By Darrell Martin

Traders know that there are many different market conditions. There can be trending markets, flat markets, high volatility or times when the implied volatility is low. It is important to have a strategy in your trading toolbox to use no matter what the market throws at you.

Earlier in the week, an opportunity presented itself when volatility was low in oil. The market had already moved 80 ticks. At $10 a tick, that was an $800 move that day and things had slowed down. After the upward move, chart indicators and price showed the market was primed for a move downward.

When volatility is low, there are plenty of choices for trading spreads. One Nadex spread considered was a contract with a risk of $48 when selling one contract. If ten contracts were traded, that would be a total risk of $480. Perhaps that seems like a lot of risk to you. To manage risk, the number of contracts can be scaled back. However, there is another way to still trade 10 contracts, keep risk realistic and not feel uncomfortable.

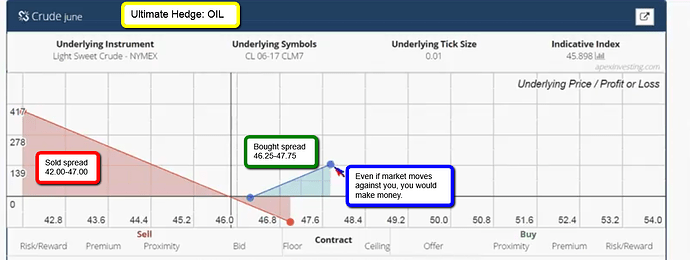

If the risk seems too great, a hedge can be added. This is where another contract is obtained in the opposite direction as the first. Where the first spread sold covered 42.00-47.00, the bought spread contract is 46.25-47.75. It has $19 risk, but that isn’t your real risk.

You may think that risk is adding both amounts together, but real risk is the difference between where you buy one and sell the other one. In this case, buy one for 46.44 and sell the other one for 46.48. This is a difference of four ticks or four dollars. Risking only $40 allows you to put those two contracts together to construct the strategy and do 10 contracts to equal a full-sized oil contract.

Option traders may recognize this as a “Married Call”, buying or selling an option in the opposite direction to protect the option being traded. Putting on a hedge is like having insurance.

On this trade, the hedge contract (buy) will expire in one and a half hours, while the trade has over four hours remaining. If the market hasn’t moved in your direction within that hour and a half, you’d exit the trade. Your risk is only $40. The trade has a $1200 stop loss for the next hour and a half. It is basically unheard of to trade Oil futures with a $40 risk without any concern of being stopped out. However, if it does move against you, you can still make some profit. The max risk would have been taken care of and then profit would have kicked in.

Still looking at the image, this may resemble a strangle, but since you focused on a direction, going short, the long side of the strategy becomes the hedge. Because of the hedge, your trade will be profitable whether the market goes up or down. The only way it can lose is if the market stays flat in between where you entered the trade on both sides. In this case, that would be between 46.44 and 46.48. If that happens, you would lose $4 per contract. With 10 contracts, that would be $40.

How did this turn out? There was a profit possibility of more than $4000 with only a $40 risk. You hoped the sell side would win, because there was more room for profit. With every tick up or down, your heartbeat didn’t rise at all.

As soon as the trade was placed, you figured out where to put your first take profit. You looked back and could see where break out traders would go short. You also saw where those traders who were painfully losing would bail out and sell their long positions. This point just happened to correspond with the low of the day.

When oil hit 45.83, you exited half of your position, closing out five contracts. Then you trailed the other five contracts until oil hit your trailing stop (MVP) where you closed those contracts, collecting a few hundred more in profits.

How can you not afford to trade spreads? This trade only risked four dollars per contract. Learn to hedge! The drawback is that the market has to move. If it doesn’t move, you will lose the amount you risked. In this example, $40 was risked to make over $500. When you can make this much, the odds are in your favor.

In summary, know that this type of trade is not hard.

-

Pick a direction.

-

Choose a daily near the market spread.

-

Look for how far it is away from the market (proximity) and the difference between the two contracts you are buying/selling.

-

How much are you putting up? (risk capital/margin)

This strategy requires zero stop loss. Even if you are wrong, you can still make money, unless the market doesn’t move. You might find yourself bored with this kind of trade. You’ll be able to be fully relaxed while you have control of $1700 worth of oil with only a $40 risk. That’s the way to trade! Be comfortable trading. Try this strategy out in demo. Understand it and then move on to doing it live.

Free day trading education is available at www.apexinvesting.com.