By Darrell Martin

Americans love cars, cars need gas and so Americans pay attention to the price at the pump. Crude Oil prices and Petroleum Data reports, as well as the number of barrels of oil being supplied by refineries, are important to Oil Commodity traders.

As a consumer, you search around town for the best price to fill up your car without much more than a grumble if the price is up or a smile if it is lower than last time. If you are a trader, you may pay more attention to the fluctuating market, holding on to any crude you own and hoping for a better price.

Trading Crude Oil with Binary Options is different than trading as a Commodity trader. When you trade with Binary Options, your risk and your reward are known before you ever enter the trade. You still watch the charts, stay on top of any news reports that may impact your trades and trade with a regulated exchange. However, the fact that your risk is capped takes some of the fear and other emotions out of trading.

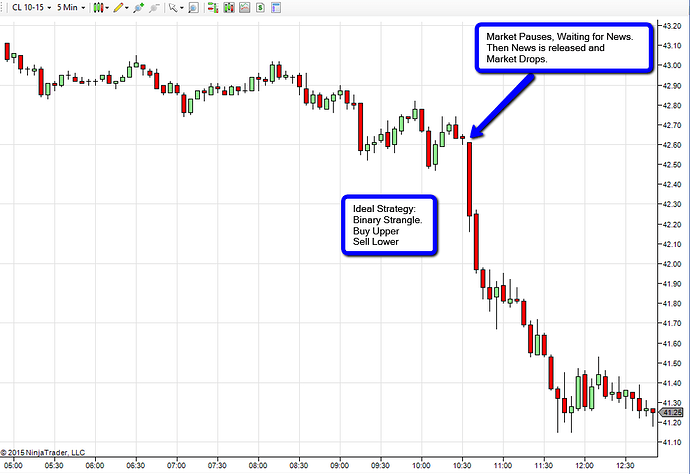

Here is a Crude Oil chart showing the effect the Weekly Petroleum Report can have on the market.

Notice how there is a pause as traders wait for the announcement and then once the report is released, the market reacts.If you are prepared for news events such as this, you can use strategies to help you collect profits. An ideal strategy to utilize when you know that a news announcement is going to cause movement in the market, but you do not know the direction, is a binary strangle strategy. For this low risk strategy, you place orders using two OTM contracts, selling a lower strike and buying an upper strike. You expect one side to lose. In this case, the buy side would probably have lost, but it would depend on your strike price, expiration time and if there was any retracement.

To create a scenario, let’s suppose you were able to BUY a CL>42.85 strike expiring at 12:00PM and SELL a CL>42.25 strike also expiring at 12:00PM. Both strikes would be OTM, so your risk would be low and unlike trading regular commodities, you would know exactly the amount you could make or lose before you hit the button to enter the trade.

In this scenario, you could have reached full profit of $100 at settlement on the SELL side of your trade but you would have lost whatever you risked on the BUY side.

This is one possibility of trading a news release using binary options. In addition to looking for the cheapest priced gas in town next week, you may be contemplating how the price of Crude Oil is affecting that price at the pump and how you can utilize that information into your trading plan.