By Darrell Martin

Statistics Canada will release Wholesale Sales news Tuesday, June 20, at 8:30 AM ET. Unlike breaking news, which is history by the time it’s in a headline with the market already moved in reaction, scheduled news can be traded, based on previous market behavior to the release. For this news, there is a trade opportunity with capped risk, trading Nadex spreads.

Risk can be further managed as well, by using stops. Based on 12 - 24 previous reports and market reaction, it was found that an Iron Condor offers an ideal strategy. The setup profits when the market ranges or makes a move and pulls back. Additionally, the range in which the market can settle and the trade can profit is quite large.

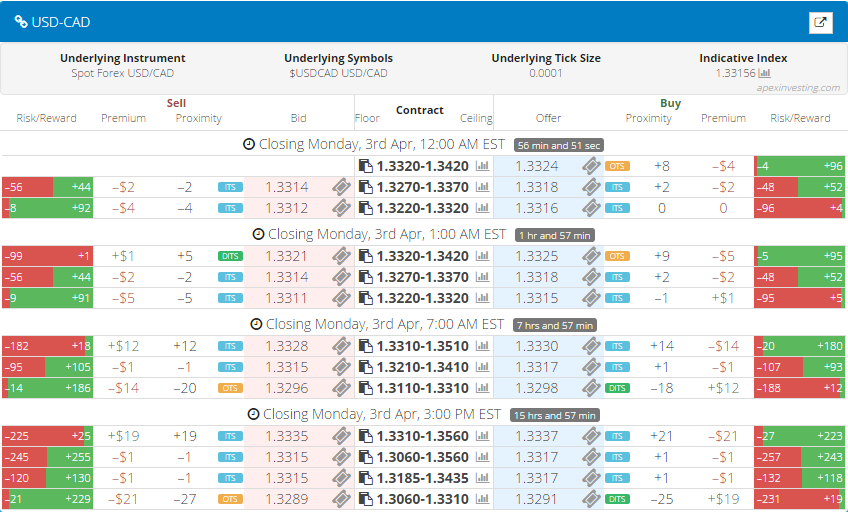

One Nadex USD/CAD spread is bought below the market with a $15 or more profit potential and one spread is sold above the market with a $15 or more profit potential. The ceiling of the bought spread should meet the floor of the sold spread and be where the market is trading at the time. The spreads can be easily found for beginner or advanced traders using the spread scanner. The trader need only look for spreads with a reward potential of $15 or more expiring at 10:00 AM ET. The trade can be entered as early as 8:00 AM ET.

Stops should be placed at the 1:1 risk reward ratio points where the market would hit 60 pips above or below from where it was at entry. The market can settle anywhere within a 60 pip range between the breakeven points of around 30 pips above and below where the market was at entry. Anywhere in that range will bring some profit, with max profit being when it settles right between the two spreads.Free access to the spread scanner is available to all traders along with free day trading education at www.apexinvesting.com. Apex Investing is a supportive community of Traders Helping Traders to reach their desired trading goals.