By Darrell Martin

The Reserve Bank of Australia will release its Cash Rate news Monday, February 6, at 10:30 PM ET, and with that comes the Rate Statement. This rate is what is charged on overnight loans between the banks. The statement is the method the board uses to communicate with investors and release the news. If the board is more hawkish than is expected, then it is expected to be good for currency. All of this can make for a good evening trade, provided the right trade vehicle and strategy is employed.

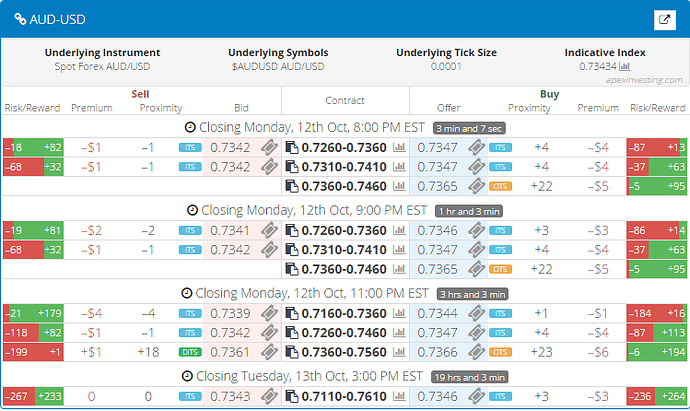

Trading two Nadex AUD/USD spreads using an Iron Condor strategy can be a high probability trade, based on previous market action on past news releases. Each spread should have a profit potential of $15 or more per spread for at least a $30 combined profit potential. The trade can be entered as early as 10:00 PM ET for 12:00 AM ET expirations.

If one has never traded spreads before, this trade is still quite easy to demo. One only needs a Nadex demo account, which is easy to open, and a free membership for using the Apex spread scanner for trading Nadex spreads. Filters in the browser-based scanner bring up the desired market and expiration times. Then, the profit potential for each spread to sell or buy is listed and visually obvious with green and red bars.

One spread should be bought with the ceiling where the market is trading at the time and one spread is sold with the floor where the market is trading at the time. Finding spreads with the right profit potential first can lead the trader to spreads that meet the floor and ceiling parameters. For a glimpse of the spread scanner, see below.

The Iron Condor is a strategy meant for profiting when a market pulls back from a move. Alternatively, the market can stay close without much movement and still profit. Stops should be placed in the event the market makes a move outside the 1:1 risk reward ratio area. For this trade, based on a $30 profit potential, stops should be placed 60 pips above and below from where the market was at entry. When the market, at settlement, is anywhere between the breakeven points of 30 above and below, then there is a profit. Max profit happens when the market is right between the two spreads at settlement.

Free access to the spread scanner is available at www.apexinvesting.com, along with free day trading education.