A common question asked is “what is the best time to trade?” Often, people are interested in trading outside of US regular trading hours (RTH). This can be due to geographically residing outside the US, or having other commitments which prevent trading during the New York market session.

The short answer is: “whenever you can get the most volume.” As Darrell says: “Orders drive the market.” If you’re going to make money, that generally means selling high, and buying low…which means the price of your asset needs to change.

In general, the more volatility in the price (i.e. the more it moves), the more opportunity you have to profit. (And in general, the better your trading system will work). And in general, more volatility requires more volume.

Regular Trading Hours

Stock markets are centralized exchanges that usually have scheduled hours of operation known as “regular trading hours” (RTH). Outside of this time, there will often be “after-hours trading” taking place after the market close, and premarket trading before the open. Together these are referred to as “extended-hours trading” (or electronic trading hours, ETH).

The forex (FX) market is a bit different, as it is global, and there is no centralized exchange. So while there are technically no “regular trading hours” and “extended hours”, you will find there still tends to be more activity during the normal business hours of the currencies you’re looking at. For example, the Euro pairs (e.g. EUR/GBP) will tend to be more active during European business hours. Similarly, US pairs (e.g. USD/CAD) will see more activity during US business hours. Pairs incorporating different regions may see similar activity across their respective markets (e.g. EUR/USD, USD/JPY)

Since orders are necessary for trading, and greater volume generally means more movement, you will ideally trade an instrument during its regular trading hours, which is when it will tend to have the most volume. Again as Darrell says: “The goal is to make money, not trade a specific market or instrument. So find out what is planable for you (schedule—account size—product availability) then find what systems/strategies work best with that.”

That being said, it is critical to understand that certain systems will work better on some markets and in some times as opposed to others. Overall you don’t want to be “married” to any particular market or system (again, the goal in trading is to make money, so whatever generates profit for you is achieving that). But it’s important that you are also familiar with any market and system that you trade.

A system like Apex Sniper will work on different markets, but having proper expectations is crucial. Even though it is a micro-scalp system—with each trade only targeting for a handful of ticks (meaning you don’t need much movement to complete a trade)—valid setups can be fewer and farther between when there is not much volume, and the probability of success on each setup can be lower.

Market overlaps

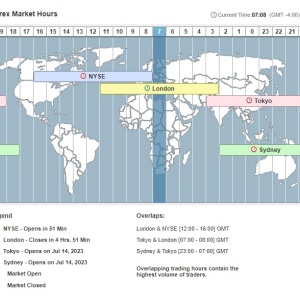

While RTH for a particular market is generally when you will see the most volume in that market, you will see the most volume overall during times when the RTH of different markets overlap. These are times during the day when one or more major markets are open during the same hours.

For example, major stock exchanges for the US (e.g. NYSE and Nasdaq), hold regular trading hours from 9:30am ET to 4pm ET. (Covert to your time zone here.) The London Stock Exchange (LSE), a major stock exchange for Europe, opens at 3am ET and closes at 11:30am ET. So there is an overlap from 9:30am till 11:30am during which both NYSE and LSE are open. (Additionally, the Frankfurt Stock Exchange and Xetra are also open during this window.) This means traders from 4 major venues are active, generally leading to more volume. (Also the opening and first couple hours of a market session tend to be the busiest.)

There are many other stock markets (and forex markets) around the world, leading to several overlap times throughout the day.

(These maps can be viewed and adjusted to your time zone here)

NOTE: Stock market hours aren’t necessarily the same as forex market hours (which are essentially 24hrs/day, as there is no centralized forex market).

It is important to note that regular trading hours for a particular market are going to be the most impactful time for instruments in that market, and will usually override any market overlap effects. That is, even though there are 3 markets overlapping in Asia from 21:30 ET to 02:00am ET, an instrument for US-based assets, like the S&P 500 index (e.g. SPY, /ES) is still going to see the most volume during US RTH, even when it is the only market open. Likewise, the DAX will tend to see more volume during Frankfurt hours, and the FTSE, during London hours, etc.

Typical market behavior

It’s generally understood that the Asia/Pacific session tends to be slower and with less movement than the European and US sessions in both the equity and forex markets (regardless of the instrument).

There are also seasonal trends as well. All markets will tend to be less volatile during local holiday times, as well as Summer months when more usual market participants are taking a break. The “Summertime Blues” occurs when there isn’t much market news being released, and the Wall Street tycoons jet off to the Hamptons.

For the longer time-frame investor, this can mean “sell in May and go away”, since there typically aren’t much gains to be expected in the overall market until activity picks up again around September. For the day trader, this means a need for lower expectations on volatility…meaning slower movement, smaller moves, and potentially fewer setups—requiring more patience. (That lowered expectation is also necessary for ETH trading, regardless of the time of year.)

During RTH

Just as the market has seasonal tendencies, there are also intraday tendencies that can be observed in most markets. During regular trading hours day-to-day, markets will tend to follow similar ebbs and flows, and periods of higher and lower volume/volatility at different times during the day.

An hourly breakdown of a typical US market day is here:

Note, the above outline is only meant to serve as a general overview of typical movement. It is not intended to be a hard commandment of what will happen, and is certainly not representative of every day. Be sure to take it only as intended.

Market phases

Another facet of market movement is often characterized as the “four phases”. Here again, this is not like clockwork, it is just a general tendency. But, it can be observed on nearly any timeframe. Note how the graphic below mentions a timeline of 6 months…but this chart could just as easily represent 6 hours or 60 minutes worth of movement. Once again, this is just a general guideline and something to watch for.

Is there anything to trade during ETH?

Forex markets and futures markets typically trade 24 hours per day, 6.5 days per week. (As noted above, equity markets often have extended-hours trading as well.) So you can certainly trade US markets at night. However, as mentioned, it is important to have the appropriate expectations. Outside of regular trading hours for the market you are watching, there will be fewer setups and less movement. Additionally, with less volume, your trading system may see lower odds of success during these hours.

Alternatively, as covered above, ETH for one market is often RTH for another. Many US traders trade foreign markets to take advantage of RTH movement during their own local night-time/early morning hours. The London open at 12am PT/ 3am ET provides some of the best volume outside of US market hours, particularly for European assets and forex. The German DAX is also a popular index to trade, and the Frankfurt market opens at 11pmPT/ 2am ET (an hour before London). (Convert to your time zone here.)

A list of hours for different markets around the world can be found here:

Trading Hours of the World’s Major Stock Exchanges

NOTE: Trading foreign markets may require additional data feeds and other costs outside of your normal brokerage fees. Funding companies such as Apex Trader Funding offer access to a variety of instruments, some in foreign markets. See a list of available instruments and their contract specifics below.

(Currently Eurex and ICE markets are only available with Tradovate accounts):