By Darrell Martin

As a trader, you know every day brings a different trading atmosphere. Some days are slow; you feel as if you are watching paint dry. Other days, the market moves fast; you feel you cannot place your trades fast enough. You are actually chasing the market. Other days, it is choppy. Some traders avoid a choppy market, finding something else to do on those days and staying away from trading altogether.

On the choppy days, provided there is volume, you can use a strangle strategy when trading binary options. What is a strangle? In a previous article titled Trading Binary Options Using A Range Bound Strategy, it explained placing a binary butterfly trade. The butterfly strategy is used in a flat market. You would not want to use a butterfly on a trade on a choppy day. A strangle is the opposite strategy of a butterfly. A strangle will not work in a flat market.

With a strangle, you use Out-of-the-Money strikes on both sides. This is a low risk trade and requires no stop loss. Your goal is a 1:1 risk/reward minimum. Set up a strangle strategy by buying an upper binary contract and selling a lower binary contract.

Use this trade when you expect a move, but you are not sure which direction. If there is no move, the trade will decay in time. With this strategy, you are expecting one side to lose, while the other side profits. However, there is a chance that the losing side could profit if there is a retracement in the market.

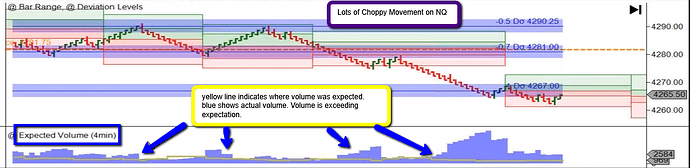

Exceeding volume is needed. When you look at your charts, notice the expected volume. Look at this example and notice the choppy market and the exceeding volume.

This is a great strategy to implement with 20-minute binary options. The advantages are quick trades with low risk. This is great for part-time traders providing plenty of opportunities, especially utilizing the narrow strikes, and there are even more strikes offered during lunchtime trading.

Remember, where the market is currently trading is always worth approximately $50. If you buy an OTM strike worth $17, and later, the market moved up to your strike, it would then be priced at about $50 making you profitable. The opposite happens when selling a lower strike. If you sell an OTM strike worth $83 now and the market moves down to your strike, it would then be worth $50 and you would profit.

This is not a strategy where you have to hold until expiration. Exit when profitable. Take advantage of the trade when it’s at the peak of profit. How will you know when that is? If you have risked $30 to make $30, don’t exit right when you have the $30 profit on one side; you have to make an additional amount to cover whatever you lost on the losing side. Then exit at the peak of profit.

Your basic goal is to have a risk of around $20 on each side, making sure you have 1:1 risk/reward ratio. Pay attention to any news that may be coming out, as this is an excellent strategy to use when news is released and you are not sure which direction it may cause the market to move. Demo it first. Get it down. Understand the rules, and then take it live.