By Darrell Martin

Binary pricing can be thought of as a probability. Nevertheless, let’s back up and make sure some basics are understood. When the underlying price and the strike are at the same price level, the binary option will be priced around 50. If the binary will expire soon, the binary price action can move quickly. If there is a lot of time until expiration, the action will move slowly.

Depending on what is happening in the market, price movement may be swift or sluggish for various strike levels as time runs out. Now, let’s examine the binary pricing being thought of as a probability.

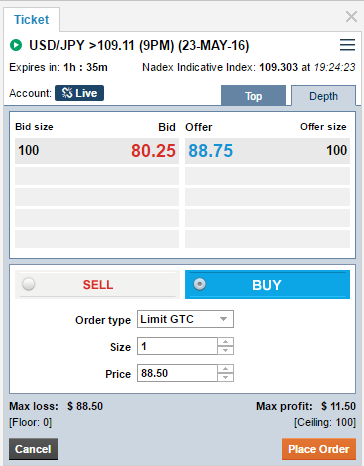

The ticket above shows the bid and offer prices for USD/JPY quoting at 80.25 bid/88.75 offer. The midpoint is found by finding the average of the two prices, which would be 84.50. This means the market place is putting an 84.5 percent chance that the binary will finish in the money for the buyer and a 15.5 percent chance for the binary seller.

This ticket shows at this time, the Nadex Indicative Index of 109.303 is above the strike of 109.11. There is over one and one half hours until expiration. As time gets closer to expiration, different strike levels could be priced closer to 100 in the buyer’s favor or the market could turn around and go in favor of the seller. These scenarios would change the binary pricing and probability.

Remember, in trading, anything can happen and a couple of ticks up or down can cause a massive price move, especially as time runs out.

Knowing how binary pricing can be used as a probability in placing your trades can help you determine the chance your trade will finish in the money. However, this information should be used in conjunction with charts, systems, strategies, rules and risk management in achieving your trading goals.