By Darrell Martin

The amount of loss one day trader reported was $142,000 after the Swiss National Bank (SNB) decided to no longer cap the Swiss franc to the euro on Thursday, January 15, 2015.

For many, $142,000 is a significantly sobering loss that could even be the value of their home or substantial amount of it, if not their life savings.

At 4:30 AM EST, Thursday, January 15, 2015, the SNB’s release of control of the exchange rate on the CHF caused a record drop/gap on the EUR/CHF sending rippling effects throughout the banking and brokerage communities internationally.

Some brokerages will be forced to close and some banks lost millions from the unexpected decision which caused the move in the currency market. This is exactly what scares traders and rightfully so. Gap crashes like this send a wave of margin calls to people all over the place including traders, market makers, hedge fund managers, banks and so on down the list.

For day traders though, it brings up a multitude of questions. Could you get caught in a flash or gap crash? How likely is it for something like this to happen again? How large a position could that trader above have had to incur that kind of loss? Could you get a margin call? Is there a way to protect yourself from that kind of loss?

In answer to the last question, there is if you trade Nadex spreads with defined capped risk.

First, it is a must to understand the federal bank or government of any nation can make announcements at any time that can send markets reeling. News events can happen unexpectedly, nations can go to war. So yes, traders anywhere can get caught in a flash crash at any time unexpectedly. Do they happen every day or even often? No, thankfully.

This particular announcement was made at a scheduled news event regarding the Swiss Interest Rate. That’s why it is good to not trade during scheduled news announcements. However, since anything can happen at any time potentially putting your trade positions at great risk, it is essential to understand the risk involved. You need to know how to properly manage risk, your account size and know what other options are out there to help protect your account.

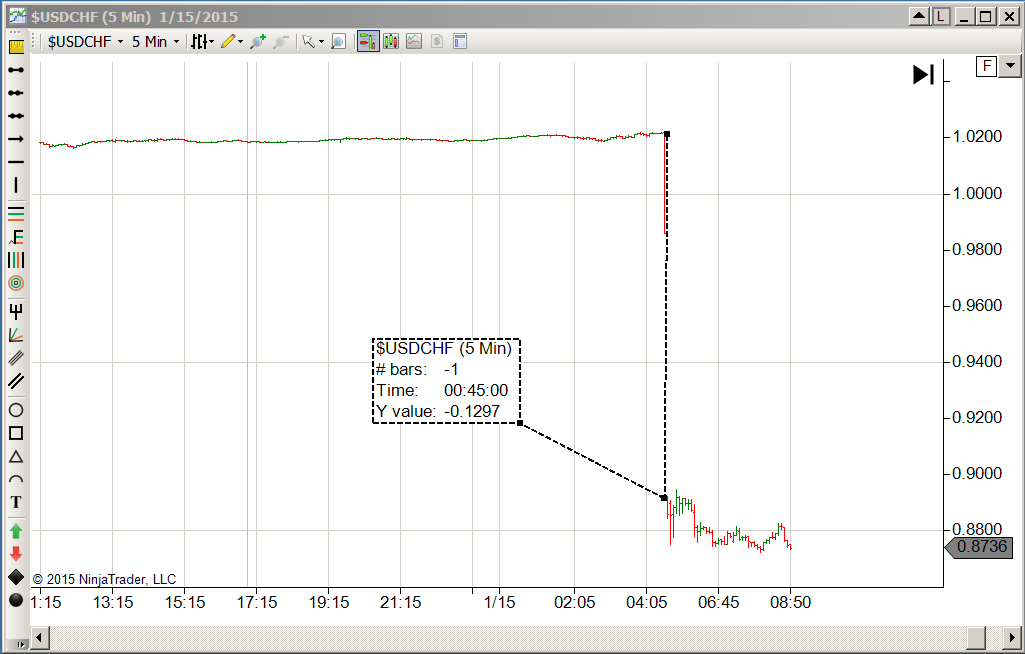

Traders most likely were not trading the actual EUR/CHF. Looking at the chart you can see the EUR/CHF moved 1 tick or 1-½ ticks up or down since the SNB was maintaining a minimum exchange rate of CHF 1.20 per euro. With such little movement it wouldn’t have made sense for a day trader to trade the EUR/CHF. After the announcement, it went sailing down 1573 pips in minutes direly affecting other markets that traders would trade.

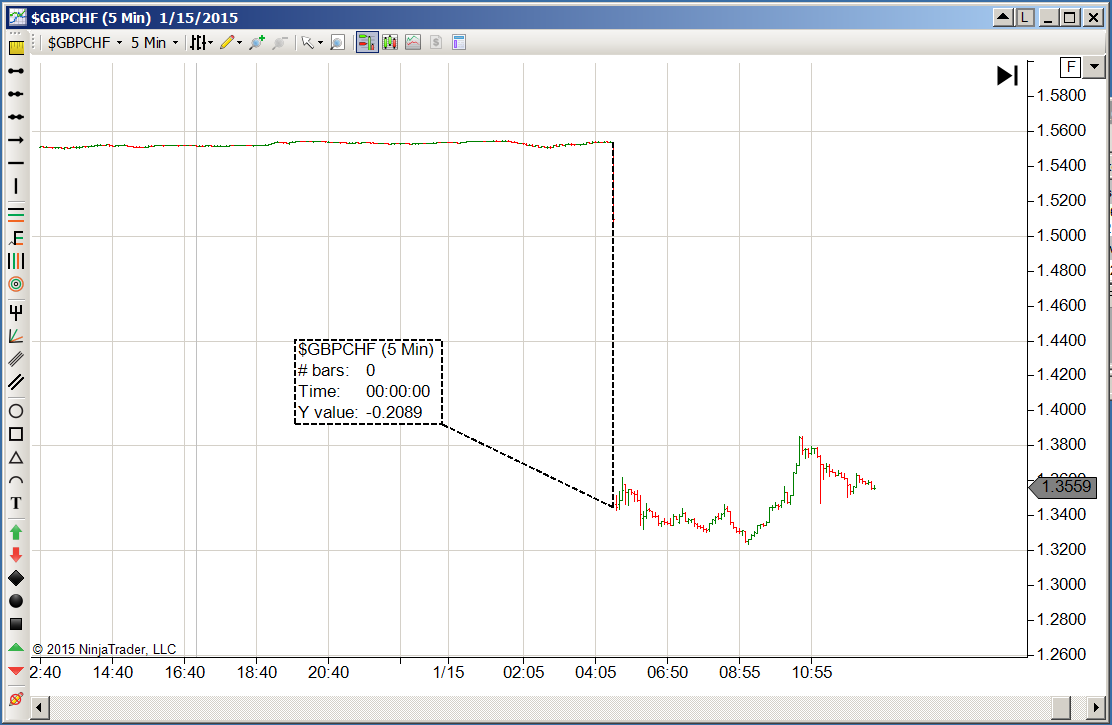

Traders could have been trading the USD/CHF which incurred a total drop including the gap down of 1297 pips after the Swiss Bank announcement. Traders could have been trading the GBP/CHF where the drop including the gap down was an even greater 2089 pips.

If you were trading those markets via spot forex and were in a long position, there was no possible way your stop, if you had one on, could have been filled. The market flew, then gapped, passing everything in its wake.

More important to point out though, who is going to place a buy order that could fill any of the sell orders out there when the market takes a dive like that?

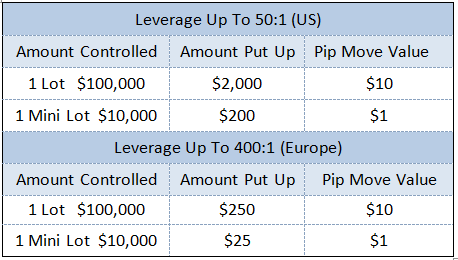

Leverage can be a double-edged sword in trading. It allows you to leverage more money and take advantage of smaller movements, and the trader can make more money on the smaller movements.

However, it needs to be planned out; more risk should not be taken on just because the trader can buy more. You do not want to over leverage your account. In spot forex you have the following leveraging possibilities:

Consider what the losses could be for a US trader. The USD/CHF lost 1297 pips, if you had put up just $200 to trade one mini lot at $1 a pip, you would have had a $1297 loss, six times the amount of money you put up for the trade. If you had put up $2000 to trade one lot at $10 a pip, you would have lost $12,970.

Now say you had traded ten lots, put up $20,000 at $10 a pip, that would have been a $129,700 pip loss, coming close to the loss the trader above incurred. With the GBP/CHF the losses would have been even greater as that drop/gap was greater!

Now look at this same scenario but from the futures contract perspective, trading the Swiss franc, 6S. To leverage and trade futures you put up a margin to control a certain amount of money.

For the 6S the CME margin requirement was $2250 to control 125,000 Swiss francs, which would get you one contract at $12.50 a tick. That margin requirement quickly changed. Thursday after the announcement there was a margin call doubling it to $4500, then Friday raising it to $6750, making it three times the amount to have a position on.

The risk model is set up so margins will cover a standard (based on historical precedent) 2-deviation move in a particular market. To give you an idea on levels, the Swiss franc 6S moved 2469 ticks which was around a 25 deviation level move!

The way margin works is once you place an order the margin amount is then held as deposit. If the market moves quickly against your trade and you’re not able to exit, this can create high losses. Margin is there to cover those losses so your account doesn’t go down to 0 and then negative. While the margin amount is being held or tied up, the balance of your trading account becomes a floating P&L. It will go up or down depending on your trade moving profitably or negatively.

Should your trade move so far negative the loss is greater than the floating P&L of your account, you would get a margin call or your trade would be closed out. The margin is a safeguard for the broker and the CME to ensure they don’t need to be collecting for losses. In this kind of gap crash, the broker would try to close trades out, however it may not have been possible. They don’t want to be on the hook.

The point to remember here is that margin calls can happen intraday if volatility becomes very erratic or there is a flash or gap crash. Margins can also increase significantly at any time. This won’t happen in spot forex, the leverage will remain the same at 50:1. However you still run the risk of stops not being filled and not being able to get out of your position in these situations.

There are ways to manage your risk by hedging off with options or trading options in lieu of spot forex and futures. Nadex Spreads are options with defined capped risk providing a great way to manage your risk. There are no margin calls or margin increases ever.

Spreads have a floor and a ceiling; if you buy a spread, the difference between where you bought your spread and the floor is your total risk. If you sell a spread, the difference between where you sold your spread and the ceiling is your total risk.

With Nadex spreads to enter your trade you put up your total risk. Then when the trade settles, the amount you put up is returned to your account with profit or less loss; therefore, all risk is defined and capped. On a buy the floor is as low as your risk will go. On a sell the ceiling is as high as your risk will go.

You can trade Nadex Spreads and mirror futures or spot forex. Spreads are a derivative, so they will not tick exactly tick for tick as their underlying market. However, if you buy a spread around 1/3 from its floor on a buy or 1/3 from its ceiling on a sell, as the underlying ticks in favor of your trade, the speed of the spread price movement will increase to tick the same speed as the underlying.

To understand spreads you can view the video, Nadex Spreads Made Easy. To understand how to trade spreads like futures you can read the article, Learn The Tricks To Trading Spreads Mirroring Futures.

The spread structure caps risk therefore allowing high leverage ability. On Nadex Spreads every tick/pip move is $1.00, which in essence is 10,000 units of currency with a full cash margin, meaning all your risk is put up. Should your trade suffer “maximum loss” which is defined up front when you enter the trade, the money is there to pay the person on the other side of the trade immediately.

There is no cash loss for the broker; however, with Nadex you are direct with the exchange as Nadex is an exchange and not a broker. That is why a margin call can never happen on Nadex, and Nadex won’t go out of business due to margin calls and not being able to meet them.

Darrell Martin trades futures, forex and Nadex spreads, but his favorite strategy is the ultimate hedge.

Having a position on a futures or spot forex market and hedging it with spreads. If you put up $100 for a trade on Nadex, that’s your total risk for that trade, $100. If you put up $1000, then that is your total risk for that trade, $1000. Great leverage, capped risk.

If you would like to learn more on how to trade spreads and news events, go to www.apexinvesting.com. Apex Investing Institute offers free education, and free access to the Nadex Binary and Spread Scanner Analyzers. Member traders are invited to trade in the rooms, take advantage of trade signal services, have key indicators and access the Apex Forum. The forum content is updated daily and includes over 9000 members. In a supportive learning community of seasoned as well as up and coming traders, traders of all levels learn how to trade Nadex binaries and spreads in depth, as well as futures, forex, stock and options, and gain an edge for successful trading overall.