by Darrell Martin

Automobile sales brought the change in total value of Canadian Retail Sales up .7 percent for March. Excluding auto sales, the Core Retail Sales came in at -.2 percent. The next release takes place Thursday, June 22, at 8:30 AM ET. There is a high probability strategy for trading the event, which isn’t dependent on direction the market moves in reaction to the news.

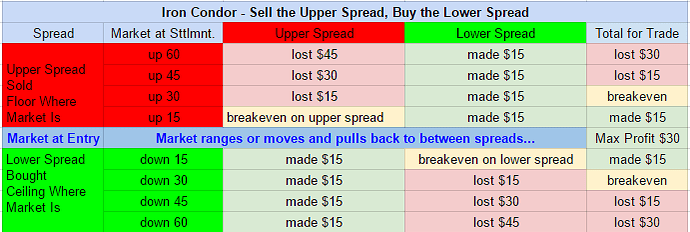

This Iron Condor strategy uses the capped risk instrument Nadex USD/CAD spreads. The market typically responds to this kind of news with a move and then a pull back. This setup is prepared to profit on the pullback. One spread is bought below the market and one spread is sold above the market. The ceiling of the bought spread should meet the floor of the bottom spread, and be where the market is trading at the time. When the market pulls back to center between the two spreads, after having made its reactionary move to the news, is where each of the spreads will make max profit.

Both the bought and sold spreads should each have $15 or more profit potential when entering, for a combined $30 or more for the trade. With these numbers, if the market settles anywhere between the break even points of 30 pips above and below, then there is some profit made. If in the event the market takes off and doesn’t pull back, then stops are set up. The 1:1 risk reward ratio points are where the market would hit 60 pips above and below from where it started.

Entry can be as early as 8:00 AM ET, when the 10:00 AM ET expiring spreads are posted for trading. Stops should be placed right after entering the trade. If there are no spreads available with $15 or more profit potential, then there is no trade. Never force a trade. Always be patient for the best trade setup. To understand how each of the spreads profit or lose, based on every 15 pips of market movement, see the below image.

Free day trading education and access to a community of supportive traders helping traders, visit www.apexinvesting.com.