By Darrell Martin

Trading multiple markets can be a challenge even with multiple monitors. Nonfarm Payroll news can create implied volatility in many markets, which can open up many trade opportunities. The right trading tools and strategy can make trading multiple markets less of a challenge and possible. Friday, July 7, at 8:30 AM ET, is the next release for Nonfarm Payroll, Average Hourly Earnings and Unemployment Rate.

Trading Nadex spreads, two different strategies can be used. An Iron Condor strategy is trading two spreads. One spread is bought below the market with the ceiling where the market is trading at the time of entry. The other spread is sold above the market with the floor where the market is trading at the time of entry. Profit is made on the pullback of a move in reaction to the news. The closer to center between the two spreads the market is at settlement, the greater the profit made.

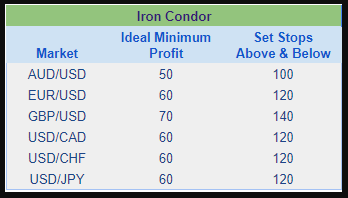

Each Iron Condor trade has a minimum profit potential, which should be shared evenly between the two spreads. Stops should be set where the market would hit the 1:1 risk reward ratio points, from above and below where the market was at entry. Below is a chart of the markets that can be traded along with where to set ideal minimum profit amounts.

The trade can be set up as early as 7:00 AM ET for 3:00 PM ET expirations to give the market plenty of time to react and play out. However, entry can also be made at 8:00 AM ET for 10:00 AM ET expiring spreads as well.

To easily find the right spreads for the trade, open the spread scanner pro, a browser-based platform specifically designed for the spread trader’s ease. Using filters, specific markets can be chosen, as well as specific expiration times and reward potential. Multiple markets can show in one screen to quickly discern which markets offer spreads with the minimum profit potential.

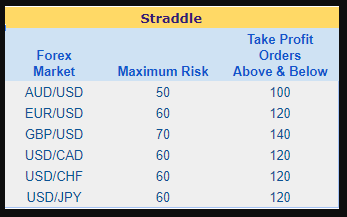

The straddle strategy can also be used for this news event. The straddle has the advantage of low risk and it is unnecessary for stops. The straddle is the exact reverse setup as the Iron Condor. To straddle a trade, one spread is bought with the floor where the market is trading at the time. The other spread is sold with the ceiling meeting the floor of the bought spread and where the market is trading at the time. Instead of stops, take profit orders should be placed once the trade is entered. Take profit orders should be placed at the 1:1 risk reward ratio points both above and below from where the market was at entry. Each straddle has a maximum risk amount to be divided as equally as possible between the two spreads. See below for the maximum risk amount and where entries should be made for the take profit orders. Entry can be made as early as 7:00 AM ET for 9:00 AM ET, 8:00 AM ET for 10:00 AM ET, or 7:00 AM ET for 3:00 PM ET.

The biggest market movement usually happens within the first 15 minutes after this news is released. If one side of the straddle takes profit, leave the other side on since the market may reverse and pull back, possibly making money on the other side of the straddle. Entry is simple for the beginner as well as advanced trader using the spread scanner pro.

For free access to the spread scanner and free day trading education, see www.apexinvesting.com.