By Darrell Martin

Purchasing Manager’s Index for the Construction Industry will be released Thursday, June 2, at 4:30 AM ET. Don’t worry- that doesn’t mean having to wake up in the middle of the night to trade! This news can be traded as early as 11:00 PM ET the evening before. For trader’s having to work regular hours during the day, this opportunity is available after working hours.

The Construction PMI for the UK is a leading indicator for economic health as it portrays the results from 170 surveyed purchasing managers. Since these managers must react quickly to changing conditions in their industry, they have the most current insight for employment, production and new orders in the construction business.

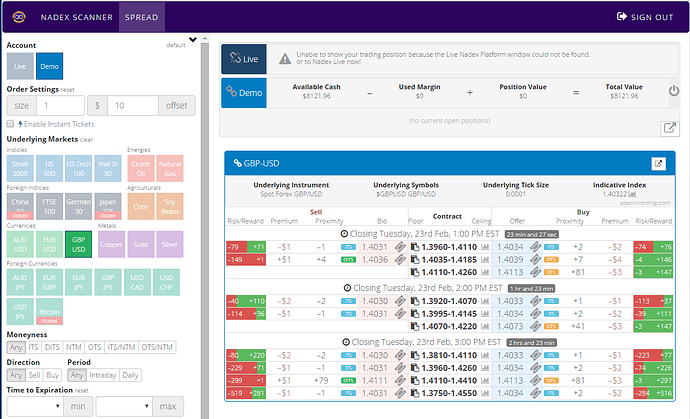

For this trade, an Iron Condor, using Nadex GBP/USD spreads, works well for the typical, average market reaction to this news, a move and then a pullback. To set up, buy a spread below the market and sell a spread above the market. The ceiling of the bought spread should meet the floor of the sold spread and be where the market is trading at the time. The reward potential for this trade should be $35 or more, or around $17 each per spread.

The spread scanner developed for trading Nadex spreads offers traders the advantage of finding all the necessary spread information in one window. Look for spreads in the expiration time with the right reward potential and verify the ceiling and floor criteria match. See below for an example shot of the spread scanner.

Limit risk by placing stop limit orders where the market would move up or down approximately 70 pips. That is where the 1:1 risk/reward ratio points are located. If the market settles anywhere between the breakeven points, 35 pips up or down, then the trade profits. Max profit is when the trade settles between the two spreads. More contracts can be traded with this strategy, to increase profit potential; however, it will also increase risk. Just be sure to have the same number of spreads on each side.

Free education and access to the spread scanner is available at www.apexinvesting.com.