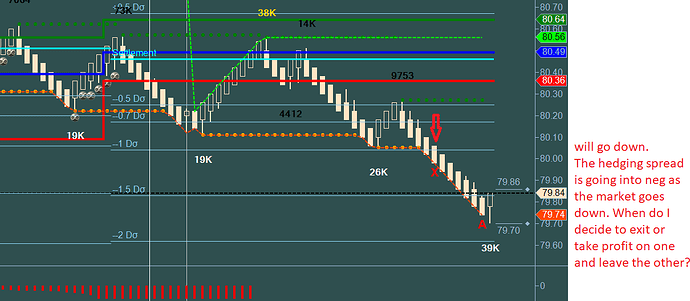

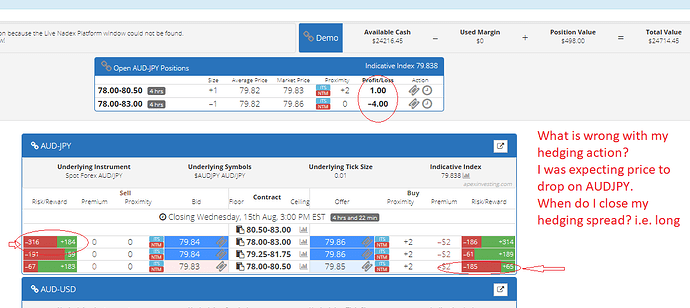

I have watched and studied lots of material but am still confused with some concepts. I have tried a hedging strategy by DM and John. Could you please explain what I am doing wrong. I hedged an AUDJPY sell spread but could not clearly sort this in my mind what whether i had selected the right spreads, and entries. And when should I exit if the market goes against me! ultimate%20hedge%20strategy%2010%20-DM|690x308

I think I recall Darrell mentioning they are going to do a Masterclass on Ultimate Hedge (or perhaps just hedging) at some point in the future. Hopefully soon as I would REALLY like to learn that information. I hated having to miss the live event earlier this year. Perhaps the masterclass will still provide all of the info to master this trade.

I have watched so many videos - with revisions! However, putting this into practice has not been straight forward. Examples, when to do it and more important when not to do it. I have several hedges set up, but getting the right entry for the hedge, near the floor or ceiling is the tricky bit. I think this should be determined by risk, or RR calculation…still practising.

You should also look at premium. Sometimes the premium is big enough that doing a hedge really makes a wide “loss” area but the pricing is cheaper for your main trade to not bother hedging.