By Darrell Martin

Canadian Wholesale Sales will come out 8:30 AM ET, Thursday, March 17, 2016, giving a percentage of total value change in wholesale sales. Last report, it was up 2.0 percent and is forecast to be up only 0.3 percent this coming report. Traders watch this report due to it being a leading indicator for consumer spending.

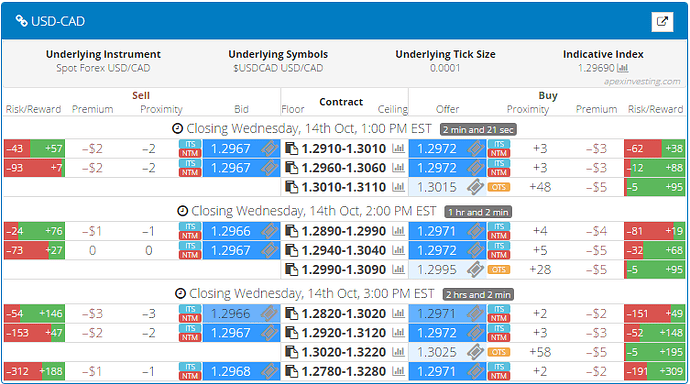

Tracking economic news events and looking for the consistent market move reactions to them can give you insight on choosing strategies to trade them. For this event, it was found after 12 - 24 reports and analysis of market reaction, that an Iron Condor strategy works well. Trading Nadex USD/CAD provides the trader with defined capped risk. You watch your USD/CAD chart while you buy a Nadex USD/CAD spread below the market but with its ceiling where the market is trading at the time. At the same time, sell a Nadex USD/CAD spread above the market but with the floor being where the market is trading at the time. You can enter as early as 8:00 AM ET for for 10:00 AM ET expirations.

Defined Capped Risk

The floors and ceilings of your spreads mark the range of the market you are trading. You can’t win or lose past those points. That is how the risk is defined up front and is capped. For this trade you want a profit potential of $30 combined between the spreads. If you want to trade more spreads, you can, just be sure to trade the same number on each side. To find the spreads with all the parameters listed, open the spread scanner at www.apexinvesting.com. Available free for to all traders with a free login, it is designed to make trading Nadex spreads easy and fast. Orders are entered instantly and risk/reward potential for each spread, whether buying or selling, can be seen at a glance. See example below.

The Iron Condor strategy is a premium collection strategy. You buy below the market and sell above the market, hoping the market will settle right around where it was when you entered, between the spreads. That would be max profit. The market could also move far enough for one spread of your strategy to profit, so be sure to enter limit take profit orders. Should this happen, leave the other spread on. As the market tends to pull back, then the other spread may profit as well. At the 1:1 max risk/reward ratio points is where to place your stop limit orders. The market would have to move up or down 60 pips to hit those points. As long as the market stays within your breakeven points, where the market moves 30 pips up or down, you will make some level of profit.

Nadex is a CFTC regulated US based regulated exchange and can be traded from 48 different countries. Apex Investing is where you can find free education on trading futures, forex, CFDs as well as Nadex binaries and spreads.