By Darrell Martin

Often traders think binaries are the more attractive contract to trade over spreads. Binaries can be quicker and easier to learn than spreads and can seem like quick profits. Whereas spreads can seem more complicated and difficult to learn and like they move slow taking longer to profit or profit very little. Interestingly though, one trader recently ran a demo on spreads and binaries, both of them for two weeks and found that his demo on spreads crushed his demo on binaries.

This trader had actually started out hating spreads, having the thought that he would make only around $8 on a spread, but on a binary, he could make $60 or more on the same trade. However, over time, this trader found that if he was patient and waited for the correct spread and entry, he was risking less per contract trading spreads than on binaries. Trading spreads, he kept his risk to $20-$30 per contract. That little 20-pip move that didn’t seem like much before at $1 per pip or tick on Nadex spreads, quickly added up, now that he trades multiple contracts. Yet, he is still only risked $20 - $30 per contract.

Traders are sometimes shocked seeing the amount needed to enter a spread trade. There are two points to consider here. First, even though you are putting up the max risk to enter a spread, remember, you don’t have to risk that amount. You can exit at any time following your chart and maintain a realistic risk that you have set for your trade strategy or system. Second, remember, the max payout or settlement for a binary trade is $100, and some portion of that is going to be the amount you put up for the trade. With a spread however, when you are trading on a trend and if you trail your stop, you can profit sometimes much more than you would on a binary.

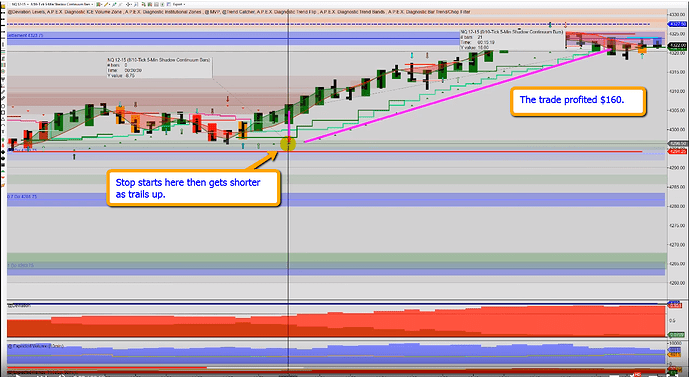

You can see from this trend trade below had you made the trade with a binary, even buying an Out Of The Money binary at around $10 - $15, your max profit would only be $85 - $90. Whereas with the right spread, you could make upwards of $160 on just one spread with a realistic risk starting out at around $87, where your stop would be on your chart. You may have had to put up more than $87 to enter the spread, but you still only have the managed risk of $87. With a profit of $160, this trade ended up having a 1:2 risk reward ratio. In addition, as the market moved up, you would have trailed and tightened your stop.

That is just one example, and if an 87 tick stop is too much, then you could have a lower risk as well. The point is, the potential for profit is higher with spreads and you can exit at any time to manage your risk. You’re also still protected with the capped risk of a spread should the very unlikely event of a flash crash happen.

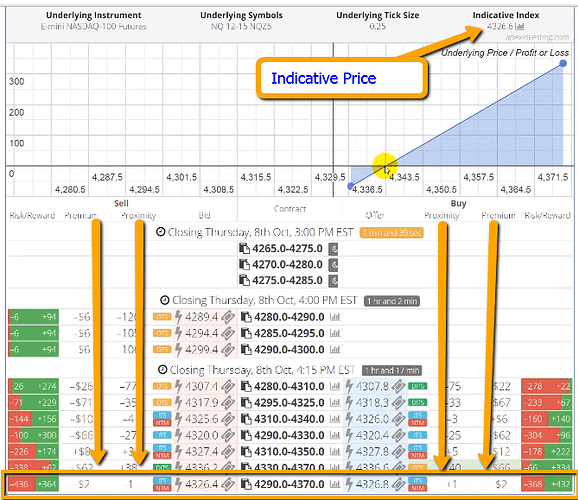

How do you find the right spread to mirror the market so you can actually see it move with the market and make profit? In the spread scanner available for free access at www.apexinvesting.com, at a glance, you can find the Nadex spread with low proximity and low premium. Low proximity and low premium spreads will move the fastest and closest in tandem with the market.

For example, in the next image, looking just at the indicative 4326.6 and the spread in the yellow box, you can see the bid price to sell is 4326.4, the proximity is 1 and the premium is $2. If you bought this spread, the offer price is 4326.8 and also has a proximity of +1 and premium of $2. Whether you bought or sold this spread, it is mirroring the market here, and it will move the fastest of the spreads, in tandem with the market.

It is always essential to demo trades to learn and be comfortable with a system, a strategy and execution before going live. As the trader above did, you could do your own two-week demo comparing binaries to spreads. Spreads may take a little longer to learn or be comfortable with, but once understood, they tend to be easier to trade than binaries, have a greater upside reward and limited risk, as they are not all or nothing like binaries.

To access free education on how to trade Nadex spreads and binaries as well as futures, forex and CFDs visit www.apexinvesting.com. Nadex is a US based CFTC regulated exchange and can be traded from 48 different countries.