By Darrell Martin

Gross Domestic Product for Australia is the value of all goods and services produced by their economy, is inflation adjusted and will be released Tuesday, September 6, at 9:30 PM ET. While this scheduled news event is released quarterly and tends to move the market, it is unknown which direction the market will go. To trade an event like this, a strategy prepared for market movement in either direction is needed.

Based on previous market moves, where the market makes a move and then pulls back, an Iron Condor strategy would work well. This strategy uses Nadex spreads with capped risk. For this event, the trade can be entered as early as 9:00 AM ET for 11:00 AM ET expirations. Trading Nadex AUD/USD spreads, one spread should be bought below the market with its ceiling where the market is trading at the time. One spread should also be sold above the market with its floor where the market is trading at the time.

For this trade, based on previous market moves, each spread should have a profit potential of $15 or more, for a combined profit potential of $30 or more. The Apex spread scanner for trading Nadex makes it quick and easy to find the right spreads for the strategy. Using filters, the AUD/USD spreads expiring at 11:00 AM ET, can be quickly narrowed down.

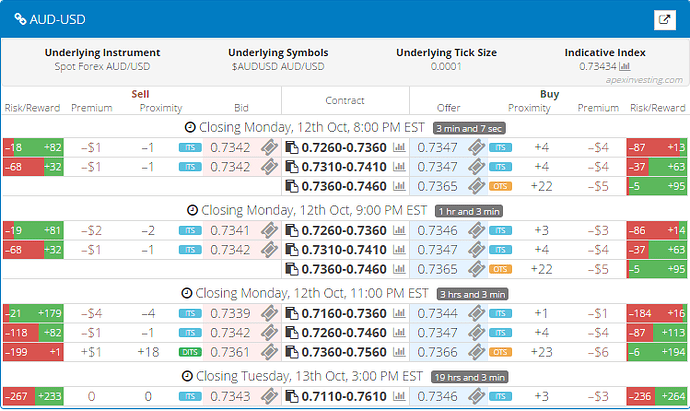

Just looking in the risk reward columns for both selling and buying spreads, ones with the right profit potentials can be found. At that point, just check the floor and ceiling parameters and the trade can be entered. For practice, the scanner can be used for demo trading and when ready, also for live trading. It is offered free to all traders. See below for a glimpse of the spread scanner layout.

Since this news event is in the evening, it makes for an evening trade opportunity. Stops should also be placed where the market would reach a 1:1 risk/reward ratio. For this trade with a $30 profit potential, place stops 60 pips up and down. For a max profit, look for the market to pull back to center between the spreads, after making any move, and be there at settlement. It will make some profit even if it isn’t right at center. It is only $1 less in profit, for every tick away from center the market is at settlement.

Free access to the scanner and a complete calendar of news trades along with day-trading education can be found at Apex Investing.