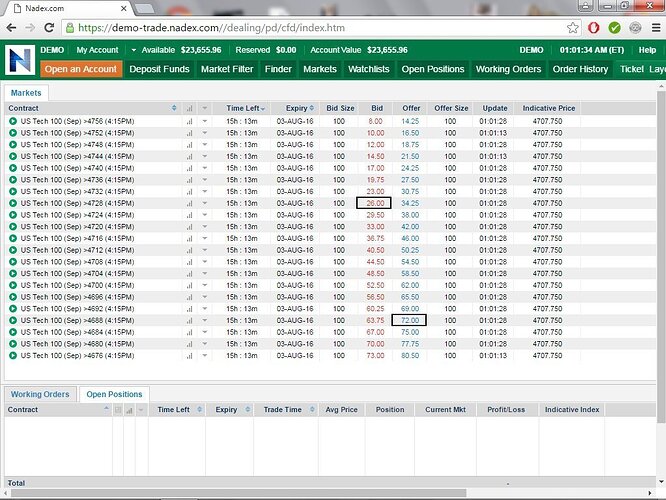

Here’s my idea. I’m about to demo this. The only thing I’m not sure about is when I want to enter… 6pm or wait until after 9:30am when it makes its initial move & try to leg into the butterfly one wing at a time. Here’s the plan. I need some input…

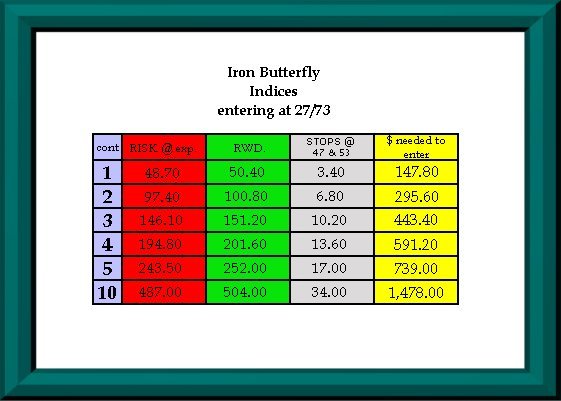

I want to get in at SELL 26-28 and BUY 72-74. In the example below, I crunched the numbers for a 27/73 butterfly. I calculated the risk if you let it expire & win one wing, the reward if you win both wings, the reward if you have your stop trigger prices set at 47/53 (-20), and the total you need to enter the trade.

“Risk at expiration” is calculated for $2.70 in commissions, because you wouldn’t pay for the losing side. You would get in on both sides & win one side.

“Reward” is calculated for $3.60 in commissions, because you would pay to get in on both sides & win them both.

“Stops @ 47/53” is calculated for $3.60 in commissions, because you would pay for the stop on one side & win the other side.

“$ needed to enter” is calculated for $1.80 in commissions, because you just need the money to get in on both sides.

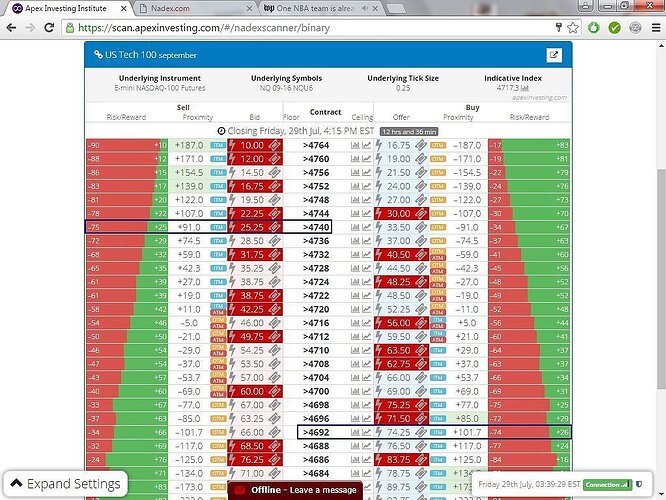

This strategy is for the DAILY binary contracts only!!! I want to get super wide strikes. The next image highlights an example of the strikes I would want to enter with a working order at 27 & 73 (looking at the NQ).

Another good thing about this strategy is if one of your stops is hit, I gave it a full 3.25 of room to still be in the positive after commissions. They can get hit at 50.25 or 49.75 & you still don’t lose anything.

ANOTHER IMPORTANT NOTE: I would definitely want to watch the market around 4pm. If you think the market is a little too close for comfort on one side, LIQUIDATE it!!! You would still be in profit overall (even better than the 47/53) & it would eliminate taking the max loss if it expires on the wrong side of the strike after you hit the dreaded “dark zone.”.

Avoid the obvious, like NFP or other big news events.

I want to make this as foolproof as possible. I really want to have SUPER wide strikes, so it’s extremely difficult for both stop triggers to be hit.

What do you all think of this???