By Darrell Martin

Beginning at 8:30 AM ET and then again at 9:15 AM ET, as many as ten high and medium impact scheduled news events will be released Thursday, September 15. The first eight reports released include:

-

Core Retail Sales

-

Production Price Index

-

Philly Fed Manufacturing Index

-

Retail Sales

-

Unemployment Claims

-

Core Production Price Index

-

Current Account

-

Empire State Manufacturing Index

The above news encompasses everything from the change in value of total retail sales, to the change in price of producers finished goods and services, to how manufacturers rate the level of general business conditions.

For this set of news, an Iron Condor trading Nadex EUR/USD spreads can work well, setting it up at 7:00 AM ET for 9:00 AM ET expiration. The market tends to react to scheduled news events by making a move right after the release and then pulling back. Based on previous market reaction to this news, the average move for a 12 - 24 month period was around 35 pips.

For this Iron Condor, one spread should be bought below the market and with its ceiling where the market is trading at the time with another spread being sold above the market but with its floor where the market is at the time. Each spread should have a profit potential of $17 or more for a combined $35 profit potential or more.

Max profit is when the market pulls back to center between the spreads and is there at settlement. The breakeven points for this trade are where the market moves past the 35-pip mark up or down. For stops at a 1:1 risk/reward ratio, simply double the profit potential and place them there. This trade, with a $35 profit potential, would have stops 70 pips above and below from where the market started.

The next set of news reports released at 9:15 AM ET, include the Capacity Utilization Rate and Industrial Production. This news can be traded the same way using Nadex EUR/USD spreads using an Iron Condor setup. This time however, the trade can be entered at 9:00 AM ET for 11:00 AM ET expiration.

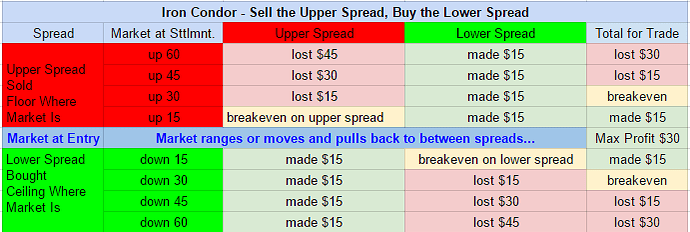

Again, one spread is bought on the bottom and the other spread sold on the top. The ceiling of the bottom bought spread should meet the floor of the top sold spread and be where the market is trading at the time. Profit potential for this Iron Condor, based on market movement from previous reports, is $30 combined between the spreads. For this trade, if each spread has a $15 profit potential, then the breakeven points would be 30 pips above and below. The 1:1 risk/reward stop points would be 60 pips up and down. This trade setup does best when the market pulls back to center between the spreads, or stays in a tight range. When the market is right between the two spreads at settlement, the trade makes max profit and for every pip away, it is only $1 less in profit. Below is an image showing the profit and loss of an Iron Condor with each spread having a $15 profit potential based on 15-pip market movements.

For free education and access to the Apex spread scanner for trading Nadex spreads, go to www.apexinvesting.com.