By Darrell Martin

Wednesday, October 19, at 4:30 AM ET, the UK Office for National Statistics will release news on the Average Earnings Index, Claimant Count Change and Unemployment Rate. The first is an indicator for consumer inflation, as it measures the change in labor costs for businesses and the government. Those costs are normally passed on to the consumer. Claimant Count gives the number of unemployed people claiming benefits.

Together, this news tends to move the market and then typically, a pullback occurs. A high probability strategy, entering the night before and having very low risk, is the Straddle trading Nadex GBP/USD spreads. The risk is so low, in fact, that stops are not necessary.

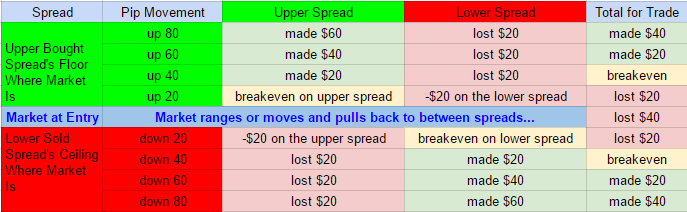

The strategy is neutral, meaning the direction of the market move is unimportant. Two spreads are traded. One spread is bought with the floor where the market is trading at the time. The other spread is sold, should be where the market is and the ceiling should meet the floor of the bought spread. Based on previous market reaction to this news, the trade should be set up for a maximum risk of $40 combined between the spreads.

The trade can be entered as mentioned, the night before, at 11:00 PM ET for 7:00 AM ET expirations. After entering the trade, take profit orders should be placed. For this trade with a maximum risk of $40, take profit orders should be set where the market would hit 80 pips above and 80 pips below. If the market hits either place, then the trade will profit $40. To see where the profit, breakeven and loss points would be for this trade, see below.

Should one side reach the take profit point, leave the other spread on in the event the market turns and goes the other direction. The loss on the other spread may be reduced and the spread may even make some profit, depending on how far the market goes.

For free day trading education and free access to the spread scanner, go to www.apexinvesting.com.