By Darrell Martin

When trading binary options on Nadex, each component offers useful information to help you in your trade. Let’s look at the binary strike ladder and then break down a binary ticket to ascertain some practical facts.

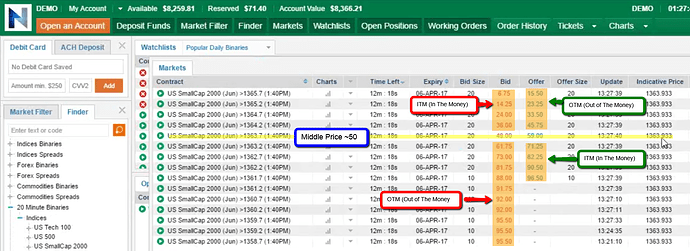

Here is an image of a Nadex binary strike ladder showing US SmallCap 2000, which has the Russell 2000 as the underlying market.

Since a binary is worth either zero or $100 at expiration, it makes sense for the binary contract with the strike price that is trading closest to the current market level or the indicative price to be worth 50. This is halfway between what the binary can be worth at expiration. It also designates a 50/50 chance the market could go either way.As shown in the image, if you draw a line, either physically or mentally on the strike priced closest to 50, you then know that contract is at the money (ATM). When looking at the strike ladder, if you are buying everything shown above the line is out of the money (OTM) and everything shown below the line is in the money (ITM). The opposite is true if selling.

You’ll find this information helpful after you’ve determined the direction of the market and want to choose a strike price for your trade. The strikes that are already in the money have a higher probability. Higher probability means the binary statement is already true. You will pay a little more to have more insurance and better probability.

If your indicators or system show the market is going up or down, you may want to choose and OTM strike. You will want to make sure you have time in your favor and give the trade time to make the move.

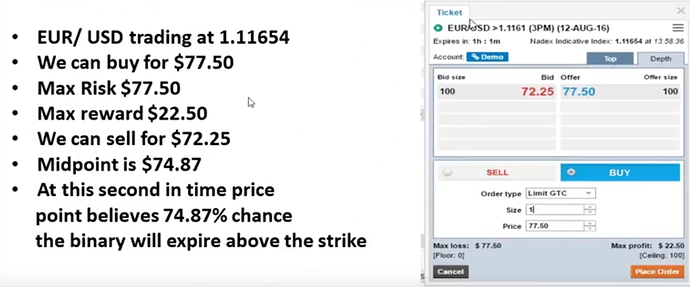

Now, let’s look at a binary ticket to see what information is available.

When you look at a ticket, you see the bid and the offer prices, also known as the bid/ask spread. On this ticket, you can buy for 77.50 and sell for 72.25. The difference between the prices is what the market maker gets to keep. This is the same for any business. The business buys an item for a price and sells it for that price. They are making a market.The mid-price or midpoint on a binary ticket gives you the probability. If you add the bid and the offer prices together and divide by two, you’ll get the mid-price. In this example, the mid-price is $74.87. From a pricing probability standpoint, because the strike price is below the current market at this second in time, the price point believes that there is a 74.87 percent chance the binary will expire above the strike. [Price Point is retail price of the product (instrument) at that moment.]

If you were selling instead of buying, since it is a false statement, the midpoint would signify that there is a 74.87 percent chance that the statement won’t be false. Conversely, you could say there is about a 25 percent chance that it will be false.

Another tool you can employ when trading on Nadex again involves the binary strike ladder. Let’s say you chose the right binary according to your system, charts and indicators, but when you look at it on the ticket, you realize the probability doesn’t lend itself in your favor. You look at a ticket for Wall St 30 (Jun) 20681 2PM with a bid of 12.00 and an offer of 18.25. This gives you a midpoint of only about 15 percent. It expires in eight minutes.

You decide to see if there is a later expiration with a similar strike price and find one expiring at 3PM with the exact strike of 20681. Its bid is 30.00 and offer is 37.25 giving it more than 33 percent probability. By choosing a later expiration of the same strike price, you more than double your probability and have given yourself more time to be right. You will pay a little more, but you are paying to insure a little higher probability.

Use all the aspects of trading on Nadex to work for you in your trading. Learn more about trading strategies at www.apexinvesting.com.