By Darrell Martin

The Euro Flash GDP coming out from Eurostat this Friday gives a broad measure of the Gross Domestic Product for Europe, in particular Germany and France, which accounts for above half of the Eurozone’s economy. Industrial Production is released at the same time. The Euro Flash GDP comes out quarterly while Industrial Production numbers are monthly. When the actual number released is greater than forecast then it is good for currency. The previous quarter release was four percent and the forecast is also four percent. Traders pay attention to the numbers, as this report is an important indicator of economic health. This report can move the market and build some implied volatility making it a good news event for trading.

Based on previous market reaction to this report over the last 12 - 24 months, looking for $35.00 or more profit potential using an Iron Condor strategy is recommended for this event. Since the news comes out in the early morning hours at 5:00 AM ET, Friday, February 12, 2016, you can enter as early as Thursday night at 11:00 PM ET, a much more convenient time, and the expiration time would be 7:00 AM ET.

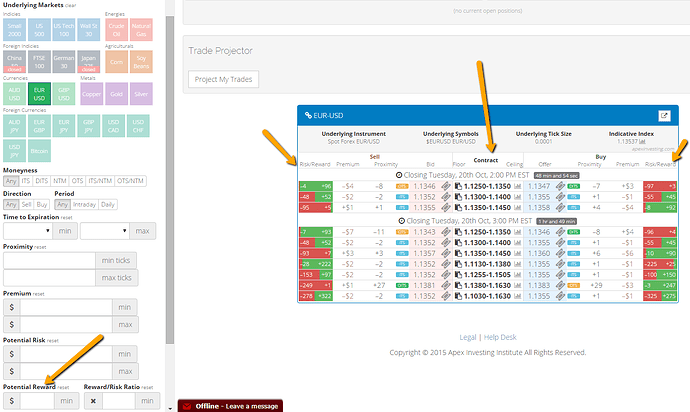

The Iron Condor is an ideal strategy, using Nadex spreads, for collecting premium in a market where implied volatility has built up and you don’t know which way the market will go. For this trade, you want to buy a lower Nadex EUR/USD spread and sell an upper Nadex EUR/USD spread. Again, the ideal reward potential for this setup is $35.00 or more combined between the spreads. Therefore, each spread should have around $17 or more reward potential.

That being the case, your breakeven points for this trade are where the market would hit 35 pips above or 35 pips below your entry point. Anywhere in between those points and you make profit. With every pip closer to the center from your breakeven points at expiration the market is, you make $1 in profit.

Alternatively, the market can move in one direction and one side of your trade can profit. Then, the market can pull back and the other side can profit as well, if it pulls back far enough. You can also wait until it expires and as long as the market pulls back or remains in the breakeven zone, you will profit some on the other side as well based on how close the market is to the center of your spreads. For the 1:1 max risk reward ratio points, where you would want to exit to manage risk for this trade, the market has to move 70 pips up or 70 pips down.

If you are unfamiliar with Nadex spreads, they are day trader options and have a floor and a ceiling, which designate the area of a market you can trade, either long or short. The risk and profit are capped at the floor and the ceiling. This provides defined max risk up-front. However, you can exit anytime to limit even the max risk. Therefore, while you pay the max risk up-front to enter a trade, once you exit that amount is returned to you plus or minus your profit or loss.

Some may say a disadvantage is the profit being capped as well; however, for this strategy uncapped profit is not necessary. Should traders want to trend trade using spreads, Nadex lists enough of a variety of spread widths, having plenty of room floor to ceiling for making nice amounts of profit for even the greediest of traders.

Spreads can easily be found at a glance using the spread scanner. Having the spread scanner open in your browser, you can filter the spreads by market, expiration time, reward potential and more, depending on how advanced you are at trading them. For a free login to use anytime, just go to www.apexinvesting.com.

Nadex is a CFTC US based exchange and can be traded from 48 different countries. To open a demo or live account just takes moments.