By Darrell Martin

On Tuesday, June 5, 2018, at 9:30 PM, ET, Australia will release news concerning its Gross Domestic Product (GDP). Issued by the Australian Bureau of Statistics, the GDP is an inflation-adjusted measurement of all goods and services produced by the economy. As such, it is the broadest measure and primary indicator of economic health and activity.

The last three reports have consistently come in lower than forecast, which would signify a bearish or negative reflection for the AUD. However, a year ago, the reports came in higher than expected causing the trader to regard the AUD as positive or bullish. This report is released quarterly.

Evening traders in the US can implement an Iron Condor strategy with Nadex AUD/USD spreads, entering as early as 6:00 PM ET using an 11:00 PM expiration. One spread is bought below the market and one spread is sold above the market. With this setup, the Iron Condor is prepared to profit when the market makes a pull back from any reactionary move to the news release. The ceiling of the bought spread should meet the floor of the sold spread and be close to, if not at, where the market is trading at the time.

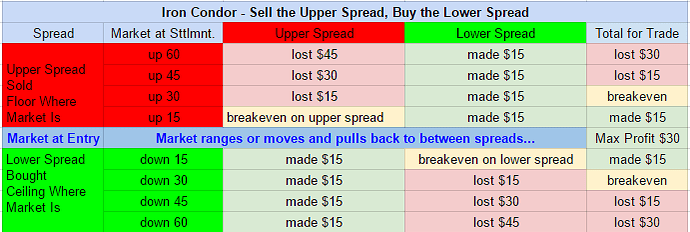

Based on previous market moves to this news, a profit potential possibility of $15 or more is suggested for each spread for a combined recommended profit potential of at least $30.

The market can move one of three different ways and the trade will make a profit: It can move and pull back. It can remain where it is, not moving at all, or it can move slightly. As long as at settlement or exiting after some time has expired, the market is between the breakeven points, this trade will make a profit. The breakeven points for this setup with a $30 profit potential are 30 pips up and down from where the market was at entry. The market can be anywhere in that 60 pip range.

If the market move 60 pips up or down from where it was at entry, the trade would hit 1:1 risk reward ratio points. This means at those points the trade would lose approximately the max profit potential amount, which in this case is $30 for the trade. To get a visual of how this works, see the chart below. It shows the profit and loss each spread would have based on where the market was at settlement.

You can see from the image that max profit is when the market is right between the two spreads at settlement. Sometimes the profit potential could be more. If it is less, then there is no trade. Never force a trade. More spreads can be traded as long as the same number of spreads is traded on each side of the Iron Condor strategy.

For free day trading education, visit ApexInvesting.com.