By Darrell Martin

If you are limited in the time you can trade because of a daytime job, if you live in the US, it may be beneficial to consider trading news as it is released on the other side of the world. On October 18, at 8:30 PM EST, Australia will release four news reports dealing with Employment. They include the following:

-

Employment Change

-

Unemployment Rate

-

Participation Rate

-

Full Employment change

Varying in importance from low to high all can have an effect on the market. This can open opportunities for trading. Of course, the markets to look at would be anything that includes AUD, such as AUD/USD or AUD/JPY.

With news, it is unknown the direction the market will move. It is a good idea to choose a strategy that can profit no matter which way the market moves.

An Iron Condor strategy is traded on spreads. One spread is bought below the market at the same time another spread is sold above the market. Although Iron Condors are suggested for range bound trades, they can prove profitable when news is released causing the market to move and then pullback.

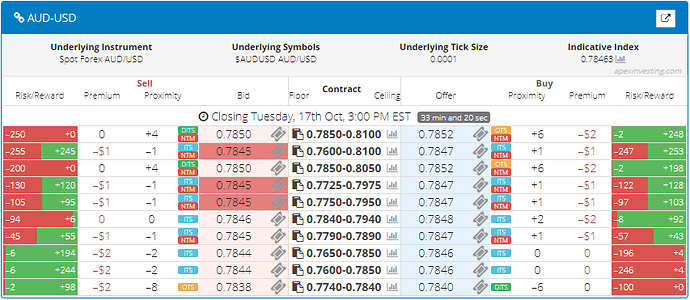

Using Nadex AUD/USD spreads, look for spreads entering as early as 6:00 PM EST with 11:00 PM EST expiration. Each spread should have a profit potential of at least $17 for a combined minimum profit target of $35. The spread scanner enables traders to immediately see the reward potential, simply find the spreads that meet the parameter of the trade and execute the trade.

See below for the layout of the spread scanner.

By placing both parts of the trade, it is as if you are encircling an area in which the market will be contained. The ceiling of the lower spread must be equal to the floor of the upper spread. The equal ceiling and the floor levels should be where the market is trading at the time of entry.

Stops should be placed where the market would hit 70 pips above and below where the trade was entered. Max profit is when the market is between the spreads at settlement.

In analyzing the logistics of an Iron Condor trade, it could be said that the risk is high and the profit is low, in comparison. However, the trader is actually taking advantage of the premium by buying lower and selling higher than the market. Ideally, the market needs to move just enough for one side to profit, and then pull back so the other side can profit as well. On the buy side of the trade, as long as the market goes up or stays flat, profit will be made. The sold side can be viewed as a hedge for the long contract with the possibility of more profit should the market pullback and be at breakeven for both contracts.

When news is released, there is always the likelihood of the market making a move, pulling back or ranging. This makes the Iron Condor an ideal strategy.

Visit Apex Investing Institute for free day trading education and other trading tips.