By Darrell Martin

An earlier article discussed the correlation between placing stops and risk management. This article will explain limit orders, how to place a stop and why placing stops are beneficial in trading. Let’s start with some basics.

What is a Limit Order?

A limit order is the basic order you place on Nadex. If you are buying, it means that you will buy at this price or below. You will not pay higher than the price you have entered on the ticket. If you pull up a ticket and enter a price lower than the market is currently trading at, it will enter you into a working order, because the price you submitted is as if you said, “I will pay this price and not a penny higher.”

If you put in an order with a number higher than the market is currently priced, you will be filled immediately. This is because you are saying that you will pay that price, but not a penny higher. It will not be a working order.

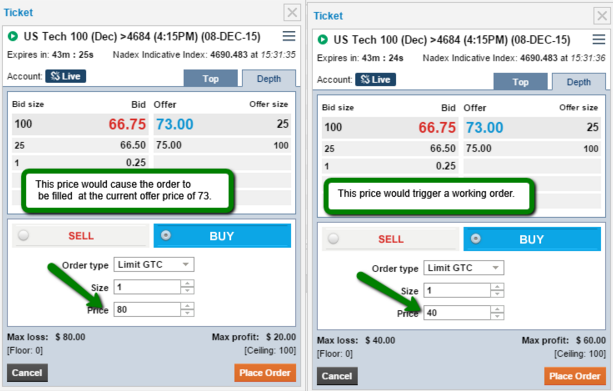

In the image above, you can see that if you put in the price of 80 to buy when the offer is at 73, your order would be filled immediately because you are saying you will not pay higher than 80. If you put in the price of 40, it would trigger a working order because 40 is below the current offer price.

If you are selling, you are saying that you will not go less than the price you submit. If you think of selling your car and you have a limit to the amount you are willing to accept, you will not go less than that amount. This is the same. You are saying this is the lowest or worst limit you are willing to take. If the market is as displayed in the following image, at 38.25 and you put in a sell order at 80, it will go into a working order because you will not go less. If you submit a sell order for 20 with the market at 38.25, you will be filled immediately because the bid price is higher than what you are willing to take.

Remember: Buy = this amount or less. Sell = this amount or more.

Placing a Stop Limit Order

If your goal is to make $20-30 per trade, then you just set a limit order. If you bought, you would put in a sell ticket for $20-30 higher than the price at which you bought. For example, if you bought at $50, manually set it to take profit at $70 with a sell ticket. It will go into a working order.

If you sold, you would put in a limit order for $20-30 lower than the price at which you sold. For example, if you sold at $50, enter a buy ticket at $30 for your take profit order. If the market moves, enough time passes, Implied Volatility changes, etc., and the binary price hits your set take profit price, you will then be able to take profit.

Stop Trigger

The indicative price for Nadex futures is based on taking the last 25 trades, dropping the upper and lower five, then averaging the middle 15. Apex Investing has an indicator known as the stop trigger, which can be set to your specifications to monitor your trades.

When the indicative price that you have entered as the trigger price is hit, your trade is closed. You can see in the image above that you can set other parameters to define further what triggers you exiting the trade, such as order size, market price offset, worst price, minimum bid size and when to stop monitoring. This keeps you from having to “babysit” your trades. Using the stop trigger indicator limits your losses letting you maximize your profits and overall benefiting your trading.

To experience the benefits of using the Stop Trigger Indicator as well as other free educational trading resources, visit www.apexinvesting.com, a service of Darrell Martin.