By Darrell Martin

The news everyone is waiting on this week is the Federal Open Market Committee (FOMC), its Projections, Statement and Rate. This news will be released at 2:00 PM ET, but you can begin entering your trades as early as 11:00 AM ET. (See the chart below for more options.) What’s the Fed going to do? Yes, they will raise rates. No, they won’t raise rates. Yes, they will. No, they won’t. Around and around we go and what they decide, nobody knows. What we do know is that this is great news for trading, especially when trading Nadex spreads using Iron Condor setups.

The Iron Condor strategy is set up using two spreads. One spread is sold above the market with its floor where the market is trading at the time. The other spread is bought below the market having its ceiling where the market is trading at the time. In this way, the ceiling of the bottom bought spread meets the floor of the top sold spread and is where the market is trading at the time.

With that setup, the Iron Condor is poised to profit when the market settles at, or close to, where it started within the breakeven zone. It’s easy to figure the breakeven zone and the 1:1 max risk/reward ratio points to place stops. Each Iron Condor has a max profit potential amount, and the two breakeven points, one up and one down, are equal to the max profit potential in number of pips. If the max profit potential is around $15 each spread for a combined $30 profit potential, then the breakeven points are 30 pips up and 30 pips down. The market being anywhere between those two points at settlement, will bring some profit for the trade, with max $30 profit if the market is right between the spreads at settlement.

If the market moves past the breakeven points, then the trade will start to lose. The 1:1 max risk/reward ratio is double the profit potential in pips. For this trade double $30 is $60. Therefore, stops should be placed where the market would hit 60 pips above and below from where it started. At those points, the total risk would be $30.

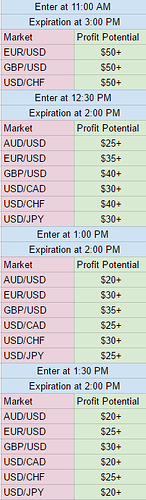

Based on previous market’s reactions to FOMC news, the following are recommended profit potential points for a variety of Forex markets. The market is listed along with the entry time for the expiration time on the spread. The minimum profit amount is the combined profit potential for each Iron Condor and should be split as evenly as possible between the two spreads in the strategy. Profit potentials can be more, but should not be less. If no spreads can be found with the right ceiling/floor or profit potential parameters, then there is no trade.