By Darrell Martin

The possibility of having profitable trades even in flat markets has been presented in previous articles. This article will show step by step how to combine both buying and selling of two in the money, (ITM) binary option contracts. The strategy is known as a Binary Butterfly and is an effective strategy to capitalize on flat or channeling markets.

When a market has been trading sideways and there is no foreseen reason that the market pricing will change, then it’s time to bring out your butterfly net.

The idea is to capitalize on both legs instead of only one leg when the markets are flat. You sell a binary strike that is above the current underlying market and buy a binary strike that is below the same current underlying market. As long the underlying market expires between the 2 strikes, you will collect the settlement payout on both strike legs of the trade.

Assume it’s lunchtime, when the markets often slow down, and you notice that the USD/CHF market has flattened slightly. It has been trading between the (0.9665) and (0.9672) levels for the past 2 hours. Using the butterfly strategy, you’re looking for 2 strikes above and below those levels within the time expiration period of the binary.

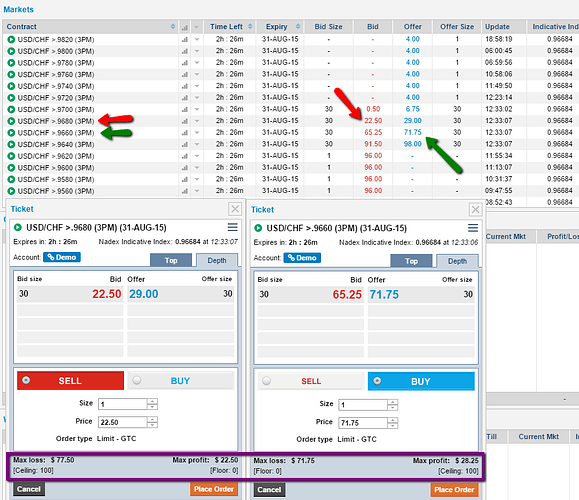

Checking the available strikes for the USD/CHF, you find that the higher strike >0.9680 is just above the current trade range and can be sold at 22.50. The lower strike >0.9660 lies below the current trading range trade and can be bought for 71.75.

The initial cost of this strategy is higher because both binary position legs are already in the money when initiating the trade. Selling the USD/CHF > 0.9680 at the 22.50 trade price will cost $77.50 per contract (100 – 22.50). That is your maximum trade risk if the underlying market trades higher. The USD/CHF > 0.9660 bought at the 71.75 trade price has an initial cost of $71.75 per contract, which is your maximum risk if the underlying market trades lower. So the combined cost of both legs is $149.25.

If successful at expiration, you can receive two settlement payouts of $100/contract each for a combined profit of $50.75. You get that payout as long as the underlying is still trading between the upper strike of $22.50 and the lower strike of $28.25.

One thing to remember about this strategy is that if you hold it till expiration, one of the position legs will always finish in the money, meaning you will always receive at least $100 settlement at expiration with the possibility of a total of $200.

(Note:Exchange fees are not included in calculations above)