By Darrell Martin

The trade balance for a country reflects the difference between goods and services imported and exported. If the value of goods and services exported is greater than the value of goods imported, then the number will be positive. If the number is higher than expected in favor of exported goods and services, then that is considered positive for the CAD. The Canadian Trade Balance due out Wednesday, July 6, at 8:30 AM ET tends to get the USD/CAD moving, and makes for a trade opportunity using a Straddle strategy trading Nadex spreads.

Straddles are ideal when it is expected a market will make a somewhat significant move in either direction, and the strategy is low risk requiring no stops be set. Using Nadex spreads, a day trading option with defined risk up front, the strategy is set to trade the market long and short. A spread has a floor and a ceiling, denoting the bottom and top of the range in the market that is traded long or short. For this set up, a spread is bought with the floor being where the market is trading at the time of entry, and a spread is sold with the ceiling being where the market is trading at the time of entry. Effectively, the spreads are straddling the market.

Each spread should have a max risk of approximately $20, for a max combined risk of approximately $40. The trade can be entered as early as 8:00 AM ET, for the two-hour 10:00 AM ET expiring spreads.

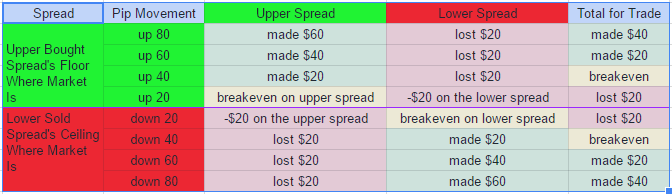

Since the total risk is a max of $40, the market needs to move 80 pips up or down for the trade to profit $40 and have a 1:1 risk/reward ratio. To visualize this, notice that the risk is $20 for each side. Therefore, if the market moves up 20 pips, the upper spread is now at breakeven and the lower spread is -$20. To see the results from movement in either direction, see the image below.

389k_image1_straddle.png

Once the trade has been placed, take profit orders need to be set where the market would hit 80 pips up or down. From the chart, notice if the market moves up or down 40 pips, the trade is at breakeven.

Free trading education and the spread scanner for trading Nadex are available at www.apexinvesting.com.