help you at least to review some?

23:27:32 {Darrell_(Admin)} Raymond

23:28:18 {tradefinder90_-_Joshua} I know you have spoke about it in the past its on the binary breakout course you explain it a little I will review and get back to you

23:28:22 {bfiege_-_Benjamin} Disconnected 11/14/2019.

23:28:37 {tradefinder90_-_Joshua} goodnight man!

23:28:42 {Darrell_(Admin)} Sounds good

23:28:42 {kidojun_-_Raymond<EN>} Not really. I think i just need the visuals for DR, i think there was a DR course in a previous thing that i understood and have just forgotten so i may just need to revisit that.

23:28:52 {Darrell_(Admin)} Yes in binary breakout i believe

23:28:57 {Darrell_(Admin)} lets watch for some live together and gather some more charts and rewatch that webinar

23:29:04 {twocats_-_David} (Ver:8.00.012) Connected 11/14/2019 [Encryption Active!].

23:29:07 {Darrell_(Admin)} ill post this in the forum for further review and questions as well as we setup a new Sniper Trading System forum section

23:29:15 {tradefinder90_-_Joshua} oh one more thing darrell

23:29:59 {Darrell_(Admin)} Divergence Conversation in ER

23:30:00 {Darrell_(Admin)} There is the post though its ugly