By Darrell Martin

Friday, July 8, at 8:30 AM ET, the Canadian Employment Change and Unemployment Rate will be released, producing a trade opportunity, with the right Nadex spreads available for an Iron Condor setup. The Iron Condor is a neutral premium collection trade, a strategy for profiting when the market ranges or moves and pulls back.

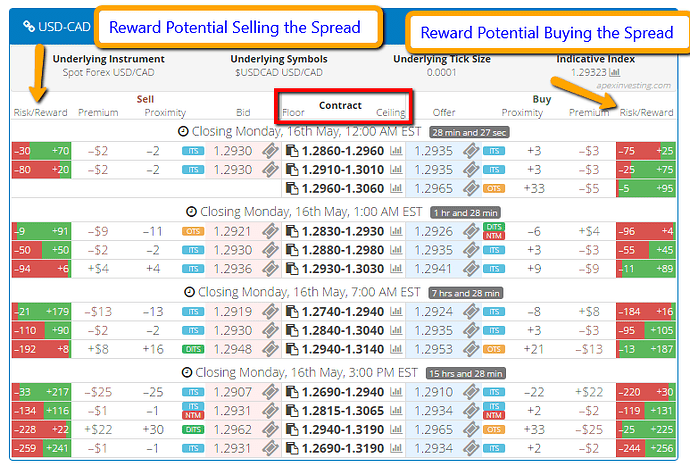

For this trade, it is suggested to buy a Nadex USD/CAD spread, with the ceiling being where the market is trading at the time, and sell a Nadex USD/CAD spread with the floor being where the market is trading at the time. The profit potential for each spread should be around $17 or more, for a combined profit potential of $35 or more.

Entry can be as early as 7:00 AM ET, for the two-hour 9:00 AM ET spreads. Using the spread scanner, traders are able to easily find spreads with the above parameters listed, all in one window.

Stops should be placed where the market would hit the 1:1 risk/reward ratio points, at approximately 70 pips above or below where the market was at entry. Max profit is when the market is right between the spreads at settlement and for every pip away, it is only $1 less in profit. This is unlike trading Binaries, where at settlement, it is an all or nothing payout, unless the trader exits early.

Free day trading education and the spread scanner are available at www.apexinvesting.com.