By Darrell Martin

This week on Thursday, April 27, the European Central Bank will meet making it the third of the eight meetings scheduled per year. The ECB Executive Board votes on the interest rate for the refinancing operations making up the majority of the banking system liquidity. This scheduled news is good for a high probability trade with the right strategy.

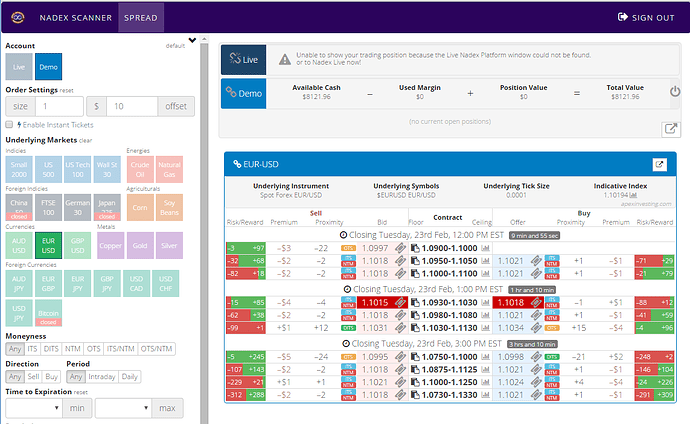

Using Nadex EUR/USD spreads, which offer capped risk, an Iron Condor strategy can profit on a pull back from the market’s move, or if the market moves a little or not at all. Based on previous market reaction, the market tends to make a move, and then pulls back after this news release. One spread is bought below where the market is trading, with its ceiling where the market is trading at the time and one spread is sold above the market, with its floor where the market is trading.

This news is released at 7:45 AM ET and entry should be around 6:00 AM ET with expiration at 8:00 AM ET. Each spread should have a profit potential of at least $13 for a combined profit potential of $25 or more. If the market goes down, the sold spread will be profitable and as the market pulls back, returning to where it started, the bought spread will be profitable as well. With this setup, the spread’s entry prices were either $13 below the market price or above the market price. This allows the market to move anywhere between those entry points and both spreads will make some profit.

If the market moves farther up to 25 - 26 pips above or below where it was at entry, then the trade is breakeven. One spread will have made the $13 profit and the other side will have lost $13. Stops should be placed where the market would reach 50 pips above and below from where it started. At those points, the trade will have lost approximately $25 depending on exact entries, reaching a 1:1 risk reward ratio.

Using the spread scanner allows even beginning traders quick, accurate entry. Easy to use filters narrow down the spread selection to the needed Nadex EUR/USD spreads with the right expiration times. Then the clear risk reward green and red bars make it obvious to see which spreads have $13 or more profit potential. The ticket icon will open a ticket to verify all parameters and the order button enters the trade. See below for a screen shot.

Free access to the spread scanner and free day trading education is available at www.apexinvesting.com.