I will share the strategy I have been using for the past week or so with great success. Everything listed below is how I have been trading it.

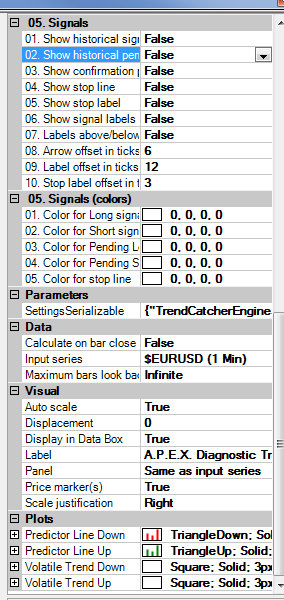

Chart Setup:

-

One minute candles

-

Expected Range

-

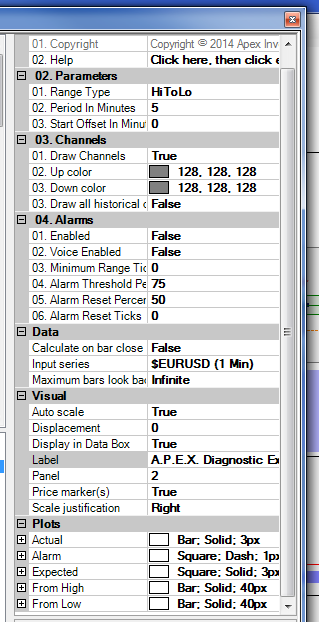

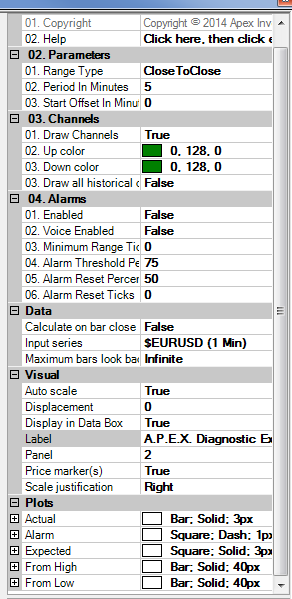

Expected Range 2

-

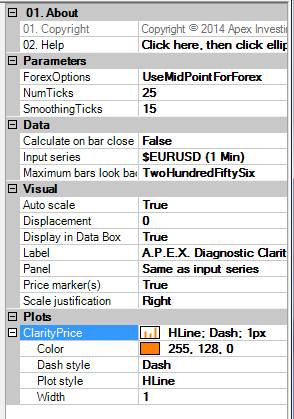

Clarity Price

-

Deviation Levels set to default

-

Expected Volume set to default

-

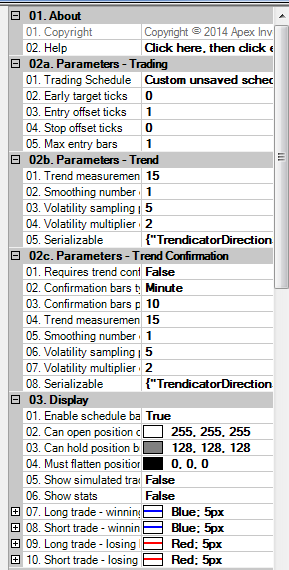

Trend Catcher

-

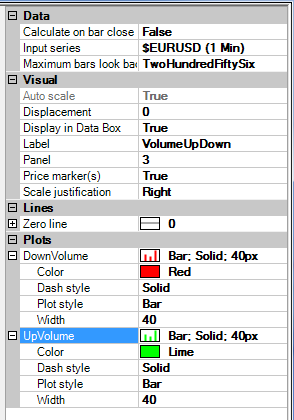

VolumeUpDown

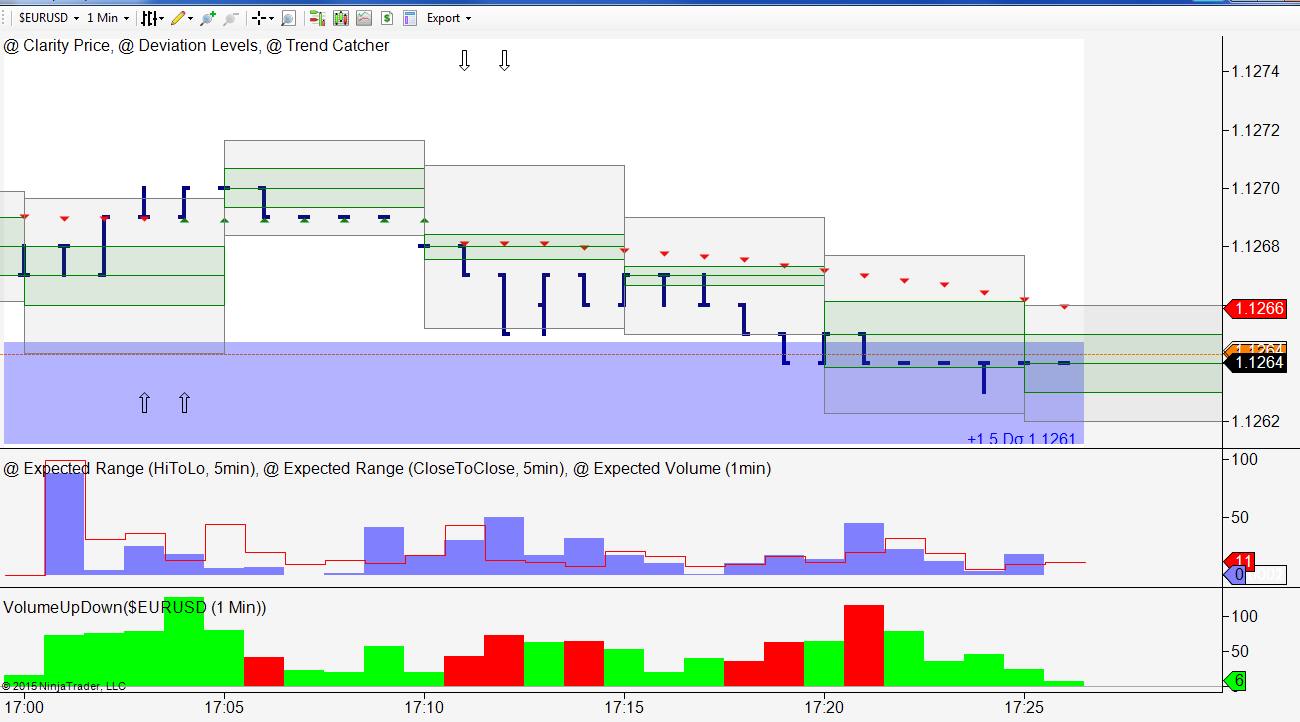

When you are done your chart should look something like this:

So the strategy is very simple: I am looking to take trades at the bottom/top of the market within each 5 minutes.

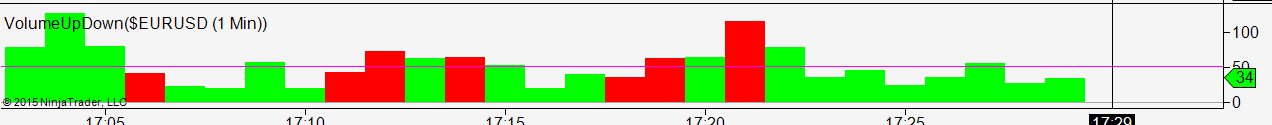

So the first thing I do is I draw a line at the very first level on the VolumeUpDown indie

This level will have to be adjusted constantly. I usually keep it at the first level but if I am constantly getting large volume bars I will move the line up to the next level.

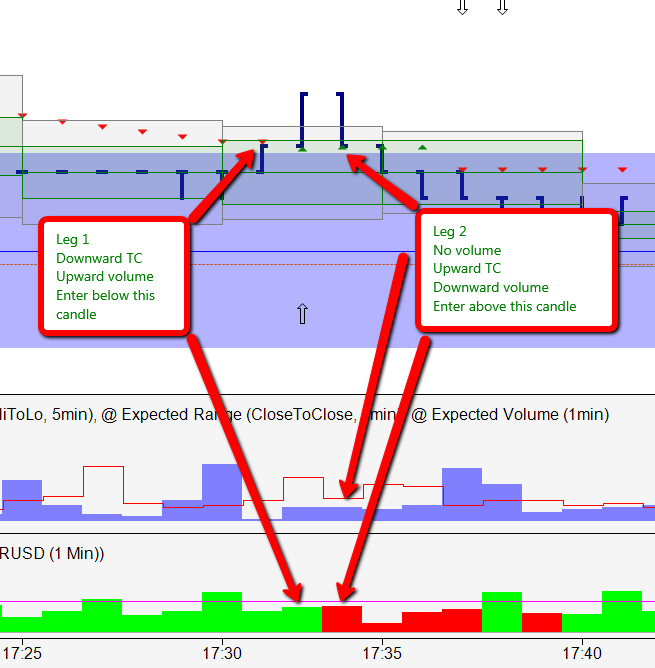

While watching the charts the first thing I am looking for is for trend catcher not to match the VolumeUpDown bar

Next, if I am trading conservatively, I want to see the candle to be around the top/bottom of the high/low box

I then want to see the VolumeUpDown bar break through the level I have drawn

Once these three conditions are met I will take a trade in the direction of the VolumeUpDown bar. If I am trading conservatively I will find the deepest itm strike I can below/above the candle. More aggressive, I will take a strike at the high/low of this candle. I NEVER take a strike inside the candle unless the market is really moving away with volume breaking the expected levels and trend catcher changing direction.

My entry will usually take place on the open of the next candle. However, if I am close to the end of the signal candle and it isn’t really moving enough to change volume direction I will enter then…the latter is more aggressive.

I take each trade to expiry and I set my stop trigger at my entry strike.

Max buy is $85 Max sell is $15

With this being said, there are so many setups that I rarely will go above/below $80/20 and sometimes can get in at $70/30.

Well that is it in a nutshell. Please post your questions and I will try to answer them to the best of my ability and as soon as possible.

I usually post my trades in the Nadex chat room on a daily basis.

Almost forgot…the butterfly setup…ha

I follow the same rules listed above for the first leg. What I am looking for in the second leg is a slow down of the market, low volume, and a far away strike or another reversal of volume, this time coming against me.

Happy Trading!

Just realized I forgot to mention one thing. The candle that you want volume to go against, this candle needs movement in favor of volume. Doji candles with no wicks are unacceptable. You want to see that the market is actually pushing against TC. Long wicks are what you are after.