By Darrell Martin

Trading news events can be tricky. It may be expected the market is going to react one way, and then it reacts entirely different and goes the other direction. This can mean missing the trade opportunity all together or losing badly on a trade. To solve this issue, use a Straddle strategy utilizing Nadex spreads.

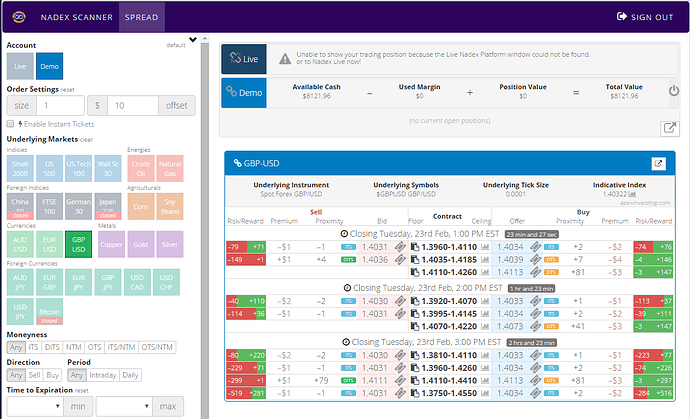

A Straddle strategy provides opportunity to profit in both directions while keeping risk low. Spreads delineate what part of the market can be traded with their floor and ceiling numbers, also marking where profit and loss stop. A spread can be traded long or short. If the market goes beyond the floor or the ceiling, that’s okay. There is no losing or profiting past those points. The market can move beyond one of those points at one end and pull back to once again be inside the range of the spread and even go beyond the spread at the other end. All the time, loss and profit are only to the floor or ceiling depending on the direction you traded the spread.

Trade Both Sides Of The Market With Only $40 Risk

Tuesday, May 3, 2016, at 4:30 AM ET, Purchasing Manager’s Index for Manufacturing will be released. Another advantage to trading Nadex spreads is you can put the trade on the night before at 11:00 PM ET, and the spreads will expire at 7:00 AM ET. This news can stimulate the market to react with big moves. Buy a GBP/USD Nadex spread with the floor where the market is trading at the time of entry, and sell a GBP/USD Nadex spread with the ceiling where the market is trading at the time. Total risk should be $40 or less combined, or around $20 risk or less on each spread.

At 4:30 AM ET the news will be released and the market will react. For a 1:1 risk reward ratio, put two limit take profit orders on where the market would move 80 pips up or down. When the market hits one of them, you will have covered the cost of both spreads and profited $40. You can still leave your other spread on in case the market pulls back. If the market pulls back to return and then passes where it started, you could make more than $40! Since this strategy is such low risk, there is no need to put on stop loss orders.

Using the spread scanner makes it easy to find the spreads you need for your Straddle strategy. Log in to your demo or live Nadex account, which takes only moments to open. Open the scanner available to all traders at www.apexinvesting.com. Choose the GBP/USD market and a window will open with all the available spreads for that market. At entry time, 11:00 PM ET, Monday evening, look at the 7:00 AM ET expiration spreads. Find a spread to sell with around $20 or less risk and a spread to buy with around $20 or less risk. Verify the floor of the bought and ceiling of the sold spreads are close to where market is. Then click the ticket icon, verify entry information and click submit. Your order will be entered immediately.

Nadex is a CFTC US based exchange and can be traded from 48 different countries.