By Darrell Martin

It hardly seems fair that when the market experiences high volatility, the Chicago Mercantile Exchange Inc. (CME) margin rates change, but that is what normally happens. This is done to ensure adequate collateral coverage.

Margin, aka Performance Bond Rates, can change if the market does not meet predetermined levels.

The CME explained in an advisory notice that the changes would affect the Short Option Minimum (SOM) and the Volatility Scan Range.

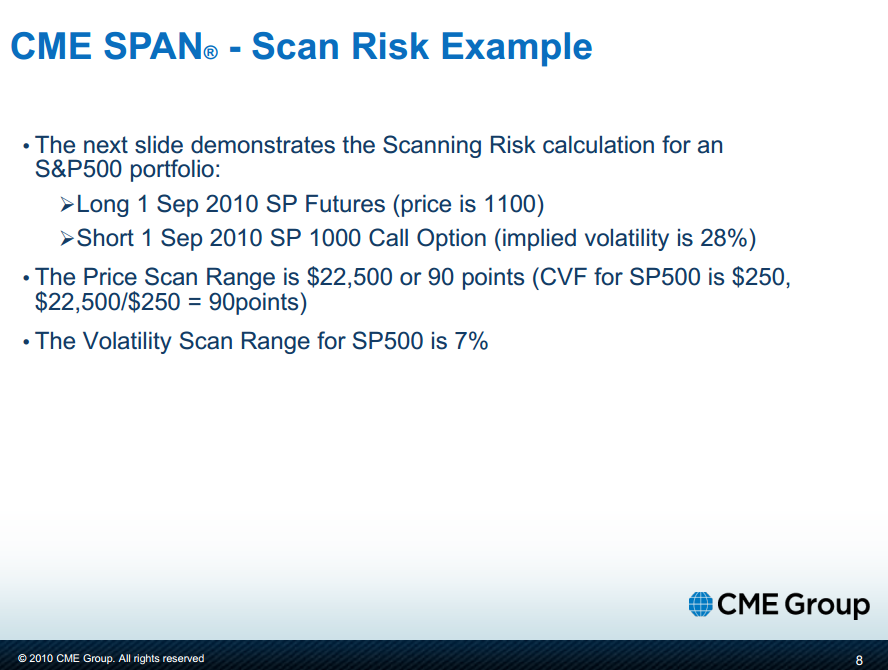

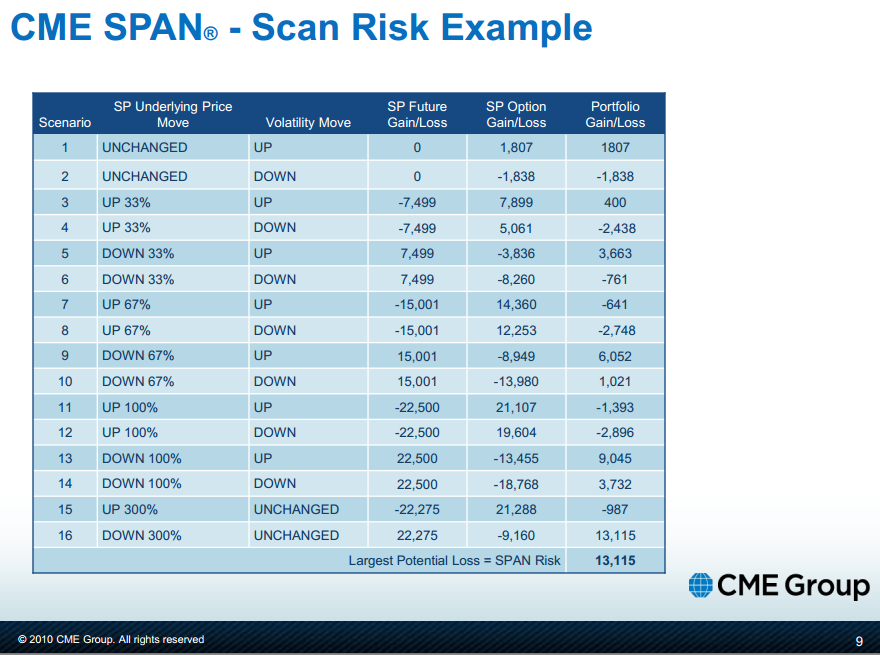

The notice goes on to explain that the SOM is a charge that is applied only to short option portfolios that do not meet the minimum margin requirement level. The margin levels are calculated using the normal 16 SPAN scenarios which are based on the largest potential loss.

The following image shows how the Volatility Scan Range is reached. This image is from www.cmegroup.com. To view a larger image, click

When the Swiss National Bank abandoned its currency cap on January 15, 2015, it caused high volatility in some of the markets. For that reason, as of the close of business on that same day margin rates would double and after the close of business on January 16, 2015, those rates would triple.

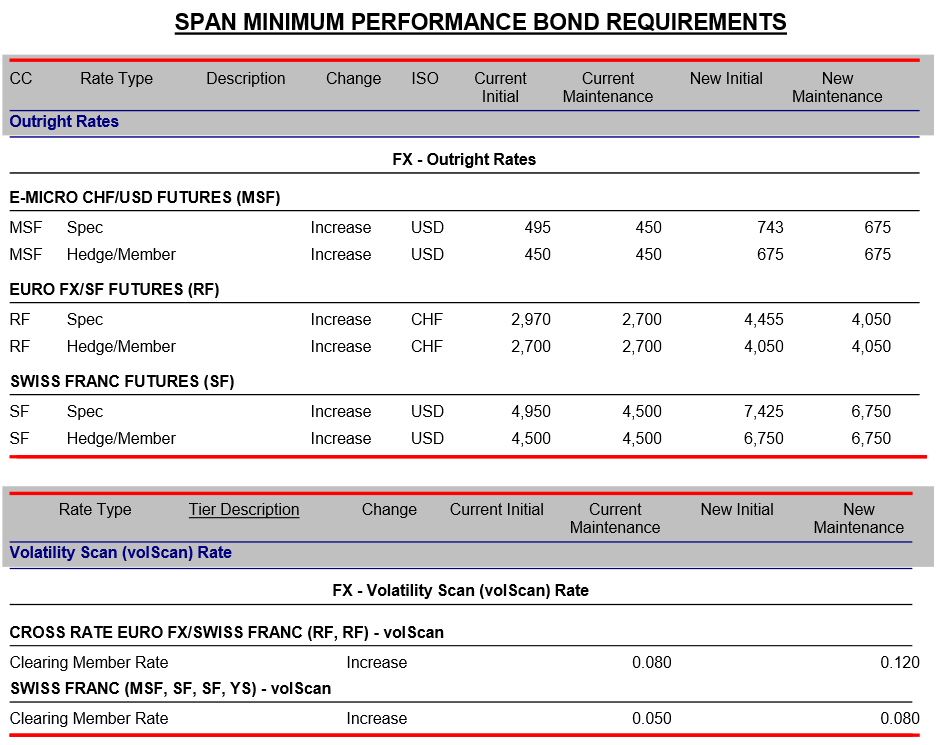

Here is the chart showing the rates effective after January 15:

You can see that the rate change from Current to New has Doubled.

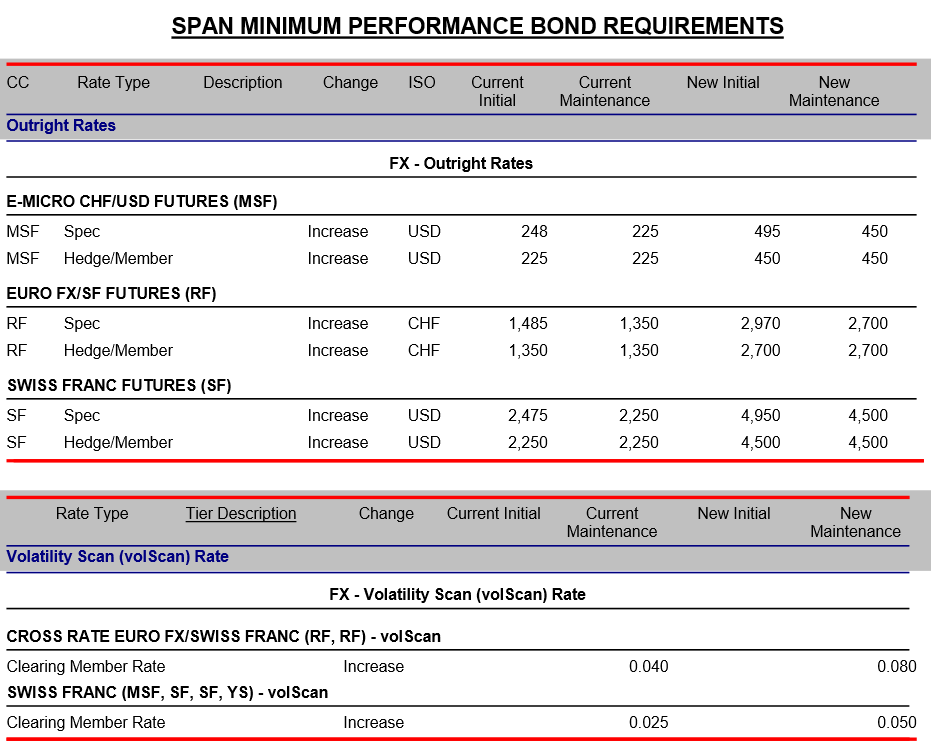

The next chart shows what the rates will be after the close of business on January 16:

This chart shows the change only from the day before, but if you compare the Current Initial of the first chart, 248, with the New Initial on the last chart, 743, you can see that the amount has tripled.

This can be alarming!

Trying to keep up with how much money you are required to maintain in your account can have you scrambling to find the necessary funds. This scenario won’t happen when you trade on Nadex.

That is because all of the binary and spread contracts offered on the Nadex Exchange are completely capped risk. You always know what your risk is from the moment you enter the trade. There is no chance for a margin call! Even with the massive move made by CHF, you would have known your risk. You may have lost the entire amount you risked, but no more than that amount. You see, even if the market moves against you, your risk is capped.

If you visited any of the forums on Thursday, January 15, there were many complaining about losing huge amounts of money as the market blew through their stops. This will not happen when your risk is defined and capped.

Whether volatility is high or low, trading with the completely capped risk contracts at Nadex eliminates margin calls.

If you would like to learn how to trade Nadex binary options and spreads, go to www.apexinvesting.com, a service provided by Darrell Martin. Apex Investing Institute offers free education, and free access to the Nadex Binary and Spread Scanner Analyzers. Member traders are invited to trade in the chat rooms, take advantage of trade signal services, use key indicators and access the Apex Forum. The forum content is updated daily and includes over 10,000 members. In a supportive learning community of seasoned as well as up and coming traders, traders of all levels learn how to trade Nadex binaries and spreads in depth, as well as futures, forex, stock and options, and gain an edge for successful trading overall.