By Darrell Martin

A Nadex binaries price is impacted by multiple factors. One of the factors is by the orders placed by other traders.

Traders Impact The Price

A Nadex binary contract is based on a Black Scholes Model and its pricing will be based on this model. The price will fluctuate regardless of trades being made on the option like any other option. However, like on other exchange traded options, on Nadex binaries you and other traders are free to place a bid or offer limit order inside the bid/offer spread.

This will cause the bid/offer spread to narrow and will change the price of the binary as displayed below.

Nadex Does Not Impact The Price

Nadex does not take the other side of trades. They are an exchange like the CME, NYSE and others. Nadex is there as a facilitator of orders between buyers and sellers, to ensure transparency of pricing and liquidity and to provide traders with anonymity so the other side of the trade does not know if you are getting in or out of the trade.

Related: What Is A Nadex Binary Option?

The Nadex Binary Ticket And Depth Of Market

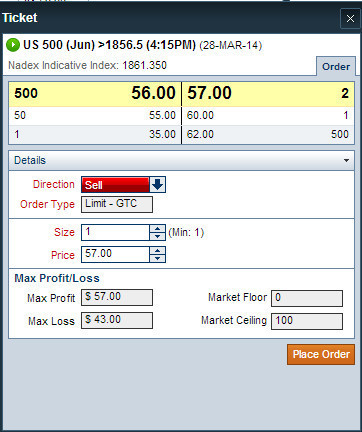

In the live Nadex binary ticket below, you can see several things: Contract Name, Month, Strike, Expiration Time, Risk/Reward, Bid/Offer Price & Size, and depth of market.

At the top of the ticket, you can see the contract terms. The US 500 (Jun) [Based on the CME’s S&P 500 Emini Futures ESM4 contract] will be >1856.5 at 4:15 pm on the 28th of March, 2014. You will also notice the current Nadex Indicative Index of ESM4 is at 1861.350.

If you believe the statement is true, that ESM4 will be greater than 1856.5 by the expiration time, you can buy the binary. If you believe the statement is false, that ESM4 will be less than OR equal to 1856.5 by the expiration time, you can sell the binary.

It is important to not miss the point that buy means TRUE, which is > than the strike, and sell means FALSE, which is < or equal to the strike. There are no ties at expiration. The settlement price of ESM4 is either > than the strike or it is not.

If the settlement price of ESM4 is > than the strike, then the binary is in the money for someone who bought the binary (so they will receive full payout) and the seller will have not been profitable. If the settlement price of ESM4 is < or = the strike at expiration then it is in the money for someone who sold the binary so they will receive full payout and the buyer will not have been profitable.

BIG TIP: On Nadex, a binary contract does not have to be held until expiration. You can enter and exit before expiration.

On the ticket you will notice that, if quantity is entered, the risk and max profit for the number of contracts is displayed in the bottom half of the ticket. An astute binary trader will lock in their profits or limit their losses versus holding the binary option to expiration, just like any vanilla call put option trader should do.

Visual Understanding Of the Impact Of Traders On The Binary’s Price

However, the most important thing to note is how the binary’s price is being impacted by other traders.

As shown in the example below, the market maker is quoting a bid with the size of 500 contracts for $56. This means that the market maker is willing to buy from you, meaning you could sell to him/her, 500 contracts this instant at that price.

You can choose to trade one contract or all 500. You could place a trade for more but may have to get filled at a different price; this is how all markets work. If you take out all the contracts that the market maker has posted, then the market maker will refill the depth of available ordeers with most likley another 500 contracts.

As you can see, there are also 50 contracts available for bid (sell price) at $55, and another trader is posting a bid at $35.00. This means other traders have placed a buy limit order to buy at this price, so it is available for you to be able to sell to them at the price listed for the quantity they have posted they are wanting to buy.

Notice on the offer (buy side-right side). There is an offer of $57 for two contracts. This means a trader is willing to sell two contracts to you to buy from them for the price of $57. Again, you can trade one contract or all the contracts listed. Often a trader can get confused when they see the binary price strike ladder, and only see an offer size of two (see image below of live market Nadex binary option chain). They may think there are only two contracts available.

However, when the ticket is opened and the depth of the order book for the contract is visible as displayed above, the trader can see there is one contract available at $60 and 500 contracts available at $62, for them to buy (see opened ticket above).

The traders offering the bid and offers inside the market makers bid/offer prices may get filled by other traders, or they may get filled by the market maker. They will definitely get filled by the market maker should the market move enough in their direction.

See article on Benzinga