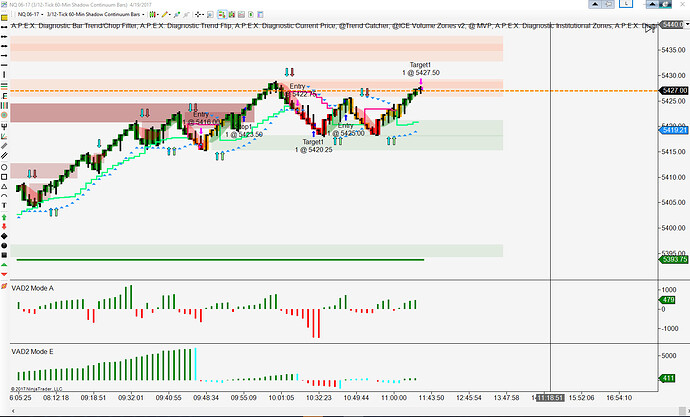

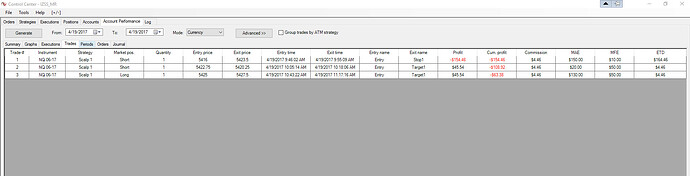

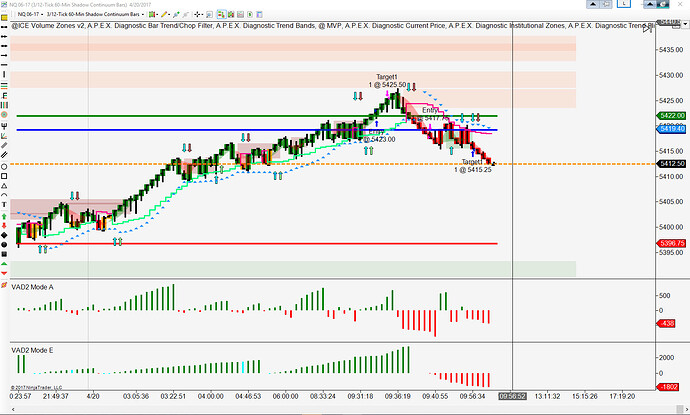

Stripped down charts, trade logs and trade summaries for your review.

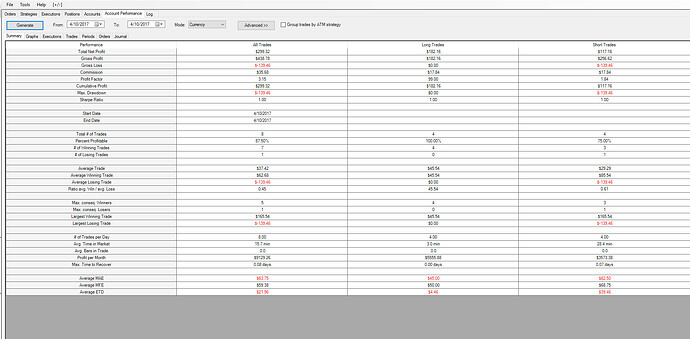

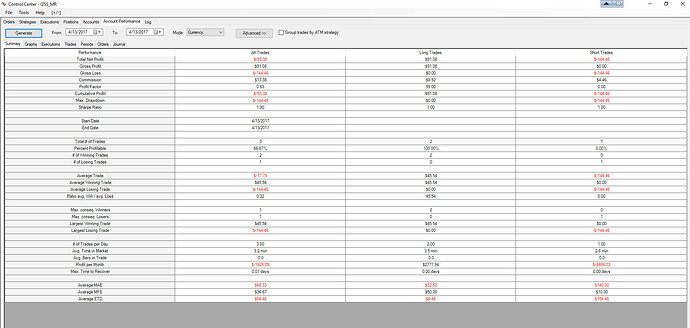

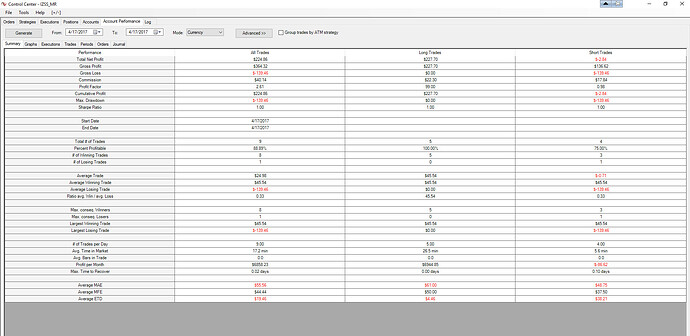

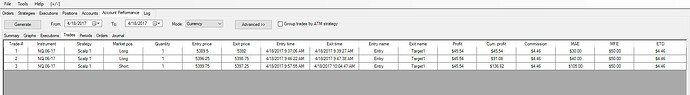

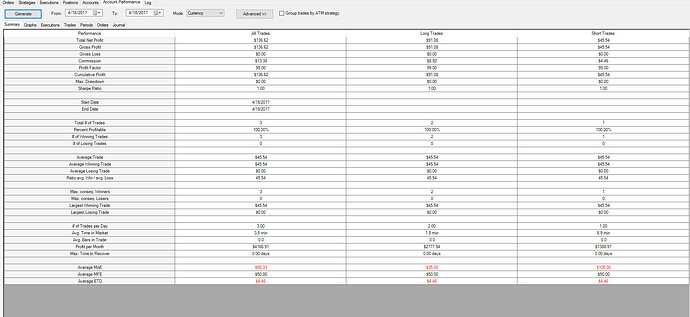

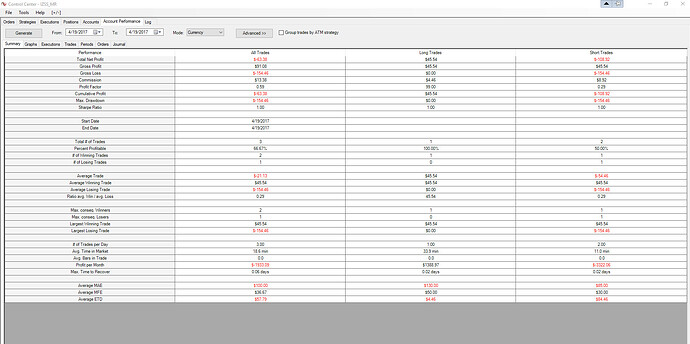

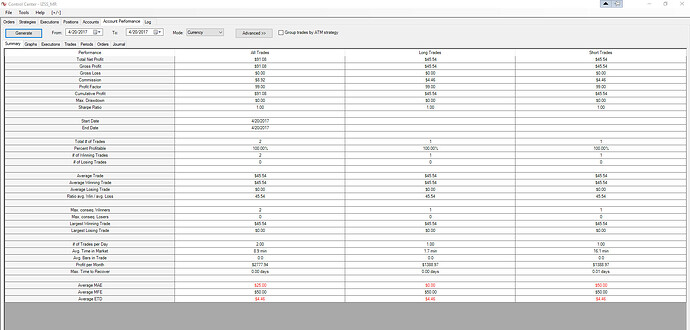

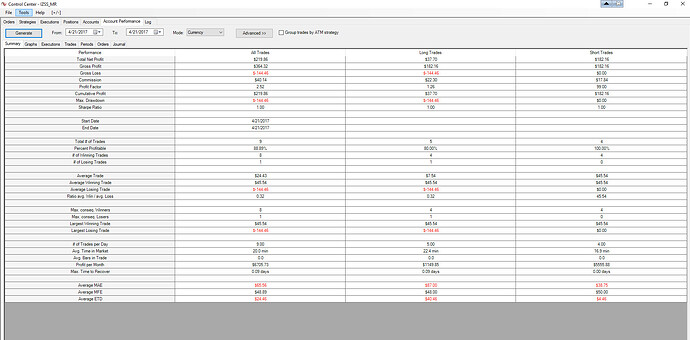

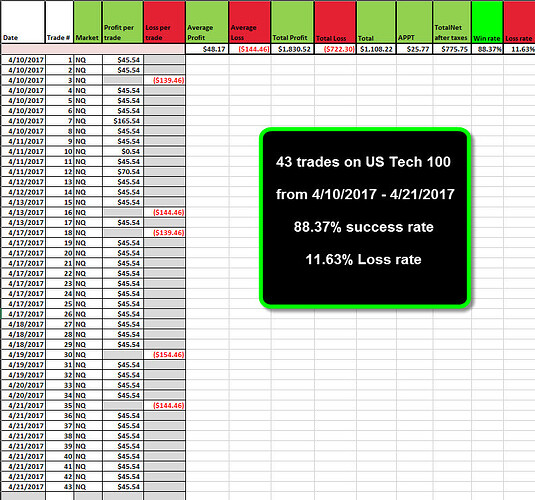

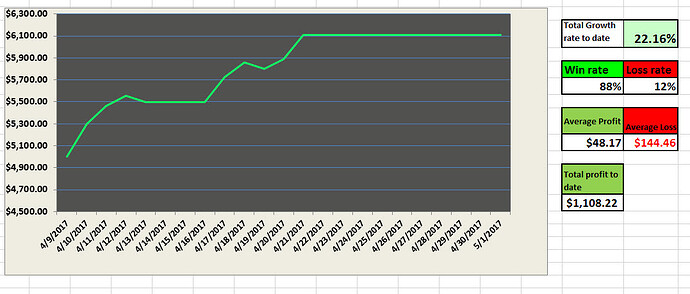

43 Trades over 9 days, 88%+ win rate, 10 tick scalps. $1108.22.

TRADE PLAN:

Market: NQ Futures $5.00 a tick, 1 contract

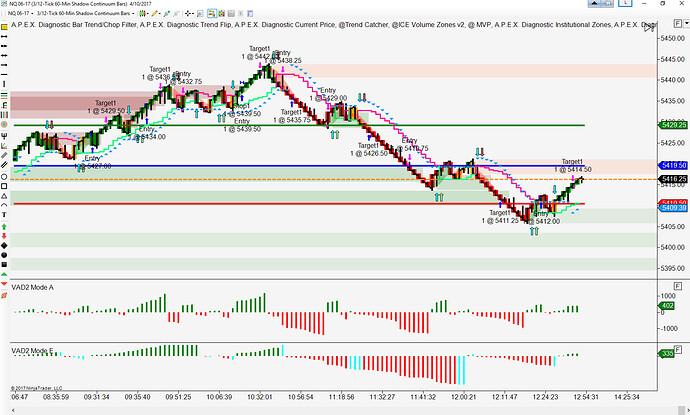

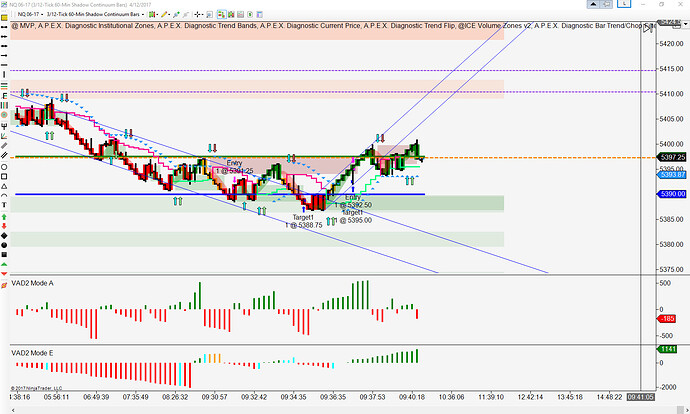

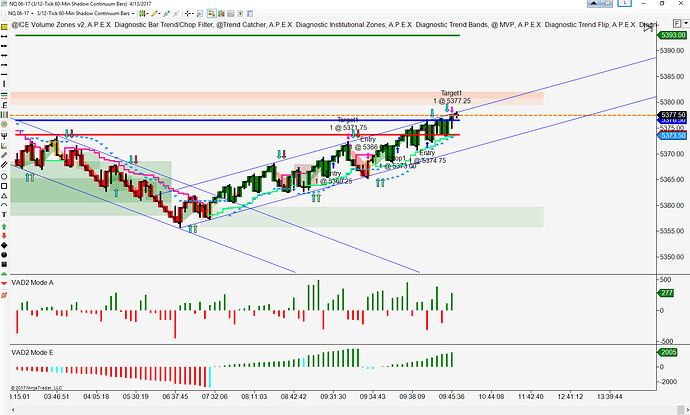

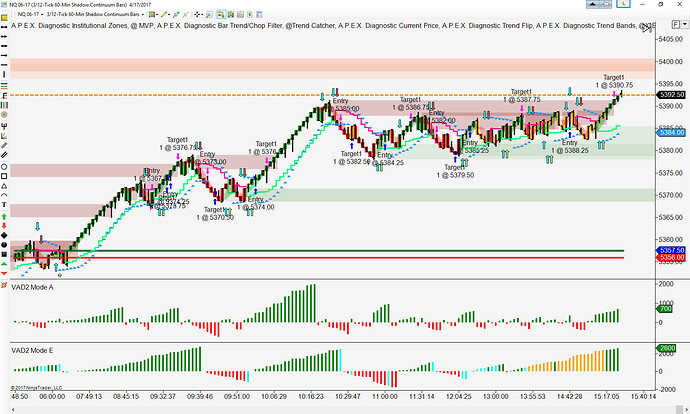

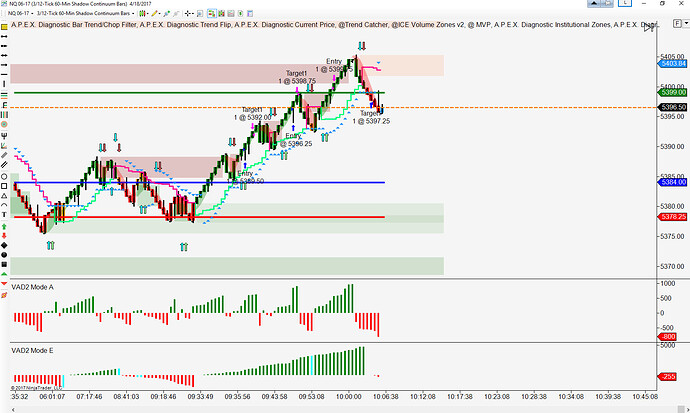

Super basic IZSS chart:

*3/12 60 minute Shadow Continuum bars

*Trend Catcher Trend Measurment period set to “15”

*Izones

*ICE levels

*VAD2 Mode A

*VAD2 Mode E

*Deviation levels (Optional) Left them off my charts to see trade markings easily for sharing these charts. Normally I trade with Deviations as well.

Trade rules:

- basic IZSS entries, 3 ticks above a valid Green Trend Catcher confirm arrow for a long with appropriate supporting Green Izone, 3 ticks below valid Red Trend Catcher confirm arrow with appropriate Red Izone

*Also took swing breakout trades according to the rules of swing breaks

*Targets: 10 tick scalps

*Stops: Nearest swing low or high depending on trade direction. No Autotrail, No autobreakeven, either hit Target or stoploss.

*Goal was 2 profitable trades then quit or continue if on a role

*Time allotted was from 0930 EST to 1130 EST. More if possible but tried to stay within those parameters

*lose 3 trades in a row, stop for the day. Lose two trades in a row, keep trading and possibly stop when out of time or only down -$50 to -$60

*If I spot a super obvious trend trade target level I might take it if UP money

*Otherwise, no extra market analysis or contextual reading, only following the IZSS entries.

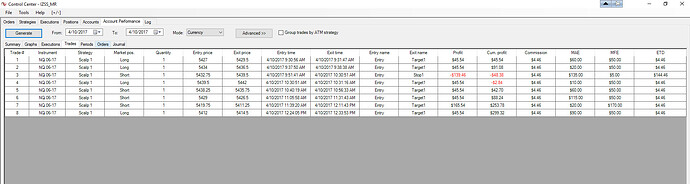

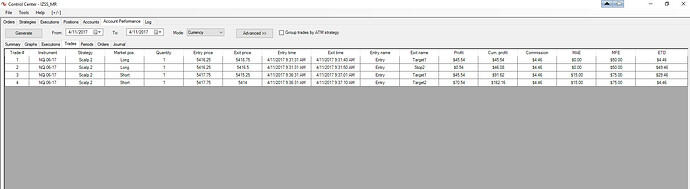

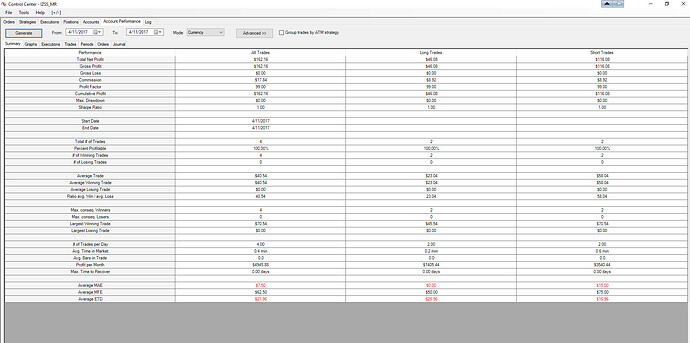

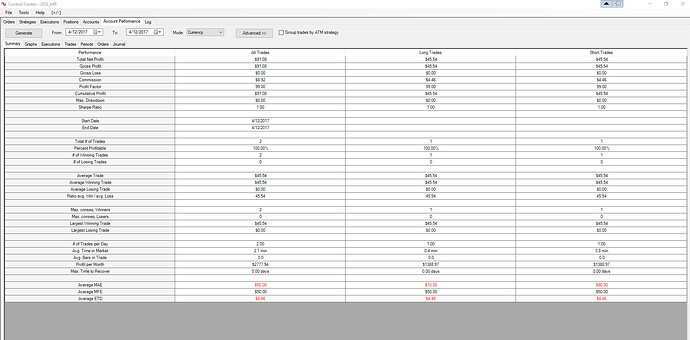

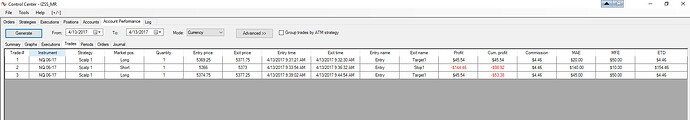

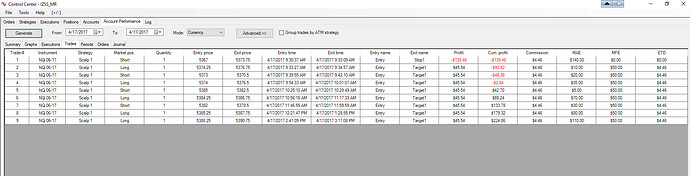

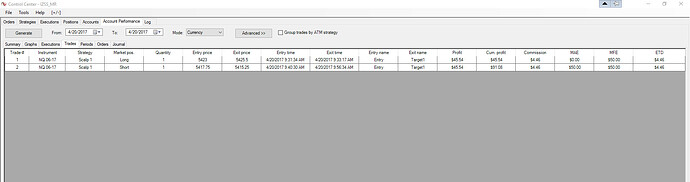

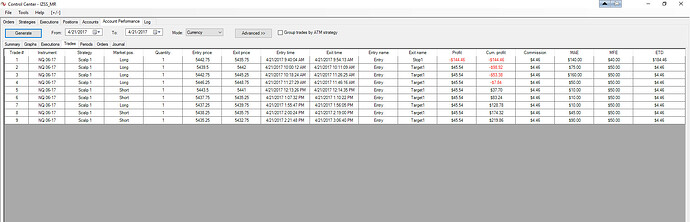

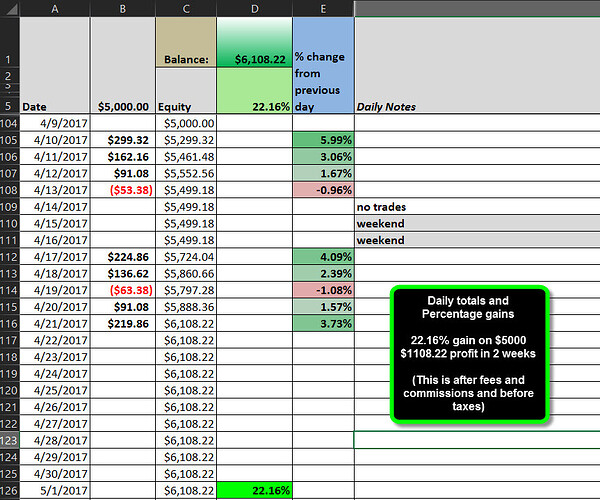

Okay Here are the days broke down and some other spreadsheet analysis:

A different view of the data broken down in my personal spreadsheet:

11 Likes

Back in the saddle again! Welcome Back! Great job in being consistent!

1 Like

Thanks Dominic! Coming from you that is high praise. I look up “consistency” in the dictionary and I see your picture there!

1 Like

wow amazing! thank you  what markets and times would you recommend for trading izss? only fuetures or fx too? and at times when markets open or not neccessirely?

what markets and times would you recommend for trading izss? only fuetures or fx too? and at times when markets open or not neccessirely?

2 Likes

Hahaha…thank you much, Christopher!

1 Like

Great job Christopher.

The same goes for the awesome documentation. Very detailed and well presented.

Thank you for sharing.

1 Like

Same here, thanks for sharing your results Christopher, nicely done.

1 Like

Great job. I am curious though. How many ticks do you risk on these trades. Is it fixed or variable and based on what?

1 Like

Ticks risked are usually 25 to 29. Stops follow the basic rules of being placed 3 ticks above or below the recent swing high or low. Using a fixed tick amount for stops is generally not a good idea. I did use a 10 tick target and it takes 3 trades to recover one loss. But IZ has an 85% plus accuracy rate taking 10 ticks so the probability is in your favor at this risk to reward. The purpose of this setup was to show a friend a very simple trade plan that could be profitable. The next more advanced stage will be targeting strong price levels and magnets for more ticks and using order prints to tighten my stops.

1 Like

Move over Gortons!

There is a new fisherman in town!

Excellent as always Ronin

1 Like

Thx. Chris. I have a question on the first chart

A couple of question on another chart.

The first chart, that entry was actually a mistake. I accidentally entered way late on a bunch of momentum. I felt the trend was very strong down so I decided to get a little bit out of it. My stop was tricky because I didn’t want to use the recent swing high as it was too far away. So I had a stop above the area of chop before that swing high. Kind of went off script with that one and got lucky.

1 Like

On the second question. My stops are always beyond recent structure highs and lows or areas of price battle. I didn’t trail any of these trades. Either I hit target or got stopped out. My second trade on this chart was a complete mistake and got lucky.

thx, Chris. Appreciate it!!!

Hi Chris, thank you for this detailed and full of information post. I’m just doing market replay using your strategy and same method. I’m wondering if you only trade in “VAD E” direction or only follow IZSS rules. I remember that Darell was saying he only trades in “VAD E” direction.

1 Like

For this run I only took the TC entries. Completely ignored VAD. But for better trade filtering, yes only trade with VAD E.

Wow.! Just wow. A really “simple” plan for noobs. A webinar on how your thought(s) process(es) unfolded along would be a great hit. I know is a big ask - is it possible to approach other APEX systems along these lines?

1 Like

what markets and times would you recommend for trading izss? only fuetures or fx too? and at times when markets open or not neccessirely?

what markets and times would you recommend for trading izss? only fuetures or fx too? and at times when markets open or not neccessirely?