By Darrell Martin

The markets can experience volatility since news is scheduled and being released around the world all the time. Because of this, trading opportunities are presented. On Friday, February 9, at 4:30 AM EST, the United Kingdom will release GBP Manufacturing and Goods Trade Balance news. Offering an overnight trading opportunity for traders in the United States, enter as early as 11:00 PM EST, the night before.

This is when the 7:00AM EST expiration spreads are released. Entering the night before as well as placing stops allows traders to rest easy. Simply place the trade and check it upon arising in the morning.

In anticipation of this news, there can be implied volatility present in the pricing of spreads. Using Nadex GBP/USD spreads, with the right strategy for this news, favors a high probability trade. Most likely, there will be movement, but the direction is unknown. A strategy to use in this situation is the Iron Condor, which uses two Nadex GBP/USD spreads.

One spread is bought below the market with the ceiling where the market is trading at the time of entry, and one spread is sold above the market price and with its floor where the market is trading at the time. Each spread should have a profit potential of $17 or more, making a combined profit potential of at least $35 for the trade.

There can be more spreads traded and the spreads can have more profit potential. Be sure to keep the Iron Condor balanced and have the same number of spreads sold as bought. Once the news is released, the market has tended to react, make a move and then pull back.

For this setup, with a contract bought below the market and another sold above the market, a market move and a pullback close to or right where it started from will bring high or max profit. The trade can be left on until settlement to let it play out, or if it has reached high profit, can be exited early.

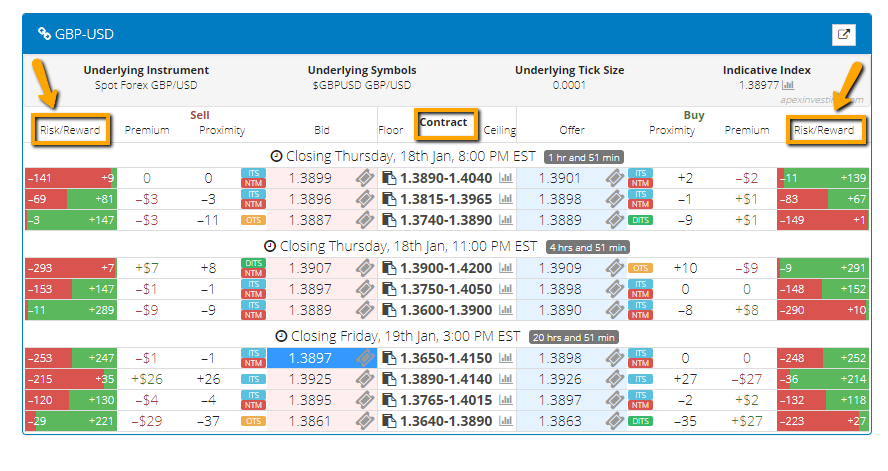

Stops can and should be placed where the market would hit a 1:1 risk reward ratio point. For this trade, that would be where the market hits 70 pips above and below from where it was at entry. Spreads are quick and easy to find, even for first time traders using the spread scanner on the Apex website. The scanner was designed by traders to meet their trading needs, including learning how to trade spreads quickly, finding the right spreads for a strategy at a glance, and including all necessary information for advanced traders for multiple markets in one screen and immediate accurate entries.

The scanner is shown in the image below.

A complete calendar of scheduled news events along with news strategies is available at www.apexinvesting.com. Free day trading education is available there for all traders.