By Darrell Martin

All of the political news that the American people are inundated with on a daily basis is enough to make you want to bury your head in the sand or move to another country. Then, to add on the plight of the insurance companies because of Obamacare, it makes the thinking person really think before deciding how to cast his vote.

Let’s look at what is happening to those of us being forced to use Obamacare. If someone is able to get assistance on premiums, the co-pays and deductibles are unaffordable if you qualify for premium discounts. Basically, it’s unaffordable check-ups or affordable with discounts. Suppose the scenario changes and someone is told they have cancer. They can pay the deductibles, but they cannot pay the out of pocket or the co-pay.

Doctors aren’t covered. Procedures aren’t covered. Hospitals aren’t covered. But you pay more. Some may be covered or less of each is covered, but you continue to have to pay more.

It is impossible to cap profit and eliminate any risk management and be profitable. You cannot expect a company to not to go out of business or raise rates substantially year after year. This does not work in trading or any other business. It only works in a government with an unlimited credit card.

Why will costs go up or insurance companies go out of business? Because the healthy will not pay. The poor and the middle class don’t care about the discount, as they cannot afford all the other costs. So, who will pay? People with high income or those who are sick will pay. This will significantly raise rates.

In addition, all group rates are subject to the changes that the self-employed have been subject to since it went into effect. It will be a big wake up call! I expect a 67% increase in 2018 after all the group plans have to follow the same rules.

Obamacare is doing exactly what it was designed to do and that was to knock out private insurance companies, enforcing a public option. All across America, as Health Insurance companies are being forced out of business, we the people are being forced to have fewer choices.

As shown in an article I shared, 250,000 people in North Carolina will only have one company to choose for their health insurance. And they aren’t the only state facing this problem.

According to the article on Breitbart.com, “States such as Oklahoma, Alaska, Alabama, South Carolina and Wyoming only have one insurer to choose from on its exchanges for 2017 statewide.

Nearly three-fourths of Florida’s counties and more than four-fifths of Mississippi’s will also be down to one insurer.” When citizens’ choices are limited, company’s rates can increase, as they have no competition.

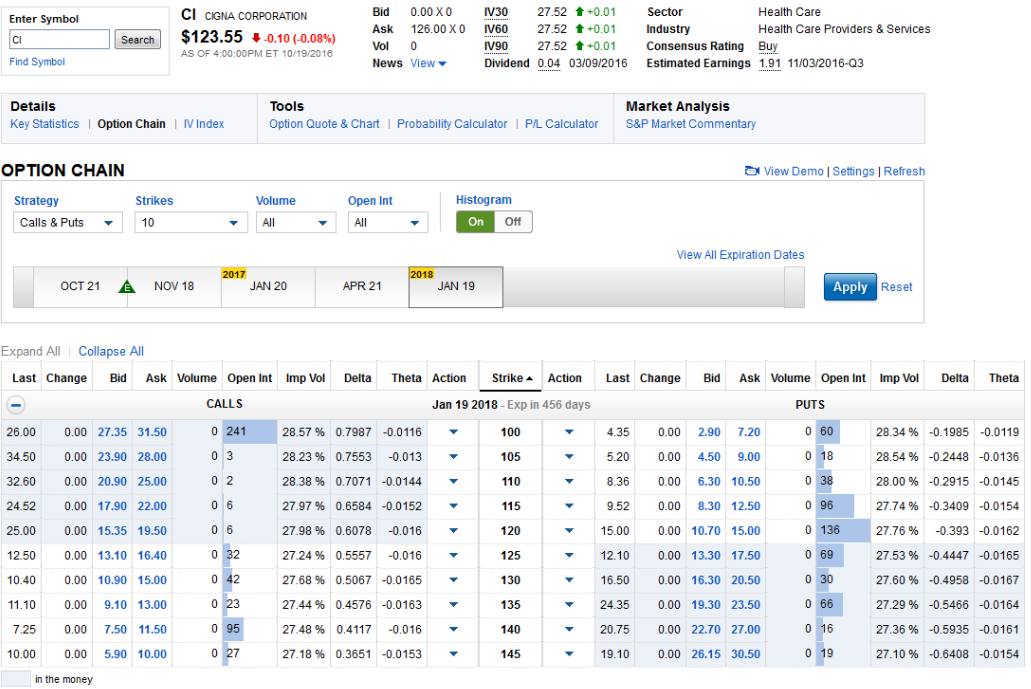

As a trader, is it possible to buy put leaps on insurance companies to help cover your cost? Some companies offer them; others do not. Not all health insurance companies are publicly traded and of the top 10 I looked at, only a handful offered year-out puts. Look for out of the money puts.

A put is a long-term option that will rise in value if a company falls in value. This is sort of like insurance. If you believe insurance companies that sell health insurance will continue to go down in value due to Obamacare, you could potentially buy puts to profit and potentially offset some of the cost of your raising rates.

If you can’t stomach either of the main political candidates, think long game. The next President will appoint up to three Supreme Court Justices. Vote for the justices you want by proxy of candidate. We know that Hillary’s plan is worse. We know the third party candidates aren’t winning, so voting for them is letting someone else vote for you. Again, think long game. Think justices, as both candidates are pretty deplorable.

Perhaps a new President will remedy the Health Industry. But until then, we had better do our homework in order to protect ourselves.

The foregoing is not intended as any type of trading recommendation. Traders are encouraged to make their own trading decisions.