By Darrell Martin

Manufacturing Production for the UK reported in January was down 0.4% and Industrial Production for the UK was also down 0.7%. These reports are indicators on the health of the economy as production reacts quickly to ups and downs in the business cycle and can affect employment and earnings levels. For those reasons, traders pay attention to this news. Fortunately, there is a trade strategy that works whether the news is positive or negative. Using Nadex spreads and a neutral Iron Condor strategy, the market can react and go up or down or remain in a tight range and this strategy can capture profit.

Since the numbers are released at 4:30 AM ET Wednesday, February 10, 2016, this strategy is planned for you to enter as early as 11:00 PM ET Tuesday, the night before. Who wants to wake up in the middle of the night to trade? Not many, and placing the trade the night before makes this strategy convenient and possible to trade news that comes out at 4:30 AM ET. Nadex Spreads are options for day traders. You want to look for 7:00 AM ET expirations for this trade.

The Floor And The Ceiling Of A Spread

A spread has a floor and a ceiling, which define the range of the market you can trade long or short. Spreads have capped risk and profit because you can’t win or lose past the floor or the ceiling depending on the direction you trade them. For example, if you go short and sell a spread, then you can’t win past the floor but you also can’t lose past the ceiling if the market turned against you and went up.

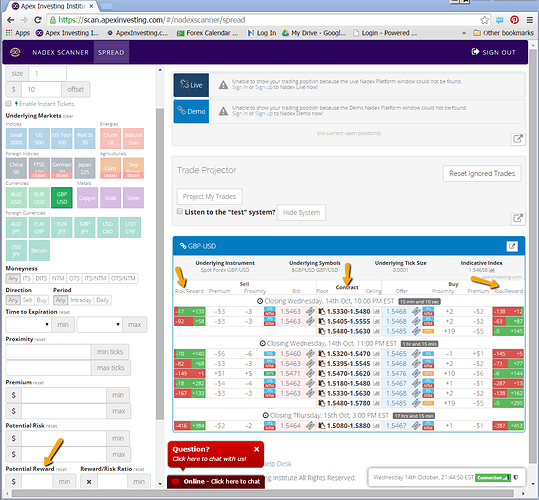

The Iron Condor strategy has you buy a spread below where the market is trading. Therefore, your buy offer price for your bought spread will be below the market. This spread should have its ceiling where the market is trading. You also will sell a spread above where the market is trading. Your sell bid price for your sold spread will be above the market. This spread should have its floor where the market is trading. The reward potential of this Iron Condor is $35 or more. The way to find the right spreads for the trade is easy using the spread scanner available with a free login at www.apexinvesting.com. Below you can see an image of the spread scanner with the spreads and their floor and ceiling numbers down the center. The reward potential is on the outside to the left for selling and to the right for buying.

Based on market movement analysis done on the past 12 - 24 reports, it was found that $35 combined between the spreads was a high probability profit potential. Once you have the spread scanner opened, just look in the reward column area for spreads with around $17 or more profit potential and the right floor and ceiling parameters. Since you are buying below market and selling above market, all you need is for the market to stay in a tight range or to make its move and then pull back to remain in a tight range until expiration.

With $35 or more profit potential, the market can move up 35 pips and down 35 pips and within that range, you will make some profit. Remember, that one pip is worth $1 and max profit is when the market is right between your spreads at expiration. Therefore, for every pip away from the center, it is only less $1 profit. The max 1:1 risk reward point is when the market moves up as much as 70 pips or down as much as 70 pips. That is where you would want to exit for managing risk. However, the market tends to make a move and pull back.

For a full calendar of news events and strategies to trade them, you can visit www.apexinvesting.com. There you will find free education on how to trade Nadex spreads and binaries, as well as futures, forex and CFDs. Nadex is a US based CFTC regulated exchange and can be traded from 48 different countries.