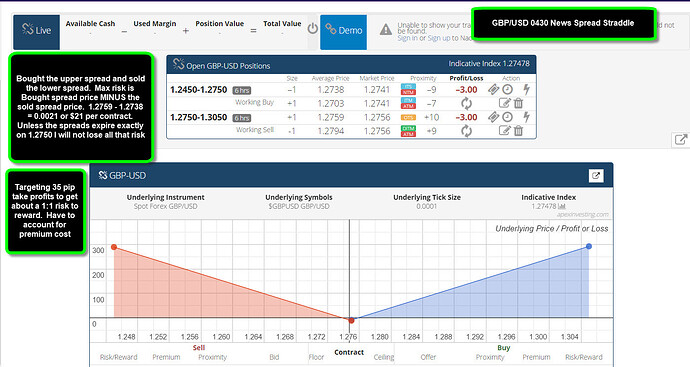

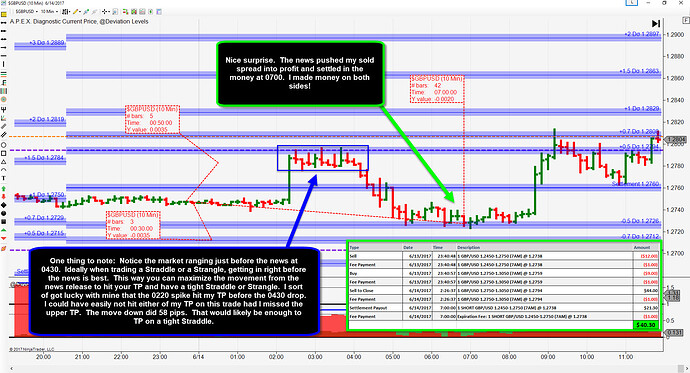

For those of you who pay attention to the APEX news plan. You were aware the plan called for a Spread Straddle on the GBP/USD for the high impact news at 0430 Wednesday morning. I love anything with spreads and straddles. These trades present some of the lowest risk trades you can take, especially when combined with high impact news. I decided to trade the GBP/USD Spread Straddle and here is my breakdown:

You could enter as early as 1100 PM EST and use the 11PM to 0700 AM Spreads to straddle the news. I looked at about 1130 and found the combined risk was only about $21 per contract.

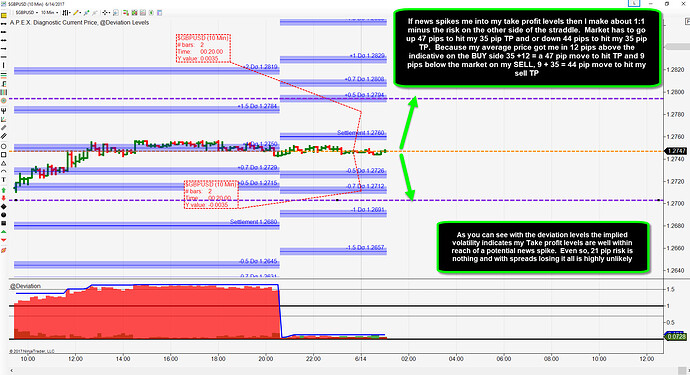

Next I consulted the G/U chart to identify some reasonable take profit levels. I used APEX deviation levels to help me see that there was more than enough room to expect the market to move and hit my take profits.

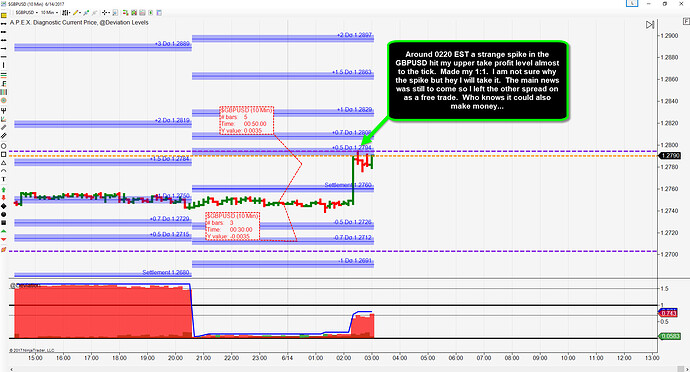

Now I waited. Interestingly there was a spike at about 0220 that triggered my bought side take profit grabbing me my 1:1 risk to reward.

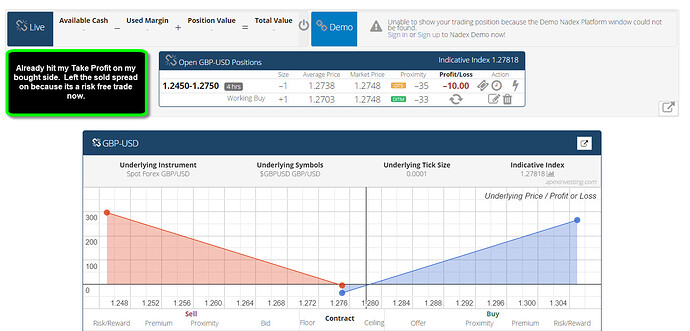

I decided to leave on my Sold side spread because you never know, it might make money as the big news was yet to come. Its a “free trade” at the moment, no loss in leaving it on.

What do you know, I woke up with my sold side settling in the money for some more easy money!

Interesting to note: Technically it is better to wait until right before a news announcement comes out to enter your straddle or strangle so you can get the tightest straddle possible to the market. see the chart for more detailed explanation why.

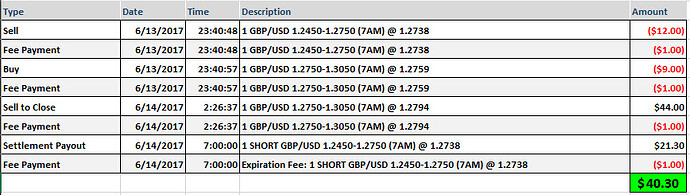

Here is my TX history breakdown: (This was a live money trade)

Risked $21, made $40 per contract. Best part is unless the market settled right on 1.2750 I would not have lost all of that $21 risk.

Hope you learned something about Spread Straddles. Thanks for reading! Happy Trading Everyone!

4 Likes

Nice job and great explanation!

1 Like

Great post, very well explained

1 Like

Learn new stuff from you all the time!!

Are the deviations really the only thing you are looking at??

I will have to try this with Oil next week.

Great result!!

1 Like

Hi Ronin. Can you explain a little further where you came up with the 35 pip TP value? I understand checking the deviation levels to validate the TP targets but how did you arrive at 35 to begin with? Basing in on the $21 total risk plus fees places 1:1 around $25 for Nadex, correct? The News calendar announcement for GBP a couple days ago only referenced a max risk of $40 but nothing about profit potential. Are you utilizing the expected range for this time frame? If so, and given that you entered so far ahead of the news event, where can the expected range information be found that far ahead of the event? Again, the rest of your post is excellent and very clear…just looking for clarification on this one part. I’m not sure I’ve ever gotten it in any of the videos I’ve watched previously…just hasn’t clicked yet I guess! By the way, I did have success with the NG news this morning so your post definitely helped. Thanks!

1 Like

Oh geez, sorry for such a late reply! I went on vacation and then a cruise. just now getting back into the swing of trading again. I can see how my 35 pip was confusing. I measured down to the .7 deviation and noticed it was a 35 pip move and was curious what room I had above it. the 35 pips was merely part of my initial check for how far I should expect the market to move based on where deiviation levels were. I wanted to stretch my actual pips gained to 35 instead of the 21 pips based on my risk. The easiest way to set your take profits is to simply double your risk on the trade and set that distance as your take profit level on each side. In this case my total risk was 21 pips so my take profit levels for 1:1 (not including fees) would by my buy entry price +42 pips and my sell entry price -42 pips. I wanted to make a few extra pips so I targeted a 35 pip move including the risk from the opposite side of the trade. Basically I made it more complicated that it has to be and threw in some confusing math because I wanted to make more than 21 pips.