By Darrell Martin

Thursday Evening, October 6, 2016 The timing of the massive Cable Flash Crash, which affected the GBP/USD forex market, happened during the most illiquid time of the 24-hour FX day. It was post-NY and pre-Tokyo, pre-HK and pre-Singapore. In a time when the GBP/USD market is usually quiet. Instead, the bottom falls out of the pound and brokers are calling margins on their investors.

Even the most disciplined trader cannot avoid a margin call when faced with a situation like the one that happened Thursday Evening. There was no hint this was coming. There was no major news event, but somewhere something did happen that caused this flash crash.

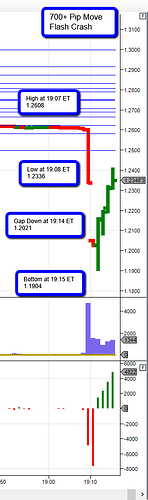

The selling began at 23:07:05 GMT with the high at 1.2608 falling to 1.2336 only two minutes and three seconds later at 23:09:08 GMT. This was followed by a gap down to 1.2021 at 23:14 GMT and the lowest point of the flash crash of 1.1904 occurring at 23:15 GMT. This is a drop of over 700 points in about eight minutes.

The GBP/USD was experiencing relatively flat volume and trading in a range of around 15 pips for the two hours prior to the crash. Except for a couple of minor increases in volume, there was nothing to suggest the crash was unfolding. Several posts online list the amount investors lost. One said he had lost $9000 USD. Another listed his losses at £12000. When a move happens that quickly, it will likely blow through any stop losses that may have been set.

A trader can be the most disciplined trader in the world, but one move like this could eat the whole trading account. Disciplined trading cannot help in flash crashes but having capped risk can. If a trader happened to be in this market in the right direction, trading with capped risk, it is possible they made a nice profit. However, if a trader was trading in the wrong direction, if they were trading with Nadex spreads or binary options, the risk would have been defined. Traders always know how much is at risk before ever entering a trade and never have margin calls.

One trader reportedly made over $6000 in this fast moving Cable crash. He happily called it L.U.C.K. – Laboring Under Correct Knowledge. This is where opportunity meets preparation. He also commented that had the market flown that far in the opposite direction, his risk was capped because he was trading on the Nadex exchange.

Using the right tools and trading with Nadex will not only save you from having a margin call, it may actually have you happy you were in the market when flash crashes happen.

To learn more about trading tools to use while trading Nadex, visit Apex Investing.