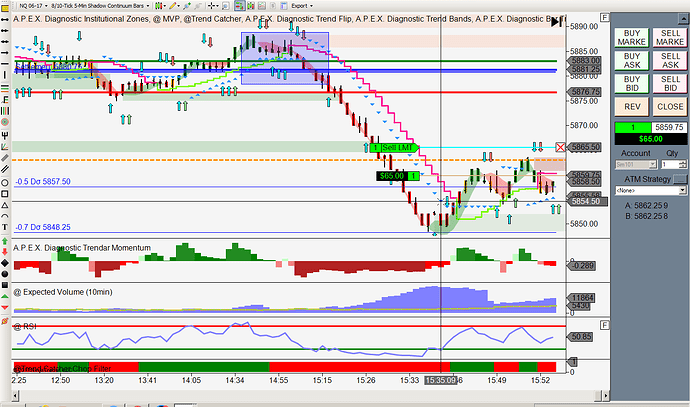

Are there any clues where the box is on this chart that would tip a smaller trader off that the market was going to sell off like it did? Any volume clues or market action that would have suggested distribution instead of accumulation?

You have a crystal clear entry signal from trend catcher right inside “the box” with price pulling away from a red izone. The trend flip lines up as well as Trendar momentum.

Yes but is there anything before those signals that could tip you off as to whether the big money is going to push the NQ higher or lower? I ask that because I’ve been the victim of too many false signals and breakouts. For instance if it started to move up and triggered a IZSS swing trade many times after being filled on such an order the mkt would retrace and stop me out for a loss or just sell off like it did here.

When you see the MVP predictor arrows start to flatten out and line up horizontally, that’s usually a good sign a potential reversal is coming.

That’s what I’ve been taught by APEX members but sometimes the flat MVP arrows act as support like a moving avg and the market continues in its previous direction. There doesn’t seem to be too many absolutes in trading. I’m starting to feel like there is always a little bit of guess work involved. I’m going to try and be more disciplined and if I miss some bigger moves so be it. Missing out on some big profits is better than losing money.

Just a few more observations in addition to what has already been said. You are trading the NQ with 8/10 5 minute continuum bars. I find those bars to be inferior to 3/12 60 minute bars (the preferred bars for IZSS). Also, make sure your trend measurement period in your Trend Catcher is set to “15” not “7”.

Also, why are you not utilizing VAD? VAD A and VAD E especially are very powerful at showing what the sharks may be lining up to do. In addition if you can especially if you are trend trading, you need to incorporate Order Prints.

As for your comment: [quote=“davidceccoli, post:5, topic:11763”] There doesn’t seem to be too many absolutes in trading. I’m starting to feel like there is always a little bit of guess work involved. [/quote]

You are looking for absolutes maybe because you are trying to predict the market? This is not possible. No one can predict the market, ever. Therefore there are no absolutes, ever. The best we can hope for as technical traders is to trade a system that provides us a statistical edge in the market and puts the probabilities in our favor. when done right, IZSS definitely provides a profitable edge. Once you have adopted a system with an “Edge” the best you can do is execute on the rules of that system without mistakes and hope the probabilities make you a profit over time. With the addition of proper risk management and risk to reward calculations, this is trading. So, as long as you consistently execute the system back to back you should make good profitable trades. While trading you may win a few trades in a row or lose a few trades in a row. These streaks of wins and losses can happen in a completely random way and can not be predicted. The best you can do is consistently execute your system and expect the probabilities to be in you favor over time.

Just my 2 cents.

I suggest loading up Darrell’s IZSS template on 3/12 60 minute bars and try trading with that.

when I took the IZSS training course I thought it specifically said use continuum bars set at 8/10/5. I use VAD A and VAD E on another chart; the VAD template chart.I dont use one system I use APEX MVP ( 6 tick and 12 tick bar) IZSS and VAD.

The course needs to be updated. using VAD on another chart is not necessary and possibly more confusing, but whatever works for you. I used to use 8/10 5 but 3/12 60 works so much better. Darrell’s personal favorite is 3/12 60.

what type of volume do you use? I noticed that the expected volume is diff than expected volume 8.

expected volume 8 is the latest one. I don’t know of anyone that uses the old one. And actually with VAD I don’t use EV8. Also EV8 seems resource intensive on my computer. Most of the times I don’t even look at it. I have learned to trade without it. Not saying EV is not valuable, I just personally don’t use it much.