By Darrell Martin

Trading at night can be tough sometimes with little movement or volatility. To look for movement, follow the news. Tuesday, December 6, at 7:30 PM ET, the Australian Bureau of Statistics will release Australia’s Gross Domestic Product. This report is released quarterly and is the percent change in inflation-adjusted value of all goods and services produced in the economy.

Traders watch these numbers, as the GDP is the main measure of economic activity and health. Since that is the case, the markets tend to react after the news is released and then pull back. For that kind of movement, an Iron Condor strategy can be used to trade it with Nadex AUD/USD spreads.

Nadex also lists binaries for trading but spreads are unlike binaries. They are not a true or false statement being traded and profit and loss is not all or nothing at settlement like binaries. Spreads have a ceiling and a floor denoting the range of a market that is being traded. Profit and loss are determined by the number of ticks or pips the market moved up or down from the entry, depending on if the spread was bought or sold. In addition, if the market moves above the ceiling or below the floor, the trade isn’t stopped out. There is no profit or loss beyond the floor and ceiling.

To set up an Iron Condor for this nighttime news event, simply buy a spread below the market with the ceiling where the market is trading at the time. Simultaneously, sell a spread above the market with the floor where the market is trading at the time. Each spread should have a profit potential of $15 or more for a combined profit potential of $30 or more. Entry can be as early as 6:00 PM ET for 11:00 PM ET expiration.

When entering a spread, the total risk is paid. Remember though, there are no margins or margin calls with Nadex, and risk is limited to the floor and ceiling of the spread. That may still seem exorbitant however; stops can be put in place to keep risk to a realistic level.

Keep Risk Realistic

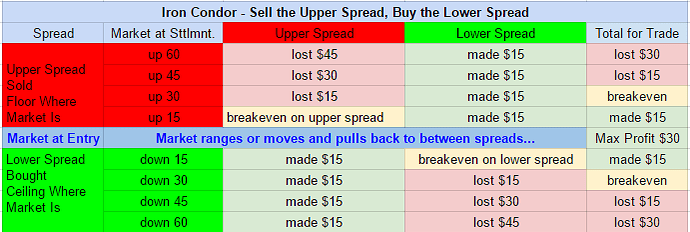

With a combined $30 profit potential, if the market goes in one direction and keeps going, not pulling back as is desired with this strategy, then stops should be placed around 60 pips above and below from where the market was at entry. If the market took off to the upside and went up 60 pips, then the market would be 60 pips above the ceiling of the bought spread and that spread would profit by $15. However, in this example, the market went up 15 pips from the floor of the sold spread. That would bring the sold spread to breakeven. Then, it went up another 45 pips, which would be a loss of $45 for the sold spread. The $15 profit from the bought spread plus the $45 loss from the sold spread, would be a $30 total net loss.

This example is displayed below for both directions. By placing stops at the number of pips equal to double the combined profit potential, then the risk is kept to a 1:1 risk reward ratio. For this trade, double $30 in pips is 60 pips and where stops should be placed above and below from where the market was at entry.

Typically, for this news event, based on previous reports, the market makes a move and then pulls back, and when it pulls back and settles anywhere between the breakeven points, the trade makes profit. Max profit is the market settling right between the two spreads. The market can move 30 pips up or down and still be in a zone to make some profit. More spreads can be traded as long as there is the same number of spreads on each side of the Iron Condor.

For free day trading education and access to the spread scanner for fast, easy, accurate execution, while trading Nadex binaries and spreads, visit Apex Investing.