I will admit that when I first joined the Apex community, I was skeptical. Truth be told I had no idea what I was even doing trading. As I explored the site and discovered the wealth of education that Darrell and his team have put together for us I was blown away, actually I was overwhelmed. I followed the courses and did my best to stick to Darrell’s philosophy - learn one system, master it, then add on. Here I am 8 months later and I am a better trader than when I started. Not only am I trading on the Nadex platform, I am also a futures trader (never even considered that prior to Apex), and for the most part I’m profitable (still have a few boneheaded moments when I don’t focus).

I am where I am today because of the tools and the education that the entire Apex community provides and that includes other trader’s like Lori, KJ, Marilyn, Beatnick, TraderJoe, Leah, Gregorious, Larry and many others who share their charts, thought processes, answer questions, etc…All while trading their own accounts. Traders helping Traders…I love that about this community. Another reason I am where I am today is my post trade analysis, this was something I never did prior to Apex and I have to say shame on me and anyone else that is not doing post trade analysis or pre trade analysis for that matter. Although we have all these wonderful tools at our disposal, I am the type of person that craves understanding of why it works. So I have really been studying price action on a deeper level to gain a better understanding of the market in general. As a result I have gained a higher level of confidence and I trade better each day. As I was reviewing my trades for the week tonight, I came across a chart I marked up from Monday and I felt I had to share it. For anyone that works a full time job, that doesn’t think they have the time to set aside to trade profitably and earn a decent income from it, let this be proof that it can be done.

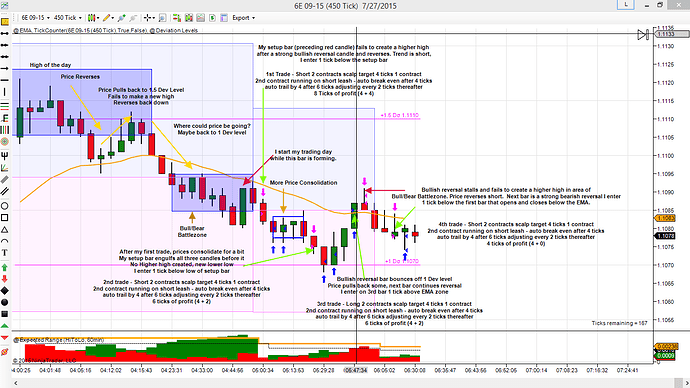

This chart is from Monday, July 27, 2015 I started trading around 4:40 am and I was scalping on 6E. I marked up the chart pretty good with the reason I took each trade and the result of each one:

I took my first trade at 4:57 am and my last trade closed at 6:23 am. In that hour and a half I had a net profit of $300 exclusive of commissions and fees:

Not every day is as clean as Monday was and in the interest of sharing the good with the bad, here is my worst day this week Thursday July 30, 2015:

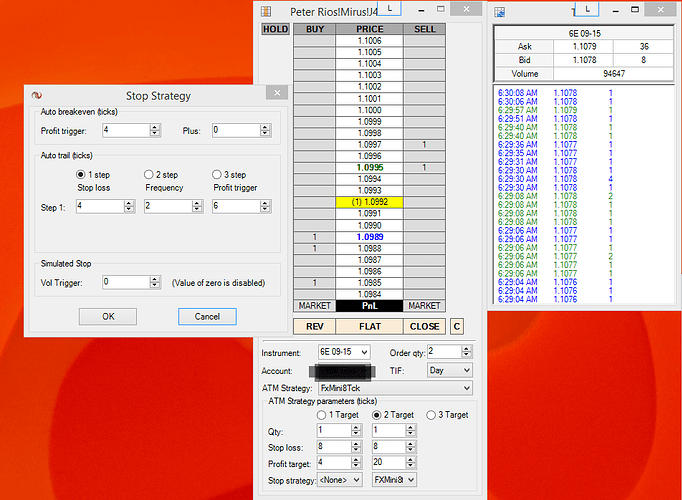

You will notice that the chart I marked up is a little different, and that is just me wanting to learn more how to read the market, I do actually have a dashboard of charts that I use when I am trading as pictured here:

I do trade mostly off of my 8 tick trend catcher chart on 6E but lately I have been using my Tick chart to find setups and using the DOM to place trades when I’m not trading the US session. That is just me broadening my knowledge base.

Being able to trade for a few hours a day and earn hundreds of dollars a week doing it has really changed my life!

I really wanted to share this because I want people to know that it can be done even when working a full time job. The big “But” is you have to put the time in and learn. I did not get where I am today overnight. I have put 8 months of hard work into this because my goal is to become a full time trader and finally stick it to “the man”. ![]() However, before I can do that I have to prove it to “The Wife”

However, before I can do that I have to prove it to “The Wife” ![]() that I can do this (trust me, she scares me more than “The Man” does!)

that I can do this (trust me, she scares me more than “The Man” does!)

I know there are a lot of skeptical people out there, I don’t know of anyone that hasn’t tried a system only to get burned by it and that is why most of us are skeptical. I do know that if you put the time in, the tools that Apex provides us actually work, I mean for real deal work! I see some people posting in the forums asking for back test data, asking if this really works, etc and I have to say for me, personally, I don’t trust anyone’s back test data but my own. Nothing against anyone, but data doesn’t mean anything to me, results do and not just any results, my own personal results. That is how I judge a system. If I can understand the system, trade the system, and be profitable on the system, that is all the back test data I need. Demo is your friend!

For anyone out there that has doubts, Are you asking questions? Are you posting your charts, marked up? Are you reviewing your trades at the end of the day/week/month? Are you practicing in demo and market replay? Are you engaging other traders in the Nadex Pit (if trading Nadex) or the Elite Room (if trading futures)? Are you being honest with yourself? If you can’t answer yes to all of these questions and you are struggling, that is why you are struggling.

Sorry for the rant, it’s not what I set out to do (really only wanted to share my chart…LOL). I do believe in this community, I hope it sticks around for a long time as I would hate to try and do this without it. Darrell and everyone else that devotes their time and effort to improving the tools we get to use I say Thank You wholeheartedly.

Peter

P.S. I almost forgot, if anyone was curious, I use a conservative ATM Auto Break Even and trail strategy when I am scalping 6E. At $12.50 a tick, things can go south real quick if you know what I mean. The biggest part is just picking the right setups to enter on. Here is my ATM strategy: