By Darrell Martin

All the recent talk of trading Bitcoin may have some traders excited to throw their life savings into the ring and collect their millions from this volatile market. Bitcoin trading using futures contracts started off with a bang, soaring to new highs, before retracing back to more conservative numbers. December 16 saw it hit nearly 20,000. Not even a week later, on December 22, the low of the day was 11,159 as shown on a BTC chart. This type of volatility isn’t for everyone.

Others may have researched the cost and decided that trading this cryptocurrency is not how they want to risk their money. With Bitcoin trading around 15,000, for one CBOE futures contract 50 percent is required along with an overnight margin of 44 percent, which is $6600. CME contract size is five coins with a 35 percent margin.

Some have heard about mining Bitcoin and possibly wondered if that is the way to dip their toes in the market without getting burned. Are you considering mining Bitcoin? What is Bitcoin mining?

Mining Bitcoin does not involve digging in the dirt. It does not involve cages or descending to great depths excavating minerals from the earth. Like traditional mining, Bitcoin mining requires courage and a sense of adventure. As any with any new venture, it’s important to do the required homework before beginning the journey.

An article in Newsweek defines bitcoin mining as “the process of generating new units of the currency by confirming bitcoin transactions on an online ledger called the blockchain—requires computing power, which is used to solve the complex mathematical puzzles used in the mining process.”

This article goes on to describe how much energy is required to mine bitcoin. “…it is greater than the current energy consumption of 159 individual countries….consuming 33 terawatts of electricity annually.”

There are many online resources offering how-to-get started ideas and courses. Bitcoin.com listed the following items to be aware of when deciding if Bitcoin Mining is for you. “The first set of data you will want to use for discovering if Bitcoin mining can be profitable for you or not is the following but not limited to:

-

cost of Bitcoin ASIC miner(s)

-

cost of electricity to power miner (how much you are charged per kwh)

-

cost of equipment to run the miner(s)

-

cost of PSU (power supply unit)

-

cost of network gear

-

cost of internet access

-

costs of other supporting gear like shelving, racks, cables, etc

-

cost of building or data center if applicable

-

key value of Bitcoin over the life of the miner

Taking all of these factors into account will give you a rough return on investment (ROI) date, which is the date by which all the components are paid for by your mining earnings. Several are recurring, though, like electricity costs, internet access, and building or data center costs if applicable.”

A click to their mining programs further details costs and approximate daily returns. Apparently, at this time, all programs are sold out!

Other websites allow miners to rent the necessary mining equipment. One says miners can start with as little as $10 and can break even in 14 months.

Perhaps miners would rather mine a different cryptocurrency and/or have everything all set up. There are sites ready to help in those ways, too, for different prices and contract lengths.

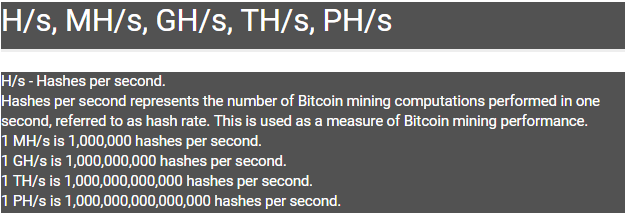

Also, it is important to understand hashes or hash rate when researching Bitcoin Mining. The following chart from bitcoin.com might aid in comprehending hashes.

The hash rate directly influences the cryptocurrency and its blockchain because it validates the data being encrypted. It prevents fraudulent transactions and double spending of the currency.

Processing the hash functions can be costly. To entice miners to invest, cryptocurrency networks reward them with cryptocurrency tokens and transaction fees. However, only the first miner to create a hash that meets the requirements receives the compensation. Hashes are usually created by solving complex mathematical equations. (See Investopedia.com)

There is much to consider whether trading or mining Bitcoin. Be sure to study it out before risking only money you can afford to lose. Bitcoin is a volatile market.

Free day-trading education is available at www.apexinvesting.com.