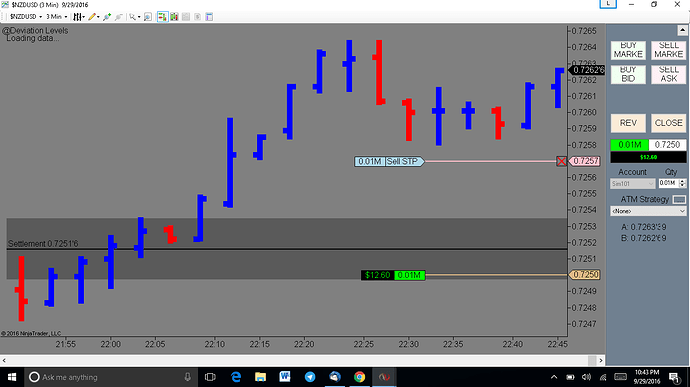

I have finally opened a live account with FXCM using Ninjatrader as the platform of choice. I am a bit nervous; however I know that my success is in my hands. I will be using the Deviation levels indicator and OHLC bars only right now.

For some reason I was unable to open a NADEX account to do spreads so I took this route.

Thanks again you all for the support!

One question. Is there a PDF or something that fully explains how the deviation levels are calculated. I would like to know the “why” of it all. I feel it will help me use this tool better. I have never seen an indicator so precise EVER. I really would like to know how it works. I have watched the various videos on this forum but I learn better by reading.

Once again…THANKS FOR EVERYTHING YOU ALL!!!

@MRSTBLEFX

Hey Elliot, Congrats on gettng started. Here is a great place to start learning more about the deviation levels indicator.

Deviations and Deviation Levels?

I hope this helps.

Peter

1 Like

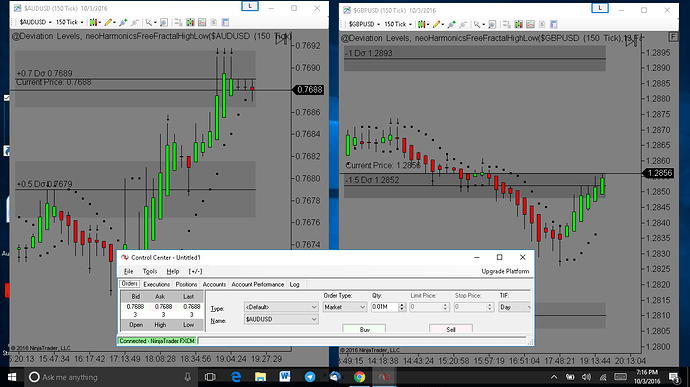

Thanks a million. I got my NinjaTrader Direct liscence today. Man; I MUST know what buy/limit orders are in order to manage my trades, I’m with FXCM. Deviation levels; .05 PSAR, heiken ashi, fractals, and 150 ticks…Thats my strategy.

1 Like

I have been doing ok with this setup. I made some adjustments. Using 3 charts for any instrument trades; 34,89,233 tick charts. I also check out a weekly and a daily chart to see if I want to actually get involved in a trade. Last week my ninjatrader would not load unless I removed the apex toolkit. That bothered me a great deal! Settlement prices can be found online, but I have no idea how the levels are mathematically calculated. Im going to have to resolve this issue.

So after many months of trying other systems and stumbling a lot; I have come to the conclusion from experience that Nadex spreads fit my trading personality much better that spot forex. Risk is already accounted for and I cannot be stopped out. Sometimes you just have to find out on your own. Since I have been away it seems NADEX has become much more popular and as a result the entry free is a little bit higher (250 bucks now). But knowing I could risk 10 dollars to make like 91 dollars with a 4hr spread entering slightly out of the money is awesome. Looking forward to re visiting the trainings and going live by April this year.

1 Like

In order to trade successfully, I feel that the deviation levels are a must; however, I have heard there are some who use the deviation levels indicator exclusively. This site is huge; is there a video illustrating the use of it as the only indicator they use? I am not fond of busy charts.