By Darrell Martin

Market orders. Limit orders. Working orders. Take Profit orders. The list goes on for the many different types of orders you may have heard about since you started trading binary options. The purpose and use for some of the different orders will be discussed in this article.

Market Order

An investor/trader uses a market order to buy or sell an investment immediately at the best available current price. Because there are no restrictions on this type of order, a market order is the default option and is likely to be executed.

Nadex offers Market Orders with Protection (MOP). This is an order type with a built-in tolerance range, outside of which you can’t get filled. The default range is $10 for binary options. On the Nadex website, you can adjust the number to your preference from $1-25. This adjustment caps the amount of risk you are willing to accept when submitting a Market Order. An MOP will be filled in whole or in part immediately or get cancelled. It will not remain on the order book like a limit order.

Limit Order

A trader/investor places an order to buy or sell at a specified price or better. This type of order may not be executed if the set price cannot be met during the period of time in which the order is left open. It is as if you’re saying fill my order for this amount or better.

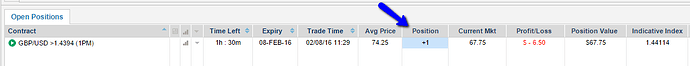

All orders on Nadex are limit orders. When you place an order on Nadex, in the Open Position area, if you bought one contract you will see +1. (Fig 1.)

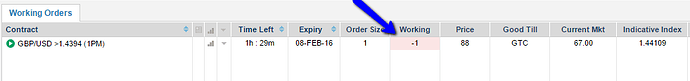

If you sold one contract, you will see -1. (Fig. 2.)

The difference of where you bought and where you can sell is shown on the price ladder chart in the profit/loss column. In Fig. 1 above, you will see $-6.50 in the Profit/Loss column. If you look at the column Avg. Price, you will see 74.25, which is the price you paid for it. Under Current Mkt. is listed 67.75, which is the price you would have to sell at to exit the contract immediately. The difference is the Profit/Loss of $-6.50.Working Order

A working order is an order to enter a position when it reaches a specific price. Working orders can be used to take profit or to exit your position. If you buy a contract, to exit out of it you have to sell it. If you sell a contract, you have to buy it back to exit. To do this in Nadex, simply click on the binary contract listing, a ticket pops up, verify the size and the price, then place the order. The order is either immediately filled by exiting your contract position, or if price has not been reached, it goes into a working order.

To use a working order as a take profit order, say you want to make $20 on the example above. You would open a ticket and when entering the price, simply enter $94.25, which is $20 more than the price you bought at to enter the trade. The order will go into working orders, unless the market has already reached that level. It will remain there until it is filled or cancelled.

Working orders can be amended if you see market changes on your charts that affect your trade. You may decide you are happy with $15 profit and exit early.

If you exit any position early, make sure to exit any working orders associated with that initial position. They will not automatically close out, and if left open, they will be filled if their level is reached and you will have an unexpected position on your books.

Futures, options and swaps trading involve risk and may not be appropriate for all investors. Past performance is not necessarily indicative of future results.