By Darrell Martin

There are items necessary to a person’s survival that are used every day. These things are placed in a representative basket of goods and services. Every month, the Bureau of Labor Statistics (BLS) in the US produces a monthly report telling of changes in the prices paid by urban consumers for these goods and services. The BLS actually releases two reports at the same time, the Consumer Price Index (CPI) and the Core Consumer Price Index. The Core CPI excludes food and energy. The data for these reports reflects consumer spending for August and will be released Friday, September 16, at 8:30 AM ET.

News reports such as the CPI can cause movement in the market, often returning close to where it was before the announcement. A suggested strategy to use in this case is the Iron Condor utilizing Nadex EUR/USD spreads. For this trade, look for a minimum profit of $25 per contract.

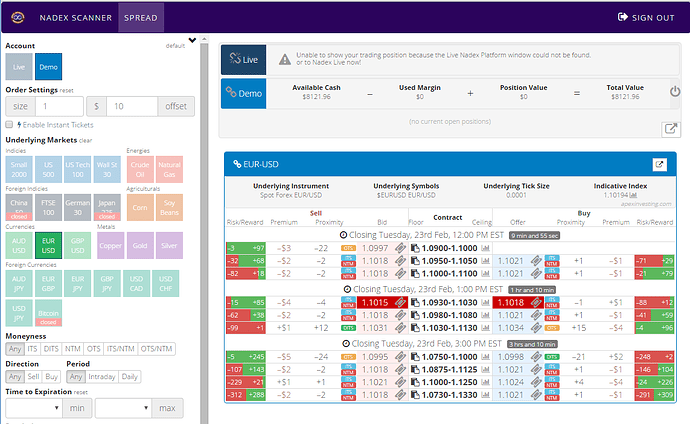

To set up the strategy for this news event, buy a spread below the market with the ceiling where the market is trading at the time and sell a spread above the market where the floor is trading at the time. Looking in the reward columns on the Apex spread scanner for trading Nadex, find the EUR/USD 7:00 AM ET spreads expiring at 9:00 AM ET with $12 or more reward potential. This is easy to do using the filters and glancing at the risk/reward columns. See below for the layout of the Apex spread scanner.

Once you have found the right spreads, verify all the parameters and enter the order. Stops do need to be placed when trading an Iron Condor. The strategy is meant to make the most profit when the market makes a move and then pulls back to center between the two spreads at settlement. As long as the market is between the breakeven points, some profit will be made. For this trade setup, the breakeven points would be 25 pips above and below.

The stops would be placed 50 pips above and below. The market would hit the 1:1 risk/reward ratio at those points. Stops are there in the event the market makes a strong move and doesn’t pull back. The risk is kept reasonable to a 1:1 risk/reward ratio. There is always capped risk as well with Nadex spreads unlike trading futures and Forex.

For free day trading education and access to the spread scanner visit Apex Investing.