By Darrell Martin

Every Wednesday at 10:30 AM, ET, a crude oil inventory report is released causing movement in the oil market and giving you three things to take into account. They are:

-

Timing: When do you think the market will move? The market tends to move around the time the report is released.

-

Distance: How far do you expect the market will move? There are deviation levels as well as other methods that can help you figure this out.

-

Risk and Reward: Have a target goal of 1:1 risk/reward ratio or better. This means for every $20 at risk, you expect the market to move fast enough and far enough to make a potential profit of $20.

The release of the crude inventory report offers the opportunity to use strategies when you know there will be movement, but you don’t know the direction of the move. Both a strangle and a straddle are strategies that can be used in this situation.

When the crude oil inventory report comes out, you will want to get access to it by visiting US Energy Information Administration. If there is an abundance in the supply, you would expect the price to drop. If the actual number comes in lower, there would be a drop in supply and you would expect the price to rise. Since you don’t know before the report comes out what the actual numbers are going to be, you can put on a strangle. With a strangle, if the market goes up or down far enough you can make a profit on the movement caused by the news report. You can check deviation levels to see the expectation on distances.

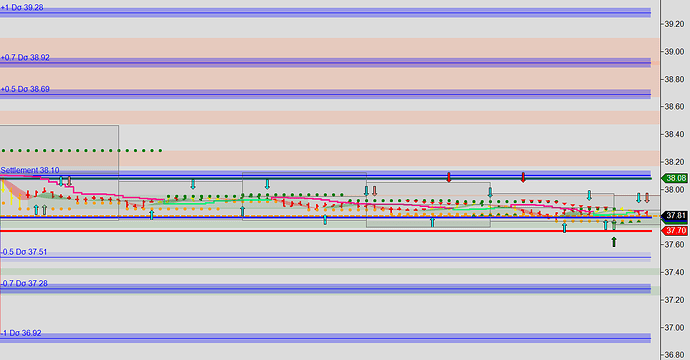

The expected distance of movement changes on a daily basis. Recently, settlement on CL (Crude Oil) was at 38.10 with full +/-1.0 deviation level moves set at 39.28 and 36.92 respectively. Each of these moves represents a move of $1.18 from settlement level. Seventy percent of the time the market will move up or down one deviation level. The move can be from -0.5 up to +0.5, which is still considered a full deviation level move. Knowing the potential distance the market may move can help you when planning your trades. The purple lines shown in the chart below are the plotted deviation levels.

To set up the trade, you would buy a binary within the expected move taking into consideration how much time must be allowed for the market to move the expected distance. You would buy the binary above the market. For example, say the market was currently at 37.87, knowing that a full deviation is 1.18, you could round slightly and look to buy a strike around 38.85 or 39.00.

At the same time, you would sell a binary below the market with a time and distance that will give you a risk/reward ratio of 1:1 or better. Sell the binary with a strike below the market. Using the same scenario as above with the market currently at 37.87, look for a strike about 1.00 below the current market level. This would be around 36.85 or even 37.00.

It is great when you can find strikes that have an equal distance from the current market and strangle the trade. You want to have an equal amount of risk on each side of your trade. To figure out the amount you have risked on each side of your trade, when buying, your risk is the price you paid for the binary. If you bought at $10, your risk is $10. When selling, your risk is $100 less the sold price. If you sold a binary at $90, your risk would be $100 - $90 for a risk of $10 on this leg of the strangle.

Remember, you want a risk/reward of 1:1 or better. Combine the risk of both binaries together. Using the example above, there was $10 on the bought binary and $10 on the sold binary for a total $20 risk. Therefore, you should have an expectation that oil will move far enough that you could recover your original $20 at risk on one of the legs of the strangle and make a profit of $20 for a risk/reward of 1:1. You are risking a total of $20 and expecting one leg to profit, while the other leg will most likely lose. In this example, the losing leg would lose $10, so the profitable leg needs to make $30: $10 to cover the losing leg and $20 to make the risk/reward 1:1. Your total net profit goal of the profitable leg needs to equal $30.

This is a low risk trade as the worst that can happen would be having the market remain flat and you would lose the $20 originally invested. Remember, you can always exit the trade at any time to lower the loss on the trade.

To learn more about the deviation levels and other trading strategies, go to www.apexinvesting.com, where all education is free.