By Darrell Martin

Just in time for evening trading Monday, January 9, at 7:30 PM ET, Australia’s Retail Sales News will be released. Retail Sales is the key indicator for consumer spending, which greatly affects the economy and thus traders watch it. In most cases, the market will react with a move and then pull back.

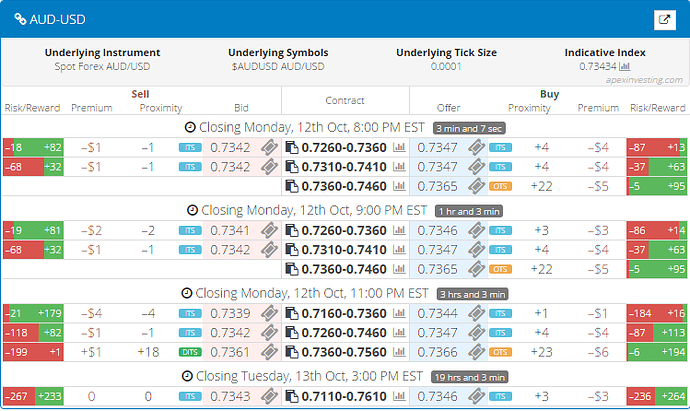

To trade this kind of move, an Iron Condor strategy works well. It is set up to profit when the market pulls back to where it was at entry. It is typically a premium collection trade. Trading Nadex AUD/USD spreads, buy one below where the market is trading and sell another above where the market is trading. The ceiling of the bought spread should meet the floor of the sold spread and be where the market is trading at the time.

For this news release, it was found when reviewing the last 12 - 24 releases, that the market moved an average of 25 pips. Based on this information, each spread should have a profit potential of around $12-13 or more, for a combined $25 minimum profit potential.

Entry should be around 7:00 PM ET for 9:00 PM ET expiration. After entering the trade, stops can be placed in the event the market takes off far enough and doesn’t return. For this trade with a $25 profit potential, stops should be placed about 50 pips up and down from where the market was at entry. This level also marks the 1:1 risk reward ratio points, should the market reach those points.

If trading spreads is unfamiliar territory, or for the expert, using the spread scanner is an ideal tool to easily narrow down the right spreads for the trade. See below for a screenshot of the spread scanner.

The market pulling back to center between the two spreads brings full profit. However, profit is made when the market settles anywhere between the break even points 25 pips above and below from where the market was at entry.

Visit Apex Investing for free education and use of the spread scanner.